The International Monetary Fund called on governments to avoid withdrawing fiscal support too quickly as economies reopen gradually after taking a hit from the coronavirus-induced slowdown.

Government support should shift gradually from protecting old jobs to ensuring people return to work, the fund said yesterday in a blog post accompanying its Fiscal Monitor: policies for the recovery report.

This could be achieved by reducing job retention programmes or wage subsidies, reintroducing job search requirements and offering training to equip people with new skills, as well as helping viable but still-vulnerable companies reopen safely, the IMF said.

Governments have pumped fiscal and monetary support worth $12 trillion into their economies to soften the blow of the slowdown. These include measures such as rate cuts, liquidity injections and asset purchases by central banks.

“However, these measures are costly and, together with sharp falls in tax revenue owing to the recession, they have pushed global public debt to ... high of close to 100 per cent of GDP,” the Washington lender said.

“Also, with 80 to 90 million people likely to fall into extreme poverty in 2020 as a result of the pandemic – even after additional social assistance – it is too early for governments to remove fiscal support.”

The World Bank said last week that the pandemic will push up to 150 million people around the world into extreme poverty by next year.

The IMF called on governments to boost public investment to create jobs and spur economic growth.

Governments were also encouraged to adopt measures to improve tax compliance and evaluate the introduction of higher taxes for more affluent groups and highly profitable companies. The fund said countries should prioritise healthcare and education investment after Covid-19 subsides.

It called on government to strengthen social safety nets to ensure that everyone has access to food and other basic goods and services.

As economies begin to recover, countries around the world have been urged to seize the opportunity to move away from the pre-crisis growth model and, instead, hasten the transition to a low-carbon and digital economy.

During the global lockdown phase, public health measures introduced by governments contained the spread of the virus and created conditions for the safe reopening of businesses. Other initiatives such as unemployment benefits and wage subsidies helped to preserve jobs while cash transfers supported poor and informal workers.

Liquidity support prevented a wave of defaults and mass layoffs, especially for small and medium-sized companies, the fund said in its report.

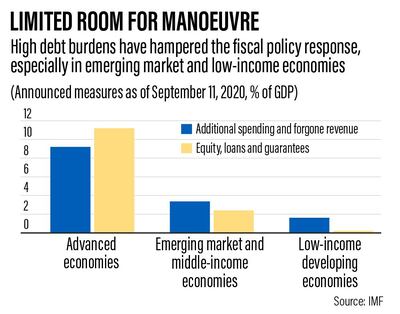

However, responses by individual countries have been shaped by their access to borrowing and their public and private debt levels heading into the crisis.

For instance, high debt burdens have hampered fiscal policy responses, especially in emerging market and low-income economies.

Governments in these countries have had limited room to raise borrowings, affecting their ability to scale up support for those most affected by the crisis.