Shiva Vig, the group chief executive of BioD Energy, a Delhi-based producer of biodiesel with a plant in Haryana in north India, says his business is being dramatically impacted by the coronavirus outbreak.

The company is taking a hit because it largely depends on animal fat to produce bio diesel. But Mr Vig explains that the coronavirus has caused a sharp drop off in meat exports to China and other Asian countries. Restrictions that were already in place meant that meat exports from India would largely flow into China via Vietnam.

“A lot of slaughterhouses in India have shut down,” he says. “What that means for us is there's no animal tallow being produced as a by-product, and hence the connection to the bio fuel industry.”

The company normally produces 120,000 litres of biodiesel per day, but this has dropped to around a third following the coronavirus outbreak. In addition, costs have gone up because it is using costly edible oil to produce the fuel in order to try to deliver on its contracts and avoid penalties, says Mr Vig.

“We'll probably have to [temporarily] close our plant by the end of the week if the situation doesn't get better,” he says.

This demonstrates the far-reaching impact of the coronavirus on India's businesses and the economy, as fears over a pandemic weigh more broadly globally.

India's central bank, the Reserve Bank of India, and economists warn that the coronavirus poses a risk to the country's trade and tourism sectors in particular, which in turn impacts the growth of Asia's third-largest economy.

India depends heavily on China for non-oil imports, including components used by manufacturers and suppliers of ingredients for the country's $33 billion (Dh121bn) pharmaceutical industry, but these imports into India are being disrupted as factories in China temporarily close because of the virus.

“Though global uncertainties relating to trade tensions and Brexit have abated, a new uncertainty from coronavirus has arisen,” the central bank said in its latest monetary policy meeting minutes published this month. “The implications for India are yet to unravel.”

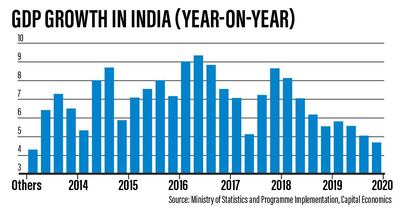

On Friday, India revealed GDP grew in the three months to December by 4.7 per cent year-on-year, while revising the previous quarter's figure upwards to 5.1 per cent, meaning growth slowed during the period.

There had been widespread hopes of a slight pick-up in the economy, as some indicators including the latest manufacturing purchasing managers' index suggested that the worst may be over in terms of India's slowdown.

Now, growing fears surrounding the spread of the coronavirus are tempering economists' expectations for an improvement in India's economy, which is expected to grow at 5 per cent in the current financial year to the end of March, according to the Indian government. That is a more-than decade low.

Any “recovery is likely to be gradual amid emergence of new global risks, with the spread of Covid-19 to countries beyond China posing a known-unknown risk to supply chains and the global economy”, according to a research note published on Saturday by Mumbai-based Yes Securities.

The consensus is that India needs to be hitting GDP expansion levels above 8 per cent annually to be able to create enough jobs for the country's young population and to achieve the government's target of India becoming a $5 trillion economy by 2025.

There have been a series of measures that have been taken by the Indian government to try to kick-start growth in recent months, as the economy slowed amid weak consumption and investment trends, exacerbated by a credit crunch in the non-banking financial sector. These included a cut in corporate taxes, a bailout package for the housing sector, and an increase in infrastructure spending. But these may not be enough to compensate for the threat posed by the coronavirus.

“If you look at our major imports from China, it's electronic items including mobile phone parts, organic chemicals, so in many cases this creates a shortage and impacts our manufacturing industry,” says Sujan Hajra, the chief economist at Anand Rathi, a financial services firm based in Mumbai. “As well as a drop in tourists from China, globally the tourism and travel industry gets affected, so India will also get negatively impacted by all these developments.”

Sanjay Bhatia, the co-founder and chief executive of Freightwalla, a digital logistics firm based in Mumbai, says that “the overall production and exports from China have dropped over the last couple of weeks, resulting in a shortage of containers at Indian ports, and shipping lines doing empty sailings”.

He explains that Indian manufacturers are looking to countries including Japan and Taiwan as alternative sourcing hubs for the products they require.

“The situation is not very severe at present, but if this continues, one can expect a surge in the prices of consumer durables by 5 to 10 per cent in the near future,” Mr Bhatia says.

Meanwhile, travel advisories and coronavirus fears have resulted in conferences and holiday plans being cancelled, which is hurting India's hospitality sector.

“Just as the industry was getting ready to look forward to a turnaround by this financial year-end, the effects of Covid-19 came as a rude shock to the travel and tourism fraternity,” says Nitin Mittal, the co-founder and chief executive of Hotel N Apartment, a corporate hotel and short-stay bookings platform based in Bangalore. “Travel and tour companies are staring at block cancellations as multinationals are scaling down travel. Similarly, hotel chains are also facing the brunt of group cancellations from leisure companies.”

Beyond trade and tourism, India's stock markets have been hit hard, as markets globally faced sell-offs as investors turned risk-averse.

India's shares this week saw their biggest weekly fall in more than a decade, as investors concerns over a global recession grow amid the spread of the coronavirus. The benchmark BSE Sensex index on Friday slumped 3.64 per cent to close at 38,297.29.

“The Indian indexes would continue to track the overseas markets which are likely to be under stress in the near-term as the impact of the outbreak would adversely impact supply chains across the globe including India,” says Ajit Mishra, vice president of research at Religare Broking, based in New Delhi.

But there are some who see a potential silver lining in the situation, and say that India could benefit by becoming less dependent on imports from China, by exporting more of its products to replace China's flow of goods.

“The global supply chain is getting impacted and so they are already looking for alternative sources,” says Mr Hajra. “Countries closer to China, like Vietnam, Malaysia, South Korea, Japan, they are also affected by the coronavirus. In some sense, India is far more insulated, so if you really want to de-risk yourself, India becomes pretty attractive as a global sourcing hub — things like electronics, chemicals.”

India so far has only had three confirmed cases of the coronavirus, which is very low compared to the spread of infection in countries such as Italy, South Korea and Iran, where hundreds have tested positive.

Mr Hajra adds that while the “short term impact is definitely negative for the whole world and India, for the medium to longer term, I would expect the impact to be marginally positive for India”.

There are some traders in India who have long been unhappy about India's dependence on imports.

“Under long term measures, the government should carve out ways and means to ensure that overdependence on any country should not happen as it will cripple our economy,” says Praveen Khandelwal, the national general secretary of the Confederation of All India Traders, an industry lobby group.

He has written a letter to the country's prime minister, Narendra Modi, urging the leader to put together a group of ministers to assess the impact of the coronavirus on trade and industry in India and to come up with solutions as soon as possible.