The chief executive of Damas, the largest jewellery retailer in the Middle East, resigned on Monday after disclosing to the board of directors "unauthorised transactions" worth US$165 million (Dh605m), the company said in a statement to NASDAQ Dubai. The departing chief executive, Tawhid Abdullah, has been replaced by Hisham Ashour, who recently joined the company as deputy chief executive.

Tawhid's brother and chairman of the board, Tawfique Abdullah, had assumed day-to-day responsibility as managing director, the company said. "The Abdullah brothers, being founding members and current owners of more than 50 per cent of the shares of the company, fully stand behind the company and have agreed to commit the necessary assets to secure and repay in full any unauthorised transactions," the company said in a statement on NASDAQ Dubai's website. It added that the company had "adequate funds to meet its current financial obligations" and was conducting business as normal. The company launched an initial public offering in July last year, raising $270.6m on the Dubai International Financial Exchange, the predecessor to NASDAQ Dubai.

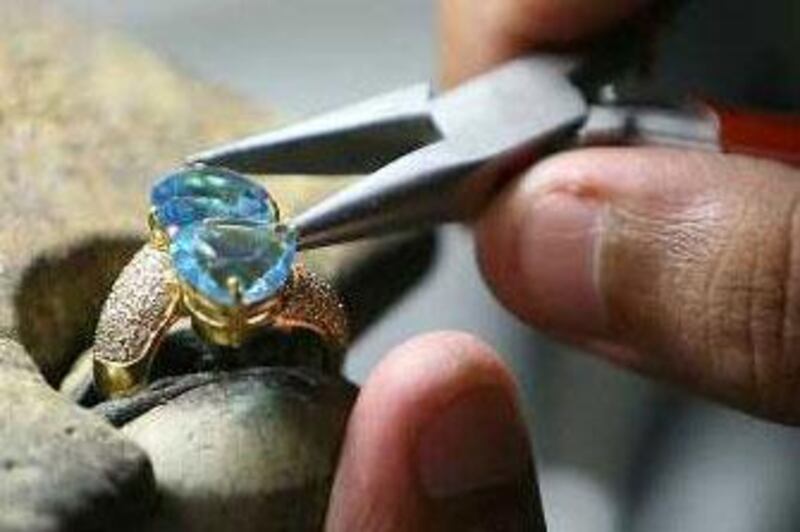

Trading in the company's stock on the NASDAQ Dubai market was suspended at the request of the company on Sunday, when the shares stood at 37 US cents. Damas offered no details on the unauthorised transactions, but said it would appoint an independent accountant and law firm to conduct a review. With origins dating back to 1907, Damas now has more than 450 stores in 18 countries, and is in the middle of a major expansion across the Middle East, Japan, Italy and India. It posted a net profit of Dh226.9m for the 15-month period that ended on March 31, and earnings per share of Dh0.25.

"The company continues to perform well in the current economic climate, as expected to be reported in the half-yearly accounts for the period ending September 30, 2009, to be announced in November," the statement said. Damas said it had introduced procedures to ensure that repayment would be conducted in "an appropriate and timely manner", and that transactions would be scrutinised in future to prevent a recurrence.

@Email:cstanton@thenational.ae