The International Monetary Fund is ready to mobilise $1 trillion (Dh3.67tn) in lending capacity to help nations combat the deadly coronavirus outbreak, as its managing director said the need for a co-ordinated global fiscal stimulus is becoming urgent “by the hour”.

“Many members are now at risk and need support because of weak health systems, limited policy space, and exposure to the large terms of trade shocks and financial spill-overs seen in recent days,” the IMF said in a policy statement late on Monday.

“The IMF is also in close contact and coordinating country support with the World Bank and other international financial institutions.”

The Washington-based lender has made $50 billion available in financing to countries to help quell the economic fallout of the coronavirus. Low-income members of the fund can avail financing of up to $10bn at zero interest through the fund’s Rapid Credit Facility. Other member countries can access emergency financing of $40bn through the Rapid Financing Instrument, according to the lender.

Emergency financing under the RCF and RFI can pave the way for new Fund-supported programmes with larger loans, drawing on the IMF’s $1tn lending capacity. The IMF already has 40 ongoing arrangements – both disbursing and precautionary – with combined commitments of about $200bn, it said.

The Fund’s Catastrophe Containment and Relief Trust has about $400 million to help the poorest and most affected countries with grants. With the UK’s recent pledge of up to $195m, the IMF hope to increase the size of CCRT to as much as $1bn, it said.

The IMF and the World Bank have been leading calls for a coordinated global monetary policy action to reduce the impact of the outbreak on the global economy.

In a shock move, the US Federal Reserve on Sunday slashed its funds rate to 0-0.25 per cent, less than two weeks after a 50 basis point emergency rate cut to 1-1.25 per cent earlier this month. The central bank also signalled it would begin a programme of asset purchases, including $500bn of treasury bonds and $200bn of mortgage-backed securities.

Central banks across the globe have stepped up efforts to shield their economies from the impact of the deadly coronavirus outbreak, which has disrupted global supply chains and is threatening to push the US, European and some Asian economies into recession.

“Beyond these positive individual country actions, as the virus spreads, the case for a co-ordinated and synchronised global fiscal stimulus is becoming stronger by the hour,” the IMF’s managing director, Kristalina Georgieva, said in a blog post on Monday. “During the global financial crisis, for example, fiscal stimulus by the G20 amounted to about 2 per cent of GDP, or over $900bn in today’s money, in 2009 alone. So, there is a lot more work to do.”

The co-ordinated policy response by the central banks, however, has done little to boost investors’ sentiment as markets across the globe suffered heavy losses on Monday with the S&P 500 index falling about 12 per cent while the Dow Jones Industrial Index and the Nasdaq Composite Index slumped more than 12 per cent each.

Portfolio capital flows to emerging markets have also declined dramatically in February as investors pulled back $42bn since the beginning of the crisis, the largest outflow ever recorded, said the Institute of International Finance.

Ms Georgieva said there may be a need for “swap lines to emerging market economies”.

“Central banks’ policy action in emerging-market and developing economies will need to balance the especially difficult challenge of addressing capital flow reversals and commodity shocks,” she said. “In times of crisis such as at present, foreign exchange interventions and capital flow management measures can usefully complement interest rate and other monetary policy actions.”

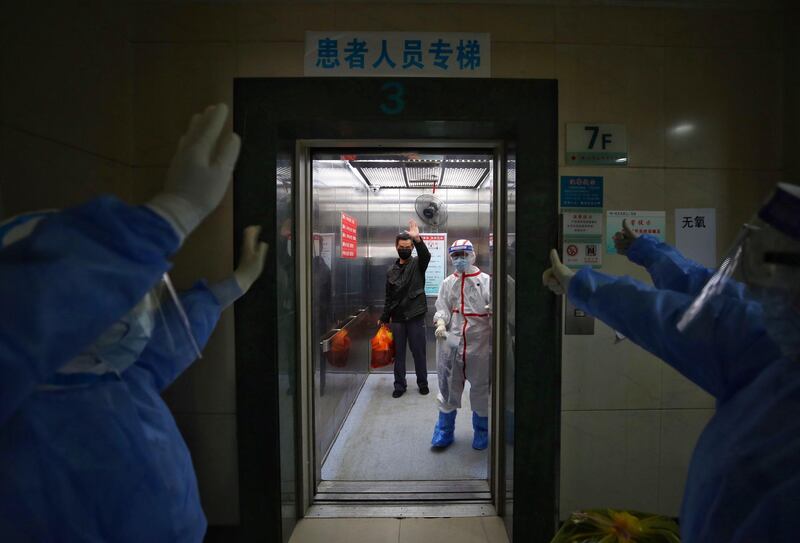

Governments in Europe and North America are trying desperately to stem the flow of the coronavirus from the Chinese city of Wuhan. The pandemic has so far infected more than 182,400 people and killed more than 7,150 across the globe. Outside China, Italy is the country hardest hit by the pandemic.

“While quarantining and social distancing is the right prescription to combat Covid-19’s public health impact, the exact opposite is needed when it comes to securing the global economy,” Ms Georgieva said. “Constant contact and close coordination are the best medicine to ensure that the economic pain inflicted by the virus is relatively short-lived.”