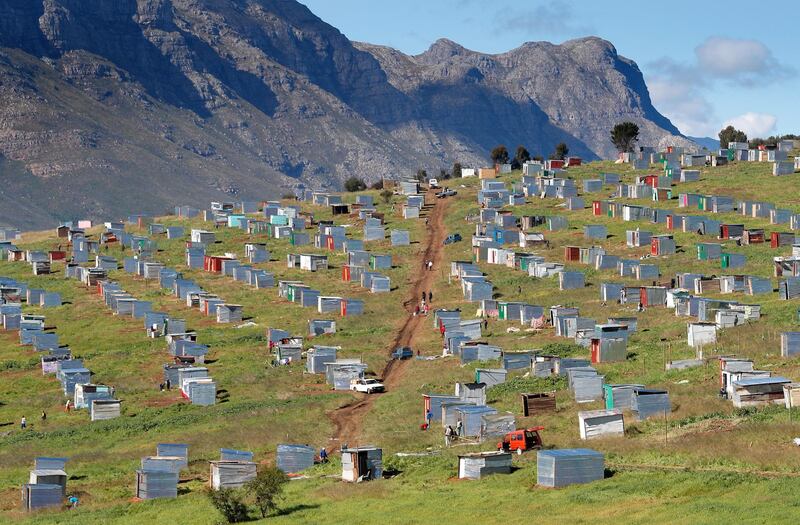

Talk of Zimbabwe-style property confiscation in South Africa has rattled investors as the government considers scrapping constitutional protection for private land ownership.

The country enjoys the safety of a constitutional guarantee to hold private property. The ruling African National Congress is, however, discussing whether to amend the highest law of the land to allow outright expropriation of property without compensation. Mostly white-owned property will be targeted and transferred to black South Africans.

Both local and international investors have been aware of the subject since it was first broached in December when the ANC voted to re-visit property rights. Most viewed it as simply party politics ahead of elections next year, but recently the land issue has become international news again, largely as a result of contradictory statements from ANC leaders on the topic.

"This is probably the biggest driver of the negative feeling now and will unfortunately remain so until there are definitive rules set for what land expropriation without compensation is," Wayne McCurrie, an equities analyst in Johannesburg told The National.

Meanwhile, South Africa’s sovereign debt is also likely to come under pressure, having risen to 2.5 trillion rand (Dh639.18 billion) or 53 per cent of the gross domestic product. Only around 10 per cent of this debt is offshore, with the bulk being held by South African banks. Because of the lack of dollar exposure, economists have generally been relatively sanguine over the country’s debt level.

However, local institutions are reaching saturation point for government debt, PwC chief economist in Johannesburg Lullu Krugel said.

"Sooner or later the government will have to go overseas to raise money. They will have to compete with other African states.

"And lenders hate uncertainty, which is what all this talk around property confiscation is creating. It will make it so much more difficult to raise finance from international lending institutions.”

The land issue was pushed on to the international stage on Thursday when US president Donald Trump tweeted that he had asked US Secretary of State Mike Pompeo “to closely study the South Africa land and farm seizures and expropriations”.

The news hit the local currency hard, which fell as much as 1.8 per cent after Mr Trump’s tweet before rebounding around 0.5 per cent. On Saturday, it sat at 14.25 to the Dollar.

_______________

Read more:

South Africa’s Land Bank says land expropriation could trigger default

South African opposition party tables law to nationalise the central bank

_______________

The Johannesburg Stock Exchange closed slightly higher on Friday, up 0.1 per cent. More than 70 per cent of its securities are exposed to offshore assets, which benefit from a weaker rand and are also seen as a haven for local investors, Mr McCurrie said.

The JSE is the world's 18th largest exchange with a total value of just over $1tn.

“The Johannesburg stock exchange is not a Johannesburg stock market, that is, not reflective of South Africa. Probably around 70 per cent of the exposure is either global or non-rand exposure,” said Mr McCurrie.

However, offshore exposure has not slowed the anxiety many investors feel. A private equity fund manager with one of South Africa's largest pension managers said he had been inundated with calls from worried clients in recent weeks.

“There has been a lot of concern by local investors, as without property rights, there is no future in this country,” he said, speaking on condition of anonymity. “No one is keen to invest locally and the economy seems to be stagnating.”

Strict exchange control laws limit South Africans to 1 million rand of direct offshore transfer a year; for any higher amounts a special clearance must be obtained through the Reserve Bank.