Talk about an eventful time for the banking sector. It's been a month of record cross-border fines, the public naming and shaming of offending financial institutions, and attempts by said banks to repair their reputations by clawing back millions of dollars in bonuses from certain traders.

The message is: unethical behaviour will not be tolerated.

But questions remain, including will this be the last scandal that rocks the sector?

The answer is no.

The problem is how to change banking culture and the conduct of its employees.

Now before I get carried away with sharing my views on how threatening traders with monetary fines is not going to fix the issue of unethical or immoral behaviour, let us ask ourselves how banks here in the UAE behave and how this affects us.

I'm not going to refer to things such as name-lending or the conflict of interest that arises from having specific well-qualified individuals on multiple boards.

I'll focus on things that affect us - the people.

This is what Prathit Harish of PwC identifies as key to improving conduct in this region's banks: "Investing in the long term ethics of front-line staff".

He was speaking at the Middle East Banking Forum this week.

Elsewhere you will read that behaviour at the top or middle of an organisation has a major influence on how others lower down the ranks make decisions.

Here we have a transient pool of staff, expat and local alike - job-hopping and staff-poaching being very much present in this market.

Add to this that I don't believe those at the top know the reality of how their staff conduct themselves with clients. And that what is honourable and acceptable can change from person to person.

And so, yes, while I agree very much that addressing the ethics of front-line staff is key, I really don't see how it can be done in an effective, sustainable manner.

Let me run you through examples of what has happened to people I know. A friend bought into an investment, sat with the bank person to fill in relevant paperwork and left a section blank that was not applicable to her.

When she had an inkling that she had been mis-sold the product, she demanded copies of the paperwork she'd been promised, only to find that the blank sections had been filled in by the wealth manager declaring her a multimillionaire. This scored him work-related brownie points. The bank agreed for her to get out of the product because she had indeed been misled - I don't know whether the wealth manager's dishonest conduct regarding the invented wealth was punished or applauded. I must find out.

Staff at a bank told me of the immense pressure they are under to hit credit card targets. They resort to begging people on the phone to just accept the card, receive it but not activate it - so that the bank employee is not humiliated in front of peers at the next sales meeting. I am not exaggerating any of this.

But let us take a step back from these worst-case scenarios and think about how a lot of banking is conducted in the UAE - unnecessary paperwork, physical presence and signatures.

The following story serves as an example. An entrepreneur friend is loyal to a certain person who looks after her business accounts, and every time he is moved to a new branch within the same bank, she has to go into the branch, close down all her accounts and open up new ones in the branch that her banker of choice now works from. She is not allowed to simply transfer her accounts. Unbelievable but true. This has happened a few times over the past few years as her banker is a "star" and has been moved around.

We, the people, don't want to spend hours on the road, looking for parking, queuing up, and after leaving, discovering yet another piece of paper that needs to be signed to carry out financial transactions.

So I was given new hope when participants at the banking forum voted that the biggest challenge facing their industry in this region is the need to be more customer-centric - their aim being to boost sales, trust and loyalty. This came in ahead of the growing burden of financial regulation.

Hoorah. Bankers care about our needs.

Jean Coumaros, the senior vice president and global head of financial services at Capgemini Consulting - was also pleased with this outcome and stated: "Because compliance is so important, banks are forgetting about customers and business."

We the people would love to be able to trust our banks and bankers. We want them to take on board our needs and how we live and work. This is the only road to boosting sales and loyalty.

As a message to the banks, I'd say put yourselves in our shoes. Common sense and honourable conduct are what we need.

Nima Abu Wardeh is the founder of the personal finance website cashy.me. You can reach her at nima@cashy.me

Follow The National's Business section on Twitter

Customers versus bank compliance

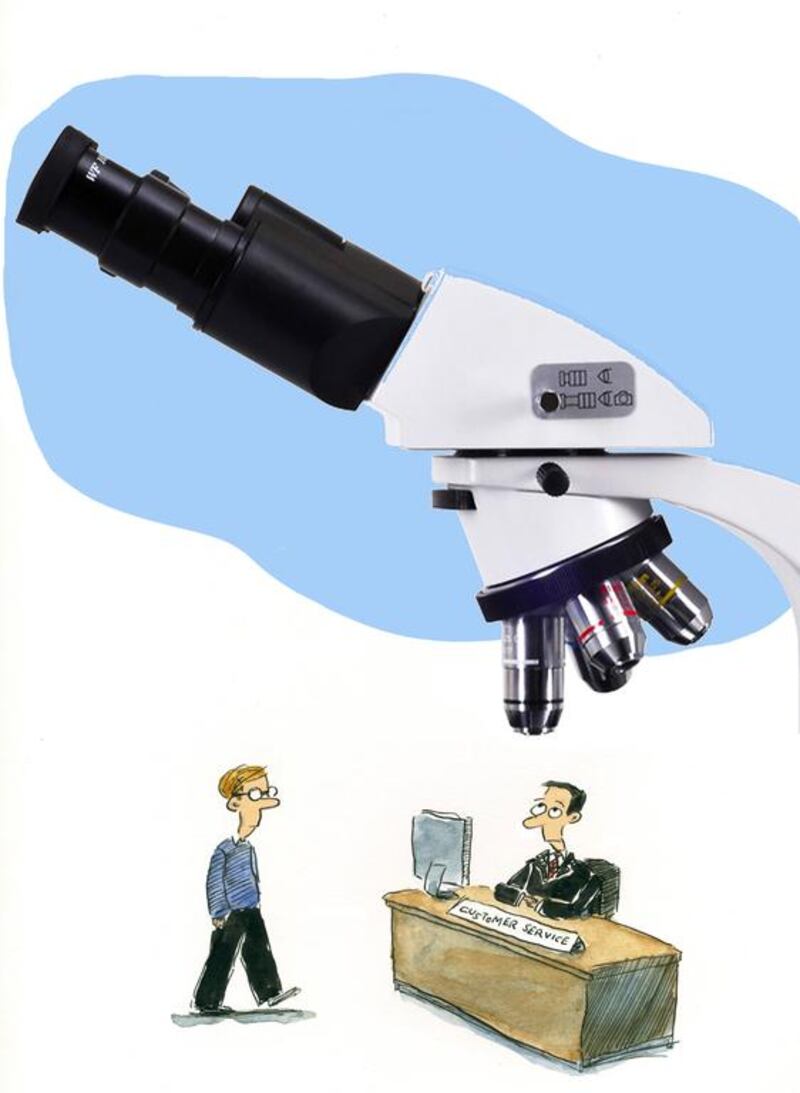

Nima Abu Wardeh shines a spotlight on the UAE's banking sector and calls for commonsense and honourable conduct for customers.

Editor's picks

More from the national