Emirates Aluminium is eying further growth at its site in the Khalifa Industrial Zone Abu Dhabi (Kizad) even as its first expansion project is still under way.

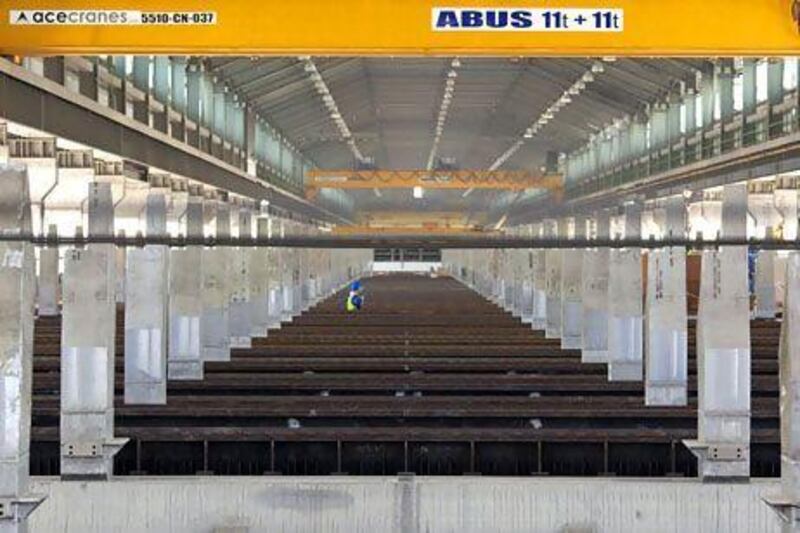

The company, known as Emal, is adding a potline to its smelter complex that will increase capacity from 800,000 tonnes a year (t/y) to 1.3 million t/y. The Phase 2 project is slated for commissioning this December, but the next expansion after that is already envisaged.

"We are hoping that our success with Phase 1 and Phase 2 will provide us with the basis to develop a bigger plant," said Saeed Fadhel Al Mazrooei, Emal's chief executive.

Phase 2 will turn Emal - a joint venture between the Abu Dhabi strategic investment company Mubadala Development and Dubai Aluminium (Dubal) - into the world's fifth-largest aluminium producer.

Further expansion is justified by a bullish outlook on demand for the metal.

"The international market is growing. There is growth in many countries … this demand has to grow," said Mr Al Mazrooei.

He expects global demand to rise from 46 million t/y now to about 60 million t/y in 2015. He did not provide details about the size and the timing of the next expansion project.

The UAE is already the region's largest supplier of aluminium with an output of 1.7 million t/y - the combined production of Dubal and Emal. Of this, only about 200,000 tonnes is sold into the domestic market, with the rest finding its way to Asia, Europe and the United States.

Emal plans to complete the US$3.8 billion Phase 2 expansion ahead of schedule. The project is more than 50 per cent complete, and the first aluminium from the new potline is scheduled for December 2. Full production capacity should be reached in the second quarter of next year.

"We are looking for opportunities to move that forward," Yousuf Bastaki, Emal's vice president of projects, said of the December deadline.

The UAE's growing smelter capacity requires larger supplies of raw materials. Aluminium is produced from alumina, which is derived from bauxite. Mubadala in November bought a stake in a bauxite mine in Guinea, the world's largest supplier, to secure access to the raw material.

The mine will help to meet Emal's increased demand.

"I'm hoping it will feed Emal, as well as Dubal. It is a good opportunity for us to secure part of our needs," said Mr Mazrooei.

Emal completed the financing for Phase 2 last month, raising $3.4bn in loans, of which $475 million represented Islamic products.

It is one of the anchor tenants of Kizad in Taweelah, and Emal's smelters are intended to attract downstream industries to the zone, which was completed last year.

So far, it has signed three memorandums of understanding for aluminium supplies in the zone, and two more agreements are imminent, said Mr Mazrooei.