A strategic trade agreement between the UAE and UK would undoubtedly benefit investors and business in both countries. But the relationship is far from new. The Emirates already has a long history of investing in Britain.

Investment from the UAE into the UK stood at £5.5 billion ($7.6bn) at the end of 2019, says the Department for International Trade, and the UAE accounted for £7.8bn of total UK outward foreign direct investment stock in 2019.

The strong ties and partnership between the two countries are built on a decades-old, dynamic, bilateral trade relationship, with the commitment increasing in recent years.

Dr Thani Al Zeyoudi, Minister of State for Foreign Trade, said the UK was a longstanding and trusted partner, with the strong bilateral relationship dating back to the birth of the UAE 50 years ago.

“The UAE believes that our relationships with like-minded, outward-looking economies such as the UK” are “essential”, Dr Al Zeyoudi said. The UAE is looking to achieve its ambition to double its total economic output to Dh3 trillion by 2021, with areas “for potential collaboration” between the two nations “constantly expanding".

Britain is now the UAE’s 25th largest trading partner, says the DIT, with more than £18.6bn in bilateral trade in 2019, up by 1.6 per cent from 2018.

Last year, that figure dropped to £12bn because of the effect of the Covid-19 pandemic on the supply chain.

Total trade in goods and services between the countries was £10.7bn in the year to April, a decrease of 41.4 per cent from £7.6bn in the same period a year earlier, highlighting the stark effects of the pandemic.

Investment into the UK is important for the UAE. Waleed Al Mokarrab Al Muhairi, the deputy group chief executive of Abu Dhabi's Mubadala Investment Company – the capital city’s sovereign investment arm – joined Britain’s newly formed Investment Council in April as one of its members.

Made up of dozens of private sector figures with backgrounds in banking, technology and other industries, the council advises ministers on how to promote the UK to foreign investors.

“The UAE is an important trading partner for the UK and home to some of the world’s largest and most experienced investment companies,” Britain’s former international trade minister Liz Truss said this year.

While post-Brexit Britain is aiming to increase its presence on the world stage, the UAE is hoping to form new partnerships and find opportunities for further investment overseas as it looks to diversify its economy from hydrocarbon.

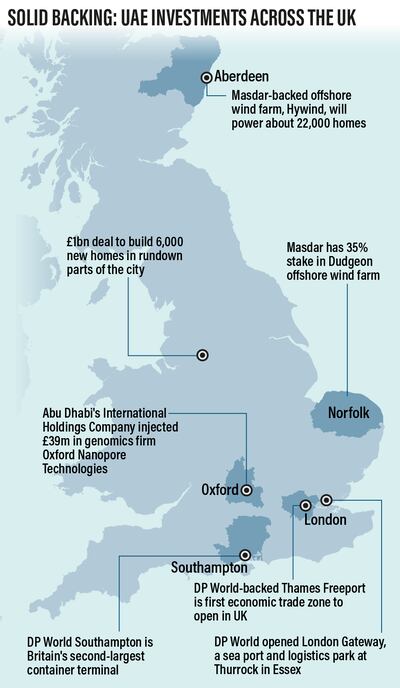

Here, we outline some of the UAE investments already made in Britain.

Life sciences

In March, Mubadala pledged to invest £800m in the British life sciences sector under a £1bn five-year Sovereign Investment Partnership signed by both countries, with £200m coming from the UK’s Life Sciences Investment Programme.

“The UAE and UK are aligned on the importance of global action on critical priorities such as healthcare innovation and delivery, climate change and the sustainable growth of high-skilled industries,” Khaldoon Al Mubarak, group chief executive of Mubadala, said at the time of the investment.

“Mubadala is already a long-term investor in UK innovation and growth and our new partnership now provides a platform to allocate stable capital to priority sectors as part of a future-focused investment relationship,” he added.

Ms Truss said it was “fantastic” for the two countries to be “collaborating more closely in the industries of tomorrow such as science, technology and green growth”, to boost Britain’s prospects of building back better and delivering an investment and jobs-led recovery from the coronavirus.

Abu Dhabi’s International Holdings Company injected £39m in Oxford Nanopore Technologies, a British company specialising in DNA sequencing technology.

The British genomics firm, a provider of rapid Covid-19 tests, is now planning an initial public offering on the London Stock Exchange, after analysts valued the company at £4bn.

“IHC has a strong track record in the healthcare device sector in the Middle East and we are very pleased to be expanding our interests globally,” Syed Basar Shueb, chief executive and managing director of IHC, said at the time of investment.

Another UK company to receive Abu Dhabi backing is Zihipp, which secured £3.3m in a Series A funding round led by Mubadala in January 2020.

The biopharmaceutical company, a spin-out of Imperial College London, is developing peptide hormones to treat the global pandemic of obesity, using science that originated in the laboratory of ICL Prof Sir Stephen Bloom.

Investing in a high net worth area such as the pharmaceutical industry “can be very lucrative”, Dr Bloom, who is also executive chairman of Zihipp, told The National.

