Religious tourism in Saudi Arabia, the Arab world's largest economy, is set to pick up pace as the kingdom undertakes at least US$50 billion worth of projects aimed at boosting the number of Hajj and Umrah pilgrims over the next three years.

“Religious tourism is already a key part of the non-oil economy, and we believe that it will become even more important as the government invests in the sector,” said Raphaele Auberty, MENA Country Risk Analyst at BMI Research, a unit of the Fitch Group.

Increasing the number of religious tourists is part of the government’s 2020 National Transformation Programme and Vision 2030, which aim to lower dependence on oil income.

This year in particular, the Hajj season is benefiting from the easing of restrictions on quotas set for each Muslim country, enabling more pilgrims to perform one of the five pillars of Islam.

The number of Hajj pilgrims last year plummeted to around a 10-year low of 1.86 million, as the kingdom restricted numbers and Iranian pilgrims stayed away over political tensions between Riyadh and Tehran. Pilgrim numbers peaked at 3.16m in 2012.

__________________________

Read more:

[ The Saudi factory that stitches the Kaaba's gold-laced cover ]

[ Heathrow airport hums with anticipation as British faithful prepare for Hajj ]

[ Medical teams to care for UAE pilgrims deployed to Saudi Arabia ]

__________________________

According to Maher Jamal, the chairman of the Makkah Chamber, the city lost around 15bn riyals per year over the last four years due to restrictions on the number of Hajj pilgrims, a figure that is expected to be recouped this year with the relaxing of quotas on worshippers.

Saudi Arabia is expanding the Grand Mosque in the holy city of Mecca at an estimated cost of $26.6bn to accommodate some 2.2m worshippers from around 600,000 currently. The $16.5bn Haramein high-speed railway linking Mecca to Medina, the prophet's birthplace, is scheduled to offer passenger services from next year. The 450-kilometer long line completed the first test run in July.

The government is also expected to conclude next year the $7.2bn expansion of Jeddah's King Abdulaziz International Airport, the main gateway to the holy cities and the country's largest by capacity. The newly expanded airport will be able to handle 30 million passengers a year.

Under the country's transformation programme, the number of Hajj pilgrims is envisaged to reach 2.5 million by 2020, with Umrah pilgrims expected to more than double to 15 million from around 7 million now.

“The need to increase the Hajj and Umrah activities will be also supported by government initiatives to diversify income away from oil,” said Iyad Ghulam, Senior Equity Research Analyst at NCB Capital, the investment arm of Saudi Arabia's largest bank National Commercial Bank.

“By promoting religious tourism, this will be another revenue stream for the government.”

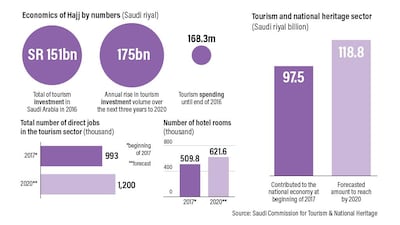

Religious tourism remains the main source of tourism for the country, which has been identified as a key contributor to jobs and income over the coming years. Overall, income from tourism accounted for 3.57 per cent of GDP in the beginning of this year and is set to exceed 3.64 per cent by 2020, according to the Saudi Commission for Tourism and National Heritage.

Investment in tourism is expected to soar 16 per cent to 175bn Saudi riyals by 2020 from the current 151bn riyals. The sector, which employs more than 993,000 people, is expected to boost that figure to 1.2 million by 2020, according to the commission.

Various industries are benefiting from increased activity in tourism.

During last year’s Hajj season in September, hotel occupancy in Mecca hovered around 90 per cent, compared to around 60 per cent for the whole of Saudi Arabia, according to STR, a data and analytics specialist.

Nearly half of the more than 64,900 rooms in the pipeline in Saudi Arabia are in Mecca, according to STR.

“It is expected that if the [2020] targets are achieved, there is enough existing [hotel] supply and new supply coming into the market to cater for the initial increase in pilgrims, which should reach the same levels as before the restrictions were introduced, over the next three years,” said Ahmed Almihdar, senior analyst Saudi at broker JLL.

“However, beyond 2020, once the number of pilgrims is expected to surpass historical figures, there may be pressure on the hospitality sector," Mr Almihdar said, adding "in this case, the pipeline of supply needs to materialise in line with the continued targeted increase by 2030.”

While the hospitality sector is an obvious beneficiary, other sectors are likely to gain from the upsurge in pilgrims, according to NCB capital.

Saudi Arabia's Al Tayyar Travel Group, Saudi Ground Services (SGS) and Saudi Airlines Catering (Catering) are among the three publicly-listed companies that are likely to benefit from the increase in pilgrims, according to NCB Capital, which has an overweight rating for all three of the company's stocks.

“The first area that will capture the increase in Hajj and Umrah traffic will be the airports,” said Mr Ghulam. “SGS has a market share of around 90 per cent of ground services. The same story for catering because they have a large market share of more than 90 per cent.”

Other sectors that will also indirectly benefit include telecom operators, who will get new mobile subscriptions during the busy pilgrimage season to fast moving consumer goods companies as pilgrims consume more water and other goods, he added.