Global gold demand surged in the third quarter on higher uptake from central banks and bar and coin investors. There was also a larger appetite for the precious metal in the Middle East as Iranians sought refuge in a haven investment, according to the World Gold Council.

Central bank gold reserves jumped 22 per cent year-on-year to 148.4 tonnes, the highest level of net purchases since 2015 as more banks joined the list of buyers, and countries including Russia, Turkey and Kazakhstan increased their holdings.

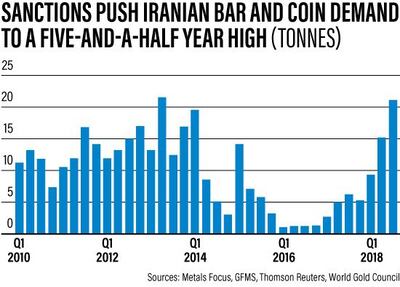

Global bar and coin investors capitalised on the gold price drop in the third quarter and bought the assets to protect themselves from stock market volatility and currency weaknesses, leading to 28 per cent jump in demand for bullion. Iranian demand soared to a five-and-a-half-year high of 21.1 tonnes, accounting for three quarters of Middle East’s demand, as the country’s citizens hoarded gold amid a plunging currency and looming US sanctions.

___________

Read more:

[ Fear of a US recession is good for gold, Goldman says ]

___________

"Renewed sanctions and the plummeting rial – with expectations for it to fall further – underpinned this flight to gold," said WGC. "VAT-free bars and coins were preferred over jewellery, which is subject to 9 per cent tax."

The Middle East bar and coin market has continued its recent upturn and climbed 144 per cent year-on-year with demand reaching 27.8 tonnes, its highest level since the second quarter of 2013, a period when demand soared in response to a sharp fall in the metal’s price.

Gold is a haven asset class that investors resort to buying in times of economic volatility, particularly in stock and forex markets. The threat of trade wars and its affect on global growth has made investors skittish about putting money into stocks and bonds, which have taken a beating this year. Gold prices fell 5 per cent in the third quarter, partly due to the strengthening of the US dollar.

Global demand for all types of gold increased 0.6 per cent to 964.3 tonnes from a year earlier.

The rise in central bank reserves and bar and coin purchases offset the plunge in investments in exchange-traded funds, which saw their first quarterly outflows since the fourth quarter of 2016. ETF investments fell 21 per cent year-on-year from the third quarter of last year.

North America, home to the largest and most liquid gold-backed ETFs, accounted for 73 per cent of outflows in the third quarter and almost 90 per cent of outflows so far this year. Meanwhile, global demand for jewellery grew 6 per cent as lower prices lured buyers.

In the Middle East, jewellery demand remained strained due to geopolitical tensions and fell 12 per cent year-on-year to 37.7 tonnes. Iranian jewellery suffered from the largest dip in the region for the second quarter in a row, down some 60 per cent

year-on-year.