If Zihipp succeeds in its bid to solve the obesity crisis, Dr Bloom estimates it is a “trillion-dollar profit area” for the company’s investors, “because our aim is to succeed in helping the entire world”.

Clean energy

The UAE is one of the largest investors in the UK’s clean energy infrastructure industry and has stakes in windfarms off the Norfolk coast, as well as in Scotland and the Thames estuary.

The Hywind project, in which Abu Dhabi’s Masdar – the clean energy subsidiary of Mubadala – has a 25 per cent stake, will provide electricity to about 22,000 homes.

Located off the north-east of Scotland, it features five wind turbines which were manufactured in Norway and then transported west across the North Sea.

A separate deal in 2014 saw Masdar team up with Norway’s Equinor and Statkraft in the £1.5bn Dudgeon offshore windfarm project off the Norfolk coast in eastern England.

Masdar acquired a 35 per cent stake in the 402-megawatt project, valued at the time at £525m.

Dr Sultan Al Jaber, chairman of Masdar, said at the time that the UAE was “committed to accelerating the use of wind energy as an effective means of balancing the global energy mix as we move towards a sustainable, low-carbon future”.

Masdar has also backed London Array, a 630MW offshore windfarm in the Outer Thames estuary, which started generating power in October 2012.

Investments by Masdar into Britain’s renewable energy projects are in excess of £1.4bn, says Simon Penney, Her Majesty’s Trade Commissioner for the Middle East and Her Majesty’s Consul General Dubai.

The UK is now expecting to sign more multibillion-pound investment deals with the UAE in clean energy and infrastructure as it looks to strengthen ties with the Arab world’s second-largest economy, Mr Penney told The National this year.

In the year the UK hosts the Cop26 environment summit, Britain has set the world’s most ambitious climate change target: to reduce emissions by 68 per cent by 2030 compared with 1990 levels, by 78 per cent by 2035, and to be net zero by 2050.

Matthew Hurn, executive director and chief financial officer for disruptive investments at Mubadala Investment Company, said Britain’s climate change goals offered opportunities for GCC investors.

"If they are looking at things around energy storage, electric vehicles ... there are so many opportunities there,” Mr Hurn told delegates attending the GCC-UK Trade Circle Summit in June.

In 2019, Masdar also invested £35m in the Charging Infrastructure Investment Fund, with the sum matched by the UK government.

The investment bolstered a £400m plan to more than double the number of electric vehicle charging points in the UK to more than 5,000, a “game-changer” for electric vehicle usage in a country that is aiming for carbon neutrality.

“With electric mobility becoming both more affordable and acceptable to consumers, accessible public charging infrastructure is a necessity if electric vehicles are to achieve large-scale penetration of the car market, and we are eager to support the UK’s bold vision,” Mohamed Jameel Al Ramahi, Masdar’s chief executive, said at the time.

Mr Al Ramahi said Britain was one of the most attractive markets for renewable energy investments in Europe, with Masdar at the forefront in the sector.

Transport

The UAE has made a number of important investments in the UK’s transport sector, in particular with ports and ferries.

Dubai global ports operator DP World is the owner of London Gateway, a seaport and logistics park it developed at Thurrock in Essex.

The £1.5bn site about 32 kilometres along the River Thames from London officially opened in 2013, providing thousands of jobs and giving the UK “a premier, world-class global trading centre,” Sultan Ahmed bin Sulayem, chairman of DP World, said.

This week DP World said it would invest £300m in building a fourth berth at the port to create more capacity.

“London Gateway’s new fourth berth will allow even more customers to benefit from world-class ports and logistics, with unrivalled global connectivity, on the doorstep of Europe’s largest consumer market,” Mr bin Sulayem said.

The £300m investment builds on the £2bn DP World has already pumped into Britain over the past decade, the company said.

When it first went live, DP World said it was able to handle 3.5 million containers a year, with the development creating 27,000 jobs in London and the south-east and contributing £2.4bn a year to its economy.

Between January and June this year, DP World’s smart logistics hub at London Gateway saw throughput of 888,000 TEU Twenty-foot Equivalent Unit, an increase of more than 23 per cent on the previous first-half record set in 2020.

In 2015, DP World bought the remaining stake in its terminal DP World Southampton and extended the licence agreement for another 25 years until 2047.

DP World Southampton, Britain’s second-largest container terminal, saw throughput in the first six months of the year hit 995,000 TEU, its second-best first half, which contributed to a record combined UK total of 1,883,000 TEU.

In February 2019, DP World reacquired UK-based transport and logistics company P&O Ferries for £322m as the company looked to grow in complementary sectors, strengthen its product offering and play a wider role in the global supply chain.

Freeports

The UAE is also involved in the UK’s new freeports, eight new economic zones that allow companies to import and export from the UK under simplified customs, tax and planning rules.

This week, the DP World-backed Thames Freeport was opened by Chancellor of the Exchequer Rishi Sunak, becoming the first post-Brexit freeport in the UK.

Thames Freeport won the support of the British government in March, with its location in east London's Thames estuary a collaboration between DP World's London Gateway port, Tilbury port and a Ford factory in Dagenham.

