South Africa’s rand is the world’s worst-performing emerging market currency, a victim of global trade tension but also of domestic troubles that are creating investor anxiety.

It was 15.35 to the US dollar at noon UAE time yesterday, remaining at an 11-month low. As with other emerging market currencies, the rand has been hit by ongoing tension between the US and China over trade. It has been in continuous decline for the past two weeks.

“Volatility has of course picked up massively over the last weeks and the rand is now officially the worst-performing currency globally since this mess started in the middle of July,” Standard Bank’s chief trader Warrick Butler said in a note.

Viv Govender, senior analyst Rand Swiss in Johannesburg, said: “We were sitting in the low 14 to the dollar, now its above 15 – that’s a move of 10 per cent, effectively. There’s global uncertainty, of course but the chances of a recession here are dramatically higher now than they were even a month ago.”

The country’s economic indicators are not providing relief. Unemployment rose to 29 per cent and the economy contracted sharply by 3.2 per cent in the first quarter of this year, according to Statistics South Africa, the state data agency. Economic growth has also been revised downward from the government’s estimate of 1.5 per cent for 2019, to 0.7 per cent, according to Stanlib bank in Johannesburg.

Meanwhile, state enterprises such as the national power utility Eskom are struggling to manage burgeoning debt. Eskom has debt of 440 billion rand (Dh28.64bn) and has approached the government for help.

Moody’s, the only credit ratings agency to have not yet assigned South Africa as junk status, warned this week that Eskom’s position was untenable.

“The current capital structure is not sustainable, absent [of] continued government cash transfers, indicating a strong and urgent need for a longer-term strategic turnaround plan,” Moody’s said in a research note.

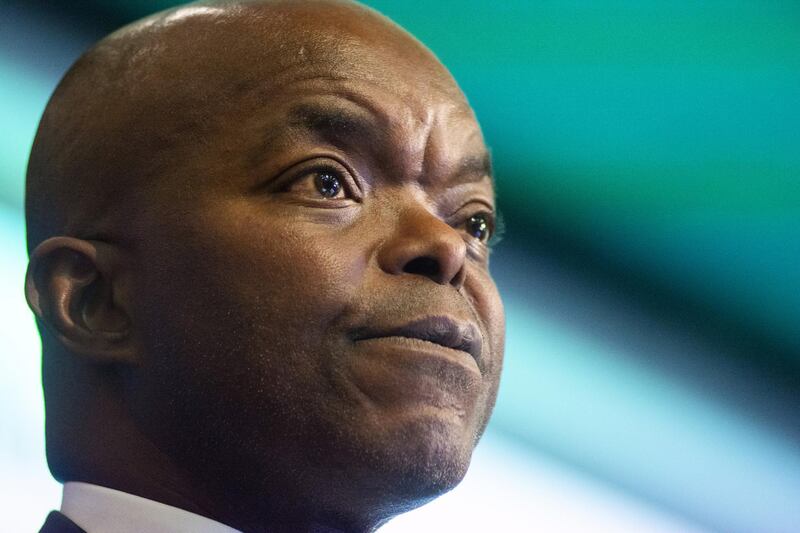

Also weighing on investor confidence is turmoil in the ruling Africa National Congress party. President Cyril Ramaphosa and Pravin Gordhan, minister of public enterprises, are fighting for their political lives as rival factions try unseat them.

Mr Ramaphosa has pledged to undo years of corruption under his predecessor Jacob Zuma and tasked Mr Gordhan to clean up state enterprises such as Eskom. A series of damaging leaks, including a list of donors who contributed to Mr Ramaphosa’s political campaign, have threatened to unseat him.

Mr Ramaphosa is viewed as a reformer and business-friendly. His opponents want him gone to put an end to his anti-corruption efforts. In an unusually forthright statement, the Chinese ambassador to South Africa said investment by Beijing into the country would not be guaranteed if Mr Ramaphosa was removed from office.

“President Cyril Ramaphosa is the last hope of this country,” Lin Songtian, China’s ambassador to South Africa, told Reuters.

One of the few glimmers of good news is that inflation is likely to remain low, said Wayne McCurrie, head of wealth and investments at First National Bank in Johannesburg.

“In this dismal SA economy, there is really only one bit of good news: as a direct result of the economy, there are no inflationary pressures,” he said. “There’s no demand so prices can’t go up. Food is the exception but still low. Add in global monetary easing, we will see further interest cuts here.”