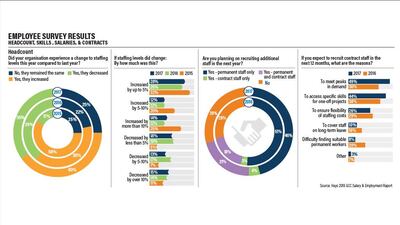

While more than a third of GCC employers reduced their headcount in 2017, four in ten boosted their workforce, reflecting the highly polarised activity in the region’s jobs market, while sentiment for the year ahead is positive, according to the Hays 2018 GCC Salary & Employment Report.

About 35 per cent of GCC employers made staff cutbacks last year, a similar figure to the 39 per cent that reduced employee numbers in 2016. However, 40 per cent of firms boosted their workforce in 2017, again reflective of the 39 per cent reported in 2016, according to the survey.

The findings of the report, which surveyed 4,250 working professionals across the GCC in the fourth quarter of last year, are “clearly indicative of what we have been seeing in the GCC employment market,” said Chris Greaves, managing director of Hays Gulf Region.

“On the one hand, the continued diversification of the local economy away from its reliance on the oil and gas sector and the increasingly globalised nature of the market have brought many opportunities to businesses in the region, who are actively hiring additional staff in order to capitalise on these," he said.

However, the sustained low energy prices and increasing competition faced by organisations in all sectors, has resulted in employers taking a cautious approach to recruitment, Mr Greaves said.

Matt Stuart, the founder and managing director of Getabed, a UK hotel room wholesaler with over 40 employees globally and 11 based in Jumeirah Lake Towers in Dubai, said the company has cut its numbers by a third in the emirate within the last 12 months.

“We’ve made the cuts due to increasing costs of employment here – we’ve been looking at the cost of living increases over the next couple of years and the pressure that’s going to put on employers to raise wages at what for us would be at a unsustainable pace because our anticipated revenues would not keep up,” Mr Stuart said.

The introduction of VAT will put further inflationary pressure on the cost of employment, something that has encouraged the company to look at alternative jurisdictions and locations to recruit staff, he added.

“We anticipate the team reducing by another 20 per cent over the course of the next 12 months with those roles being redistributed elsewhere to other jurisdictions. We’ve opened an operational office in Romania so we are moving some of that operational headcount there because it will be more cost-effective for us,” Mr Stuart said.

______

Read more:

Almost half of UAE residents worried about increased living costs from VAT

UAE salaries: VAT set to eat into pay rises, new report says

UAE salary guide: How much should you be making?

______

Even at the lower end, such as clerical staff, when all costs of employment are considered such as size of office space, medical related, salaries, and flight tickets versus hiring the same staff member in another location, it becomes more cost-effective to shift roles elsewhere, Mr Stuart added.

Companies are increasingly selective towards hiring, with application processes that are more rigorous and prolonged than previous years, said Mr Greaves. Five per cent of working professionals said they were made redundant in 2017 while 29 per cent of started a new job with a new employer.

Another difference noted in the report was an increase in the number of roles offered on a contract rather than a permanent basis in 2017, due to cost efficiencies that can be gained by companies working on short-term deadlines, such as IT or technology projects. This allows employers to take on full-time employees without the costs of fully onboarding a permanent employee.

The outlook for 2018, however, is more positive, according to the study, with seven in 10 of those polled planning to recruit additional staff in the next 12 months and 66 per cent predicting market activity to increase year-on-year for their business.

In terms of salaries, the report found similar results to 2016 with 39 per cent of respondents reporting an increase in salary while just over half experienced no change and almost one in 10 receiving a decrease.

“Some companies are selectively targeting higher performers for above inflation pay rises, but for the third year running the single biggest explanation offered by our candidates for an increase in their pay in 2017 was ‘a new job with a new company’,” Mr Greaves wrote in the report.

The number of available jobs in 2018 was unlikely to reach the peaks experienced in 2015, however, hiring activity is expected to rise compared to 2017, he said. Sectors likely to benefit from this include the IT industry, due to the region’s increasing focus on e-commerce and digitalisation, and tax implementation specialists as VAT is rolled out across the GCC.

“The bang you get for your buck elsewhere, even in the UK, which is not considered a low cost location for employment, is significant," said Mr Stuart. "The costs of employing someone in the UK versus what that person will cost in Dubai, because of the inflationary pressures, is for us starting to reach a tipping point where we cannot justify and afford to have people here."