DP World Southampton has also been awarded freeport status as part of Solent Freeport.

Britain hopes the freeports, part of its bid to build back from the pandemic, will attract investment and trade and boost jobs across the country.

The freeports, which include ferry ports and airports, are eligible for stamp duty and business rates relief, with a lower rate of VAT and employment tax also offered to employers in some instances.

Goods can be imported into the freeport, then manufactured and exported again without facing standard tariffs or requiring the usual customs checks.

Bradley Jones, executive director of the UAE-UK Business Council, said Britain’s freeports offer a great opportunity for UAE investors because they are all well located and offer a large workforce, making them “good locations for establishing operations for manufacturing and re-exporting to Europe or the US or Africa".

Property

Property has also been on the UAE’s investment radar, with a plethora of major deals over the past few years.

Dubai-backed luxury property developer Northacre said last year it was optimistic about growing its prime central London portfolio in 2021, despite the coronavirus pandemic delaying the completion of some of its developments.

The UK-based company, a subsidiary of Dubai investment banking firm Shuaa Capital, is constructing The Broadway project in Victoria, as well as its No. 1 Palace Street development, which overlooks Buckingham Palace.

Mustafa Kheriba, executive director of Northacre and deputy chief executive and group head of asset management at Shuaa Capital, said the gross value of Northacre's London developments stood at £1.2bn at the end of 2020. The company was acquired by Abu Dhabi Financial Group in 2013 before it merged with Shuaa Capital in August 2019.

The first of its current two London projects, The Broadway is located on the site of the former New Scotland Yard Metropolitan Police headquarters, which ADFG bought from the Mayor’s Office for Policing And Crime in 2014 for £370m.

Originally set for a 2021 completion date, the development, which offers views across Westminster and St James’s Park and has health, fitness and spa amenities, will provide 268 apartments across six residential towers, comprising 32,981 sq metres of space, alongside offices and retail outlets.

The company’s other project, No.1 Palace Street, was purchased for £310m in 2013 and will become the only property offering a view of the gardens of Buckingham Palace.

Meanwhile, Damac Properties, the UAE's third-biggest property developer by market capitalisation, said in December last year it would double its share in the Nine Elms project in London.

The company's board approved increasing its stake to 40 per cent direct and indirect ownership, from a 20 per cent indirect stake.

Damac Tower Nine Elms, a 50-storey building in the new Nine Elms district of south London, has 450 one, two and three-bedroom apartments for sale.

The majority of the Nine Elms project is owned by Dico Group, a private company owned by Damac Properties' majority shareholder Hussein Sajwani.

In 2014, Abu Dhabi United Group (ADUG), a private investment and development company belonging to Sheikh Mansour bin Zayed – the owner of Manchester City football club – signed a 10-year, £1bn deal with Manchester city council to build more than 6,000 new homes in once-rundown parts of the city to accommodate the rapidly growing population.

“Given ADUG’s existing long-term commitment to Manchester and the council’s economic growth plan, it was a logical decision to look at ways to create a commercial partnership with the city to deliver its wider residential strategy,” ADUG board director Marty Edelman said at the time.

Exhibitions

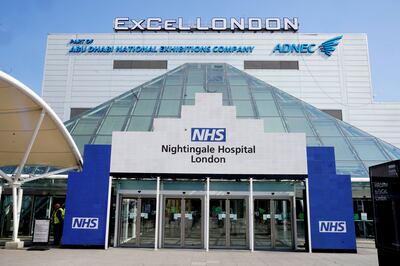

Abu Dhabi owns ExCeL London, with Abu Dhabi National Exhibitions Company (Adnec), acquiring the UK capital's largest international exhibition and convention centre in 2008.

Events at ExCeL generate £4.5bn for the UK economy, support 37,600 jobs and drive 25 per cent of London’s inbound business tourists, says its chief executive Jeremy Rees.

The venue typically hosts 400 events a year, attracting 4 million visitors and 40,000 exhibiting companies.

ExCel underwent a huge transformation at the start of the pandemic when it was transformed into Britain’s first coronavirus field hospital to help the country cope with a surge in Covid-19 cases.

FinTech

The UK is looking to finalise details of investments into its technology sector, including financial services, that may reach £1bn, Mr Penney said.

“We haven’t put a number on it because we’re deliberately not boxing ourselves in on numbers … the size will be determined by the need,” Mr Penney said in April. “It could be bigger than £1bn.”

Investments could be channelled through an infrastructure fund or might be split into funds and direct investments, Mr Penney said at the time.

In terms of technology investments, Mr Penney expects funds to flow into Britain’s FinTech industry as it “resonates quite significantly".

Some of that investment is already coming in, with the owner of WeBuyAnyCar raising more than £1bn in May to help drive the expansion of Cinch, a new digital used-car platform, in Britain and Europe.

Constellation Automotive Group attracted investment from Abu Dhabi Investment Authority, as well as Soros Fund Management, eight months after the online car retailer was launched in Britain.