China took another step to clamp down on leverage in the financial system, ordering banks to ensure they are not exposed to risks from their entrusted loan business.

Banks can only act as intermediaries when arranging entrusted loans, and must not provide guarantees or get involved in decision-making, according to new rules posted in a statement on the China Banking Regulatory Commission’s website over the weekend.

The entrusted loan business, which normally involves companies providing finance to each other with banks acting as intermediaries, has seen “certain potential risk hazards” due to rapid growth and a lack of regulations, according to the CBRC statement. Entrusted loans cannot be used for investments in bonds, derivatives, asset management products or equities, the CBRC said.

____________

Read more:

[ China's Didi strengthens Brazilian presence through controlling stake in 99 ]

____________

The new CBRC rules will have a limited impact on Chinese banks’ revenues because the entrusted loan business was already on the decline, following rapid growth in the three years to 2016, China International Capital Corp analysts including Victor Wang said in a note. Investments through entrusted loans reached 7.4 trillion yuan (US$1.14tn) at the end of 2016, the CICC analysts said.

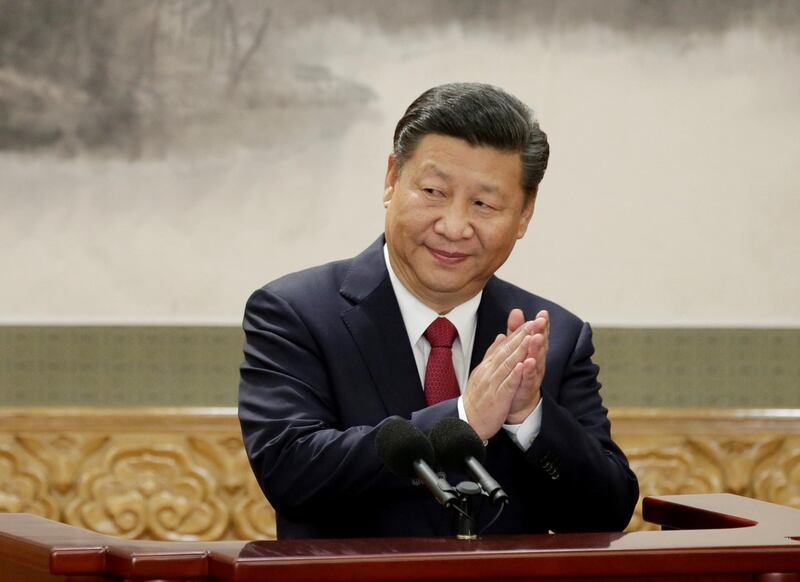

President Xi Jinping and his senior economic officials have vowed to make controlling financial risks a top priority, a pledge renewed at the Communist Party’s twice-a-decade leadership congress in October. Since April, regulators have stepped up efforts to curb the threat that excessive leverage in the financial system poses to economic growth.