Surging inflation and the Russia-Ukraine war are threatening economic momentum in the Middle East and North Africa through several channels, with oil-importing and low-income countries particularly vulnerable to commodity price pressures and supply chain disruptions, the International Monetary Fund said.

The region, in which gross domestic product grew by about 5.8 per cent last year, maintained economic momentum entering 2022 despite rising inflation and a short-lived pandemic-induced slowdown in January. But the pace of economic recovery will be uneven for different country groups.

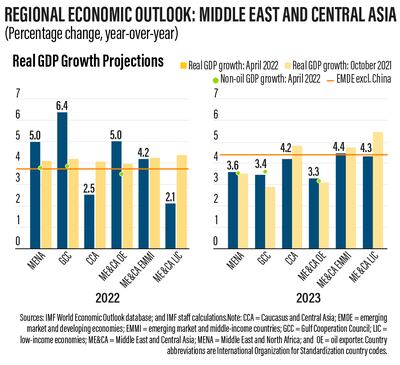

Overall, Mena real GDP is projected to expand by 5 per cent in 2022, more slowly than 5.8 per cent in 2021, but still an upward revision of 0.9 percentage points from the fund’s October estimate, the IMF said in its latest regional economic outlook for the Middle East and Central Asia (ME&CA).

“The upgrade reflects the improved outlook for oil exporters and better than expected growth in the first half of fiscal year 2022 for Egypt,” the IMF said.

But the war in Ukraine and western sanctions on Moscow, the persisting pandemic and winding down of Covid-19 support measures by governments and central banks are causing headwinds.

“The economic environment in 2022 is defined by extraordinary headwinds and uncertainties, particularly for commodity importers, with higher and more volatile commodity prices, rising inflationary pressures, faster-than-expected monetary policy normalisation in advanced economies and a lingering pandemic,” the Washington-based fund said.

“Downside risks dominate the outlook and include a prolonged war and further sanctions on Russia, tighter than expected global financial conditions, possible de-anchoring of inflation expectations, a sharper slowdown in China and new pandemic outbreaks.”

The war in Ukraine and sanctions on Russia have worsened global growth and inflation prospects, adding to the uncertainty.

Oil prices rose more than 67 per cent last year on better than forecast demand, but have remained volatile since Russia invaded Ukraine.

Average petroleum spot prices have fluctuated between $98 per barrel and $130 a barrel since the conflict began and are expected to settle at about $107 per barrel in 2022 – an increase of about $43 a barrel compared with the October estimate – above the 2019 average of $61.4 a barrel, according to the IMF.

Food prices are expected to increase by about 14 per cent this year on top of the 28 per cent increase in 2021. Russia and Ukraine collectively account for about a quarter of global wheat supply. Before the war, Russia was the world’s largest wheat exporter and Ukraine the fifth, according to World Bank data.

Inflation in the ME&CA region will remain elevated this year. The IMF forecasts Mena inflation will reach 13.9 per cent, slightly lower than the 14.8 per cent recorded last year, driven by a significant increase in food and energy prices, and in some cases, exchange rate depreciations and lax monetary or fiscal policies.

The IMF expects inflation in the Caucasus and Central Asia (CCA) region to hit 10.7 per cent this year, up from 9.2 per cent in 2021.

“Higher food prices and potential supply shortages are challenging both the affordability and availability of basic food staples like wheat,” the IMF said.

“Higher wheat prices alone can increase ME&CA’s external financing needs by up to $10 billion in 2022. Supply shortages … can endanger food security, particularly for low-income countries, as they may also suffer from potential aid diversion.”

The economic recovery in Mena will vary, with growth in oil-exporting nations projected at 5.4 per cent, the IMF said.

Economies of emerging markets (EMs) and middle-income (MI) countries in the region will grow at 4.4 per cent and 1.1 per cent, respectively, amid limited policy space, inflation and elevated debt.

Debt in ME&CA EMs and MIs is expected to increase further in 2022 and stay above pre-pandemic levels in the medium term. Public gross financing needs are expected to increase to $584bn over 2022-23.

“By 2024, the impact from faster-than-expected normalisation of monetary policy in AEs [advanced economies] is projected to increase EM and MI countries’ annual budgetary interest expenses by about 4.5 per cent of fiscal revenues.”

In contrast, oil exporters will have better prospects because of higher oil production in line with the Opec+ agreement, higher-than-expected crude prices and successful mass vaccination campaigns in several countries.

Growth in the GCC countries is projected to accelerate from 2.7 per cent in 2021 to 6.4 per cent in 2022, an upgrade of 2.2 percentage points from the fund’s October projections.

The upgrade “largely reflects upward revisions for Saudi Arabia (2.8 percentage points) and, to a lesser extent, other economies (Kuwait, Oman and UAE), reflecting higher oil production in line with the Opec+ agreement, base effects and a recovering non-oil sector”, the IMF said.

The lender expects non-oil GDP in the GCC to expand at a healthy 3.5 per cent to 4 per cent in 2022 and 2023, despite a gradual slowdown relative to 2021.

“This will sustain the outlook for these economies as oil GDP slows down after 2022,” the IMF said.

Inflation prospects vary across ME&CA oil exporters this year.

In the GCC, inflation is expected to peak at 3.1 per cent, from 2.2 per cent in 2021, with high inflation remaining a “concern outside GCC countries”, the fund said.

Inflation estimates have been revised significantly for Iran and Iraq by 4.8 and 2.4 percentage points to 32.3 per cent and 6.9 per cent in 2022, respectively.

These high levels capture the “pass-through from currency depreciation and loose monetary and fiscal policies (in Iran), and higher imported inflation (in Iraq),” the IMF said.

“Inflation for CCA oil exporters is expected to reach 10.4 per cent, on average, in 2022, largely driven by Azerbaijan, which is seeing a broad-based surge in prices.”

The windfall from higher crude prices is expected to improve fiscal and external balances for oil-exporting nations and the IMF expects oil revenues reaching $818bn – an upward revision of $320bn from its estimates in October.

Proceeds from oil in 2022 are projected to increase by an average of 5.3 percentage points of the GDP compared to 2021, the fund said.

Oil-exporting nations’ current account balances are expected to improve to 12.2 per cent of GDP, an upward revision of about 8.7 percentage points from October.

“Official reserves are expected to increase to $1.3 trillion in 2022 – an upgrade of about $235bn. Most oil exporters are expected to rebuild fiscal buffers,” the IMF said.

But with risk skewed downwards, policymaking has become increasingly complex, with dwindling macro policy space to deal with “extraordinary shocks amid high debt and inflation”, it said.

“Given divergent outlooks, policies will need to be calibrated carefully to country circumstances to manage uncertainties, maintain macroeconomic stability, and support the recovery while protecting the most vulnerable, and ensuring food and energy security,” the fund said.

Structural reforms have become even more urgent to prevent scarring from the pandemic and the effects of the war, the IMF said.