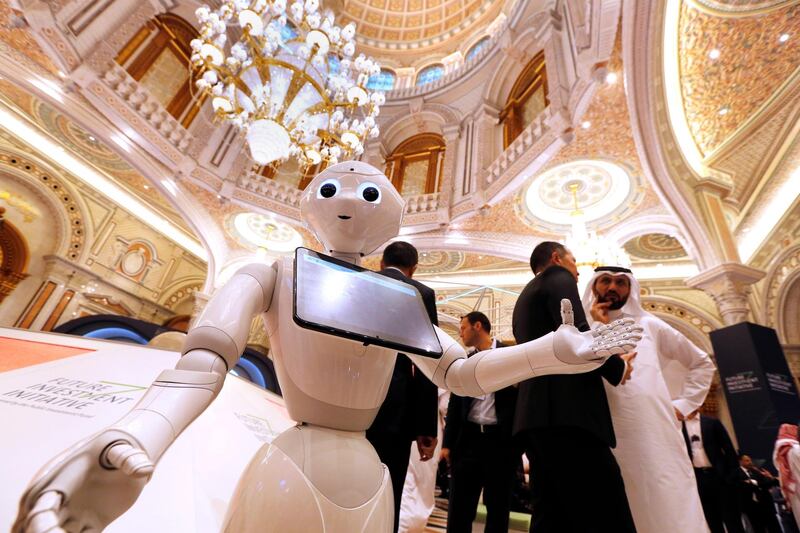

Saudi Arabia closed the third Future Investment Initiative (FII) on Thursday with 24 investment deals worth $20 billion (Dh73.4bn) as the Arab world’s biggest economy continues to institute reforms, opening the kingdom further for foreign investments.

The kingdom announced 23 deals across energy, transport, oil and gas, petrochemicals and manufacturing sectors worth $15bn on day one of FII in Riyadh. The final day saw the closing of a $5bn investment agreement between Saudi Real Estate Company (Al Akaria) and Triple 5 - the owner and developer of three of the largest commercial malls in North America - to develop the Arabian Dream project, Saudi Arabian General Investment Authority (Sagia) said.

The development will be the world’s largest mixed-use entertainment and shopping complex, at Al Akaria’s Widyan site in Riyadh, the developer said in a separate statement to Saudi stock exchange Tadawul, where its shares trade.

The mega scheme is expected to attract more than 70 million visitors annually and employ over 25,000 Saudi nationals, the statement said.

The deals build on the positive momentum that Saudi Arabia has seen so far this year in terms of inward investments.

“As Saudi Arabia welcomes investors and decision-makers from across the globe to this annual global investment platform, the agreements exchanged here today reflect the strength and diversity of the economy,” Ibrahim Al Omar, governor of Sagia, said on Tuesday.

“Under Saudi Vision 2030, Saudi Arabia is undergoing an ambitious programme of economic reform, and the world is taking notice. The indicators are clear: Saudi Arabia is not only open for business, it’s the economy of the future,” he said.

Saudi Arabia has been going through a transformation of its economy under Vision 2030, an overarching social and economic agenda driven by Crown Prince Mohammad Bin Salman. Weaning its economy off oil, part-privatising state entities and opening its non-oil sector for investment are among the key pillars of Saudi Arabia’s reform programme.

This month, Saudi Arabia climbed 30 places in the World Bank's Doing Business 2020 report, becoming the most improved economy globally.

Sagia on Tuesday announced a slew of deals including a $700 million investment by Modular Middle East to set up a prefabricated building facility in the kingdom, a $300m investment from Chinese shopping platform OneDeal for a new distribution hub and a $200m deal with the UK’s Shiloh Minerals to develop production capacity in the kingdom.

Saudi Aramco signed deals with APQ for a $600m joint venture, with Dassault for a $200m collaboration around data analytics and smart systems, and with GE-owned Baker Hughes for $230m worth of co-investments and developments around artificial intelligence and digital transformation.

The kingdom’s Industrial Clusters authority agreed on feasibility studies into a $250m local vaccine production plant with Instituto Butanan, a $110m pharmaceutical plant with Eurofarma and a $100m wind energy facility with Aeris.

The largest deal finalised was between Acwa Power and Air Products for the $11.45bn Air Product Qudra project.