The Abu Dhabi National Oil Company (Adnoc) is in advanced discussions with more than a dozen energy companies over the renewal of a major offshore oil concession under a new structure and terms that will accommodate a greater number of strategic partners bringing in technology, expertise and value.

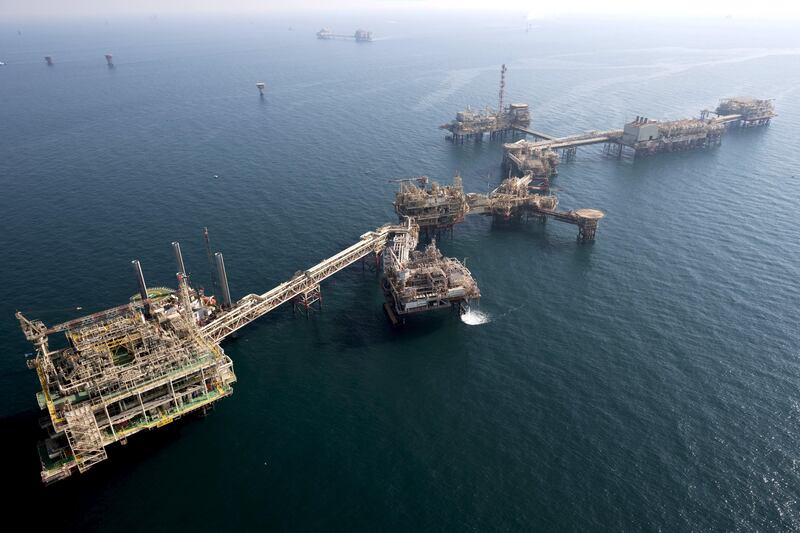

The current concession comprises fields operated by the Abu Dhabi Marine Operating Company (Adma-Opco) – namely Lower Zakum, Umm Shaif, Nasr, Umm Lulu and Satah Al Razboot (Sarb). It will be split into two, or more, concessions with Adnoc retaining a 60 per cent shareholding in each.

Adma-Opco, together with Adnoc’s other major offshore operator Zadco, account for half of the emirate’s production with Adma-Opco’s capacity at about 700,000 barrels per day.

“We have received great interest in the concessions from both existing and potential new partners. Discussions are progressing well and companies have been drawn by our stable investment environment and Adnoc’s reliability as a partner, as well as the attractive and sustainable returns that will be generated,” said Sultan Al Jaber, Adnoc group chief executive.

The current concession, dating back to 1953, expires in March. The current shareholders in Adma-Opco are BP with 14.67 per cent, Total with 13.33 per cent and Japan’s Jodco with 12 per cent. The Abu Dhabi Government, through Adnoc, has a 60 per cent holding.

_________________

Read more:

Adnoc is active on the debt front as it pushes ahead with transformation strategy

Dubai Ruler and Sheikh Mohammed visit Adnoc headquarters - in pictures

_________________

The potential new partners talking to Adnoc are a mix of existing concession holders in its offshore fields and new participants from around the world including Asia, Europe and the United States.

“Our ideal partners should also be willing to invest across different parts of our value chain,” said Mr Al Jaber. Adma-Opco’s production capacity is set to increase to 1 million bpd by 2021, as part of Adnoc’s strategy to boost overall output for upstream and downstream operations.

Last month, Adnoc said it would open up for new partnerships and co-investments as part of a new approach to drive growth and boost revenue creation, while also enhancing performance and securing greater access for its products in key growth markets such as in Asia.

The new Adma-Opco concessions and the Zadco operated Upper Zakum concession will be under the new integrated offshore company created by the merger of the two companies, which is scheduled to be completed by the end of this year.

Paul Navratil, Abu Dhabi-based oil & gas partner at EY, said that the renewal of the Abu Dhabi offshore concession comes amid a renewed focus by national oil companies (NOCs) in the region, including Adnoc, on profitability rather than just prioritising production capacity.

"Availability of volume is one thing, but there is a real focus among the chief executives of the region’s NOCs on delivering value," he said. "So the timing is very good with regards to being able to focus on the specific terms and outcomes they want to best maximise volume and value."

Benchmark Brent crude prices have averaged about US$52 a barrel this year, supporting some industry optimism that the worst of the oil price crash is behind it.

Last month, Sultan Al Jaber was in China and Japan to explore potential new partnerships to support Adnoc's growth strategy.