Smartphone shipments to China in February fell to their lowest in six years, market data indicated, as consumers continued to put off handset purchases amid a slowing economy.

Shipments to the world's biggest smartphone market totalled 14.5 million units, down 19.9 per cent from a year ago, according to data from the China Academy of Information and Communications Technology, a government-affiliated research institute.

That is the lowest since February 2013, when shipments to the China totalled 20.7 million, Reuters said.

Overall consumer purchases typically slow during February as the Chinese spend much of the month with family celebrating the Lunar New Year. But shipments this year fell more than usual as a slowing economy, exacerbated by a Sino-US trade war, hurt demand for gadgets across the board.

Apple cited slowing iPhone sales in China when it took the rare step of cutting its sales forecast earlier this year. The firm then teamed up with China's Ant Financial and local banks to offer interest-free iPhone financing in its first such move in the country as it looked to boost waning sales.

Several third-party retailers have also offered iPhones at discounted prices.

With smartphone sales expected to stay weak, companies like Chinese market leader Huawei Technologies have aimed to launch more expensive models to corner higher margins.

In 2018, Huawei's market share of China's $500 to $800 device segment rose to 26.6 per cent from 8.8 per cent, according to Counterpoint Research. Apple's share fell to 54.6 per cent from 81.2 per cent as it launched devices cracking the $1,000 price point, while others released competitive devices for less.

China's total February exports, meanwhile, fell 20.7 per cent from a year earlier, the largest decline since February 2016, customs data showed. Economists polled by Reuters had expected a 4.8 per cent drop after January's unexpected 9.1 per cent jump.

"Today's trade figures reinforce our view that China's trade recession has started to emerge," Raymond Yeung, Greater China chief economist at ANZ, wrote in a note.

Imports fell 5.2 per cent from a year earlier, worse than analysts' forecasts for a 1.4 per cent fall and widening from January's 1.5 per cent drop. Imports of major commodities fell across the board.

That left the country with a trade surplus of $4.12 billion for the month, much smaller than forecasts of $26.38bn.

China’s first batch of major official indicators this year are forecast to show that an investment recovery that began in mid-2018 is set to continue, but the economic slowdown and trade war are still undermining factory output and consumption, according to Bloomberg.

Official releases due Thursday will show that measures since last year to boost infrastructure constructions have probably started having an effect, with a slight strengthening seen in investment.

However industrial output growth is forecast to have slowed in the first two months of this year versus the December pace, while retail sales remained stable, according to economists surveyed by Bloomberg.

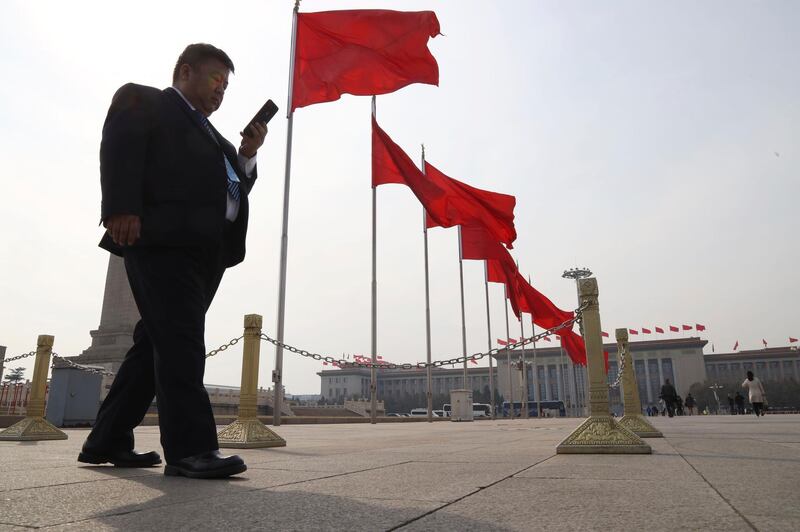

The data will be released during the final days of the annual national legislature meeting, at which the government lowered its growth target, unveiled a record amount of tax cuts, increased support for smaller firms and also reiterated that a debt-fuelled investment boom is not on agenda.