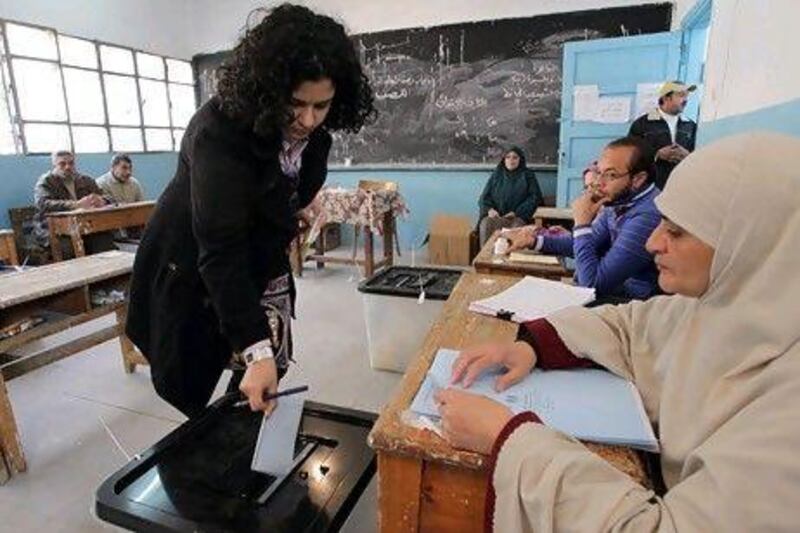

Egypt passed another hurdle in its efforts to entice foreign investment yesterday as the country's citizens cast their ballots for the upper house of parliament.

A successful election process is viewed as vital in helping to turn around the Arab world's second biggest economy.

"The elections have been weighing on investors' minds and signs of an acceleration of the process are certainly a positive," said Liz Martins, a economist for the Middle East and North Africa (Mena) at HSBC. "It will make a big difference for investors once a government is in place."

Yesterday's first-stage voting for the Shura Council, an advisory body, follows elections for the People's Assembly, the more powerful of the two houses of parliament, that took place between November 28 and this month.

After the election of the council both houses will choose a 100-member panel to draft the country's new constitution.

Creating jobs and fixing the country's shaky finances are deemed as priorities for a new government a year on from a revolution that toppled the former president Hosni Mubarak.

Millions of people are out of work and the budget deficit has swelled to 34 billion Egyptian pounds (Dh20.69bn), or 8.6 per cent of GDP, in the year to June 30.

"I have no doubt of the medium-term prospects of Egypt, where it can be a stellar economy like Malaysia," said Yasser El Mallawany, the chief executive of EFG-Hermes, an Egyptian investment bank. "But we still suffer from short-term challenges and, quite honestly, harsh decisions need to be taken.

"Now, since you have a parliament that is legitimate and that has ordinary people entrenched in it, it can take harsh decisions" such as slashing unsustainable subsidies that cost Egypt about 160bn pounds, and devaluing the Egyptian pound, he said.

The government hopes to help to ease its problems by securing a US$3.2bn (Dh11.75bn) IMF aid package.

The IMF has made it clear any agreement would have to attract broad political support within the country and be followed up with financial commitments from other donors. But political uncertainty could yet threaten the release of the funds.

"While the precarious external sector position may well push the government towards a quick agreement, the domestic pressures which forced the government to pullout from an arrangement last time do not seem to have gone away," Raza Agha, a Mena economist at the Royal Bank of Scotland, wrote in a report released this month.

Aversion to external borrowing, particularly from the IMF, from secular and liberal groups, prompted the ruling military council to pull out from talks with the organisation last year.

Islamists dominated voting for the People's Assembly in previous elections. After yesterday's first stage, a second stage of voting for the Shura Council is due to take place on February 14 and 15.

A final stage in the country's democratic transition is slated to take place by the end of June when the military council that took over after Mr Mubarak's departure cedes power to an elected civilian president.

Ahmed Ozalp, the founder and managing director of Akanar Partners, a finance company based in Cairo, said investors would be looking more towards the next few months and the presidential elections in June for confirmation of political and economic stability.

"In general, Egypt was open to business" but convincing foreign investors of that would be difficult, he added, especially during a period of political transition.