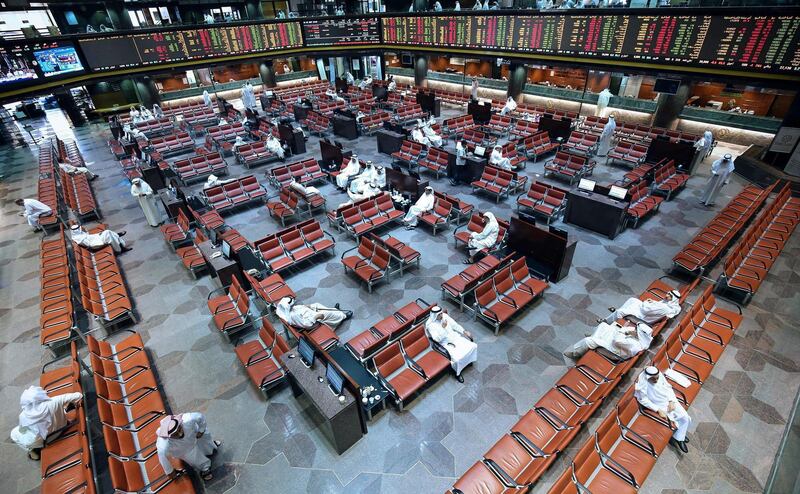

Kuwait’s stock exchange, which will see two public offerings by year end, still intends to list in 2019 and expects to record as much as 15 per cent more in capital inflows following its inclusion in the FTSE Russell Emerging Market index, its chief executive said.

"The country saw an influx of foreign investors even before the inclusion and now we are seeing a lot of interest from international investors who are contacting us and our local listed companies … more frequently," said Khaled Al Khaled of Boursa Kuwait.

It is too early to calculate the exact rise in flows since September, and there is a second tranche of inclusion in December, but the chief executive said gaining emerging market status together with capital market reforms Kuwait has been implementing since 2016, will boost liquidity and encourage more public listings.

“As the whole ecosystem of Boursa Kuwait [evolves], we expect a liquidity increase of between 10 to 15 per cent over 2019, and it will be even better in 2020,” he said.

_______________

Read more:

Kuwait Finance House third quarter net profit rises 31.4%, beating estimates

Kuwait joins FTSE Russell, affirming ‘safe haven’ for foreign inflows

_______________

Mr Al Khaled anticipates two initial public offerings of Kuwaiti companies on Boursa Kuwait, the oldest market in the region, before the end of the year. They are utilities provider Shamal Azzour Al Oula Company and a financial services company he did not name.

The chief executive is targeting two or three listings per year as the stock market develops – particularly Kuwaiti diversified family businesses going through a transition period to their second or third generation of leadership.

Boursa Kuwait was upgraded to FTSE Russell emerging market status in September in what analysts described as a "watershed moment" for Opec's fifth-largest oil producer.

“Capital market developments like this make the region difficult to bypass from an investor point of view,” Salah Shamma, head of Mena investment at Franklin Templeton, said at the time. It predicts an additional $1 billion (Dh2.6bn) of passive inflows as a result.

Kuwait is in the midst of a five-year programme to bring its capital markets into line with global standards and attract more foreign investment to the country.

Among the reforms made to date are segmentation of stocks according to market capitalisation and liquidity since April, and publication of foreign ownership data for Kuwaiti banks for the first time – required by index providers to assess foreign ownership limits.

Forthcoming reforms will see the introduction of short-selling (the sale of borrowed securities) on the exchange, the listing of real estate investment trusts, and a product called SLB (stock lending and borrowing), which are expected in the first quarter of 2019.

From 2020, Boursa Kuwait will introduce derivatives trading and exchange-traded funds. In the coming weeks, the bourse is launching an over-the-counter stock market, intended to help prospective listed companies with "price discovery" before they decide to go public, Mr Al Khaled said.

It is hoped that the new platform will eventually include one of the first venture capital exchanges in the region, to encourage investment in Kuwaiti start-ups.

The planned IPO of Boursa Kuwait is on track for the first quarter of 2019, led by Kuwait’s Capital Markets Authority.

“We will be the first fully fledged privatised regional stock exchange, 94 per cent owned by the people and private sector,” Mr Al Khaled said.

Under the FTSE inclusion, Kuwaiti stocks entering the index were given 50 per cent of their weightings in September and the remaining 50 per cent in December.

Kuwait will have a 0.51 per cent weighting in the index.

Next year could bring further developments, as index provider MSCI will decide in June whether to reclassify its Kuwait index with emerging-market status. Analysts estimate such a move could trigger passive fund inflows of $2bn.

“We have introduced extremely major changes in a short time since 2016, which people thought we could not do but we have proved to them we can,” Mr Al Khaled said.

“However, the changes are new and the market needs time to adapt.”

__________________

Get stories like this one in your inbox each morning. Sign up for our daily newsletter here