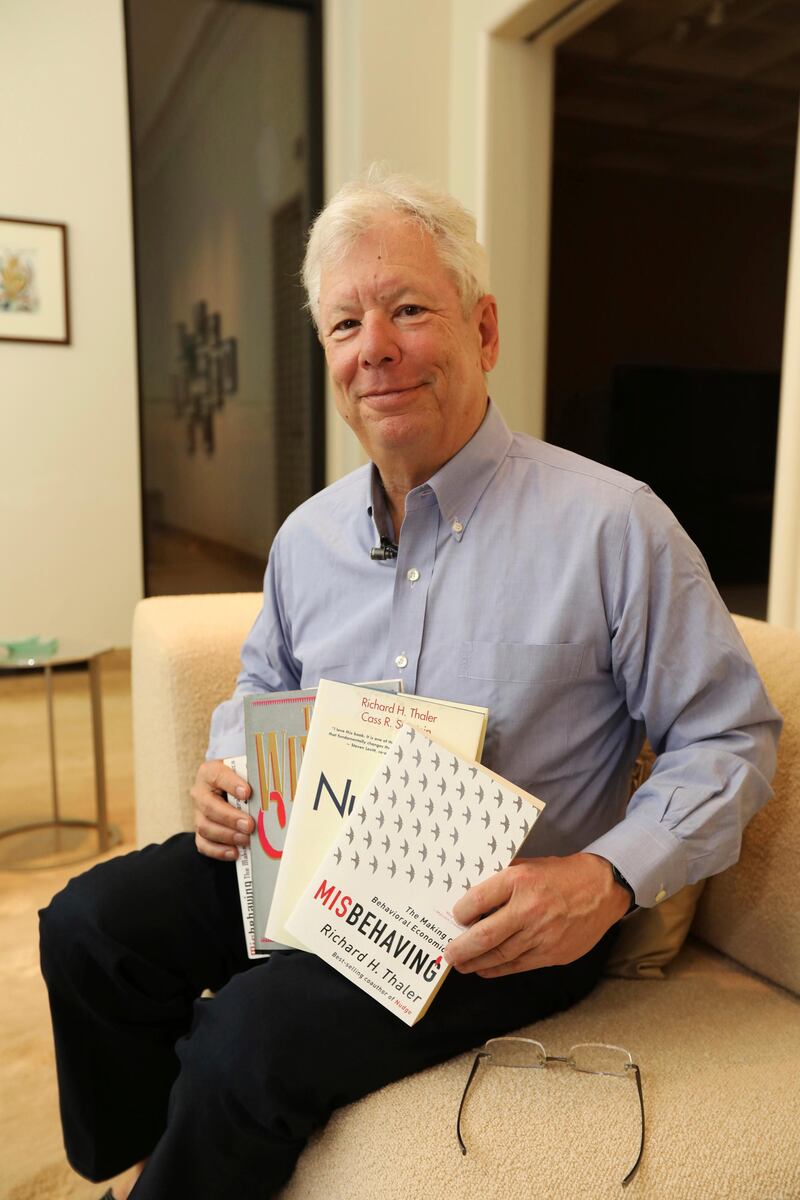

Richard Thaler, an economist at the University of Chicago Graduate School of Business, won the 2017 Nobel prize in economics for his contributions to behavioural economics. What is “behavioural economics,” and what is its importance?

To answer this, let's take a step back and think about scientific modelling. In science, a key goal is to learn about the relationships between different phenomena, sometimes out of abstract intellectual curiosity, and other times to inform policymakers that are striving to improve the lives of everyday people. This latter category is of particular interest to economists, who ask questions about the effect of education on earnings, the effect of unemployment insurance on the rate of unemployment, and so on.

The problem is these relationships are almost exclusively embedded in environments whose complexity is beyond what the human brain can handle. We have good reason to believe that education affects earnings, for example; but many other factors are at play as well, such as experience, race, gender, height, strength, intelligence, sociability, the job type, and so on.

Rather than giving up, scientists - including economists - develop “models,” which are simplified descriptions of otherwise complex environments. Thus, an economist trying to understand earnings may decide to focus on the effect of education and experience only, and to ignore the fact that many other variables have an effect, too. This makes the problem cognitively digestible, or “tractable”: by cutting down on the dimensionality of the environment, to almost perversely simple levels, a scientist can muster the mental resources necessary to analyze the relationships, and to make predictions about what would happen in real life if one of the variables was changed.

When you were in high school, you used models in science all of the time. In physics, when you wanted to predict the speed with which a ball would roll down a slope, you built a model which assumed that there was no friction or air resistance. In chemistry, when you wanted to predict which elements could form compounds, you used a model that characterized atoms in terms of electrons, neutrons, protons, and nothing else.

_______________

Read more:

[ Economics 101: Should Arabian Gulf countries worry about remittances? ]

[ Economics 101: Inter-cultural ties are key building blocks for international business ]

[ Economics 101: Terrorism rarely destroys tourism for good ]

_______________

Both models are fundamentally inaccurate descriptions of reality, but for certain environments, they did a pretty good job of predicting outcomes. As you acquired more skills, you were taught more complex models, that allowed for more nuanced predictions. However, at no point did you use a model whose assumptions were even close to being accurate.

What does this have to do with Richard Thaler and behavioural economics? Loosely speaking, modern “neoclassical” economics is the study of decision-making, which is subject to three modeling assumptions.

Firstly, people have a notion of how their actions affect their own well-being, and they make decisions to maximize their well-being. Secondly, people’s well-being depends purely on their own outcomes, and not the outcomes of others. Thirdly, people’s well-being is determined by their financial income.

This suite of assumptions has been deployed by economists to gain great insights about how real phenomena work, such as how to control price inflation, how job-seekers find vacancies, and how international trade improves living standards.

Like physicists and chemists, economists constantly refine their models to gain additional insights. Thaler’s work was primarily about loosening the neoclassical assumptions underpinning modern economics to better understand human behaviour in certain areas where the models did a poor job of predicting behavior.

In particular, Thaler, building on the work of former Nobel Prize winner Herbert Simon, and working alongside fellow laureate Daniel Kahneman, imported alternative assumptions about human behavior from the field of psychology to improve the predictive accuracy of the neoclassical economic model.

One line of inquiry challenged the first assumption, and suggested that limitations to people’s cognitive abilities prevented them from maximising their well-being. For example, humans can only remember and retrieve so many pieces of information, and so they rely on rules of thumb (such as keep 50 per cent of your portfolio in stocks, save 10 per cent of your monthly income, always look left then right when crossing the road etc) as a substitute for often more complicate decision making processes.

Thaler and his colleagues also posited alternative assumptions about people’s interactions with others: they asserted that humans care about their well-being relative to others, especially neighbors and colleagues. They also exhibit spite and altruism, both of which are inconsistent with the neoclassical model.

Finally, non-financial factors also affect a human’s well-being, such as how liked they are by their family, or how much power they wield over others.

This new field was behavioral economics, and it has afforded us a better understanding of why people struggle to lose weight, why employers prefer layoffs to wage cuts, and why we rarely see large, anonymous charitable donations. The fruits of Thaler’s work can be seen in the behavioural “nudge” units operating in the governments of many of the world’s richest countries.

Omar Al-Ubaydli is the program director for International and Geo-Political studies at Derasat, Bahrain. We welcome economics questions from our readers via email (omar@omar.ec) or tweet (@omareconomics).