Kuwait, Opec’s fourth-largest producer, has appointed Wadha Al Khateeb as chief executive of its state-owned refiner, the Kuwait National Petroleum Company (KNPC).

Ms Al Khateeb was appointed by the Kuwait Petroleum Corporation (KPC), according to official news agency Kuna. She has spent 25 years with the company.

She was previously deputy chief executive of the Mina Abdulla refinery, which can process up to 270,000 barrels per day of crude.

Before that, Ms Al Khateeb held various positions within KNPC, including the roles of senior processing engineer in 2003, environment team leader in 2005 and technical services manager for the Mina Al Ahmadi refinery in 2013.

Ms Al Khateeb, who was a board member at the Kuwait Styrene Company in 2018, has also been chairwoman of the Kuwait Paraxylene Production Company since May 2019.

KPC also named Ahmed Al Aydan as chief executive of the Kuwait Oil Company (KOC), Kuna reported. He was formerly deputy chief executive of the state oil company.

The appointments come at a time when Kuwait is looking to boost its production and refining capacity over the next few years.

The Gulf state, which currently produces 650 million cubic feet of gas per day, plans to increase output to 1 billion cfd, Reuters reported in September.

“With the world recovering from the disruptions caused by the Covid-19 pandemic, demand for oil and gas returned to its pre-pandemic levels in 2019,” KOC's acting chief executive Khaled Al Otaibi was quoted as saying by Kuna.

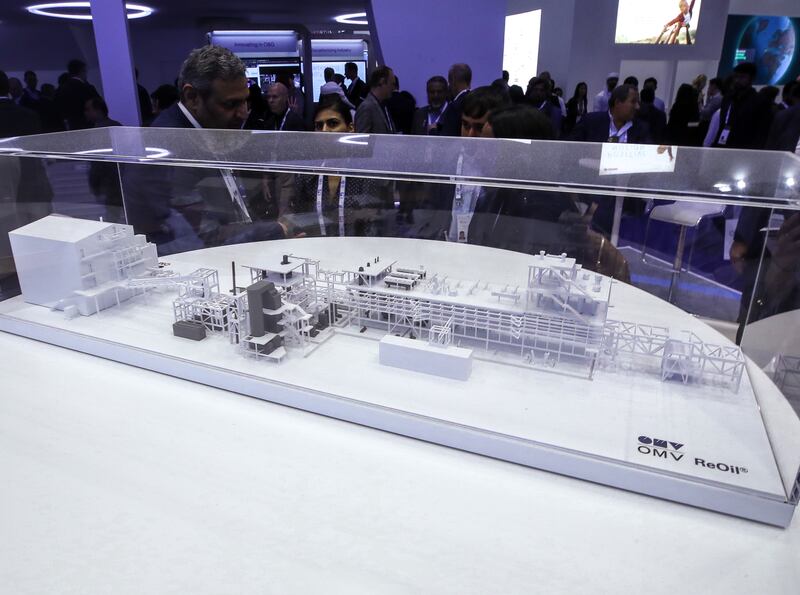

Kuwait has begun commercial operations at its Al Zour refinery, which is set to be the largest integrated refinery and petrochemicals plant in the country.

The complex, which will supply low sulphur oil to the domestic power sector, is designed to process heavy crudes and will have a capacity of 615,000 bpd.

Oil producers worldwide are reaping windfall profits after crude prices surged by more than 15 per cent over the past 12 months.

Looming sanctions on Russian crude and a recent Opec+ decision to cut output have contributed to tighter oil markets.

Last month, the 23-member Opec+ alliance agreed to slash its November output by 2 million bpd, its biggest production cut since the onset of the pandemic in 2020.

The UAE and the Opec+ are “keen on” meeting global energy requirements, the UAE's Minister of Energy and Infrastructure, Suhail Al Mazrouei, said at the Adipec energy summit last week.

“At the same time, we are not the only producers in the world … there are others who need to do their part in investing and encouraging investments is needed more than ever,” he said at the time.

The next Opec+ meeting is expected to be held on December 4, a day before the EU’s ban on Russian seaborne crude imports comes into effect.

GCC economies are projected to grow 6.9 per cent in 2022 before moderating to 3.7 per cent and 2.4 per cent in 2023 and 2024, respectively, driven by stronger hydrocarbon and non-hydrocarbon industries, according to World Bank.