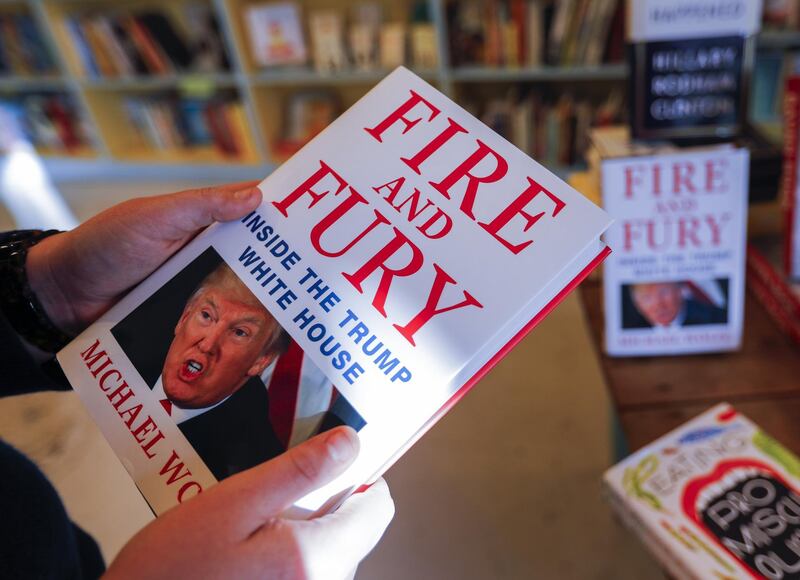

Fire and Fury: Inside the Trump White House, the recently released book about Donald Trump and his family and staff has garnered a lot of attention. However, the revelations offered in Michael Wolff's book are not wholly surprising when viewed through a business lens which allowed some prediction of Trump's general behaviour a year or even as far back as two years ago.

It can be hard to separate one's political values from that of Trump and thus allow for a more detached, and useful, business analysis. The power of dispassionate business analysis of Trump, however can be critical, such as in the case where a Trump expansionary fiscal policy could trigger contractionary monetary policy is borne out.

____________________

Read more from Sabah al-Binali:

[ Donald Trump applies winning business strategies to his US presidential campaign ]

[ As Trump reveals more, we can make an investment plan ]

[ Understanding the success of Fox News - and why some people hate it ]

____________________

Fire and Fury is backward looking but plays to emotion via innuendo with no analysis. One example is the revelation that Trump and his team thought that they were not going to win the presidential election. The idea that this scenario might be true was clear well before Trump became the Republican nominee; a full 9 months before the Republican primaries ended. Where the book really fails is to reconcile Trump not expecting to win with quotes in the book that Trump is arrogant. After all, the very definition of arrogance would have Trump full believing that he would win. This lack of intellectual inquisitiveness makes the book not so useful for businessmen and investors, at least not in a financial sense. So what can be learnt then?

Following on the idea that Trump's team did not think that Trump would win the presidential election, the general insinuation is that this was a lack of loyalty then and that the lack of belief remains today. This is rarely true for the simple reason that people love winners. Look at any start-up company. There is always self-doubt and this self-doubt leads to self-examination which in turn leads to improvements. Trump has actually shown this before. A 1999 New York Times/CBS News poll showed that 70 per cent of American viewed him unfavourably. Yet Trump came back from that. Today, about the same percentage of Americans view Trump unfavourably. Who says he can't come back from that?

This brings us to the allegation that there is a lot of turnover in Trump’s team and that the team is light in terms of experience and number. The insinuation is that this is a sign of a badly run White House. Let’s look again at the start-up company analogy. When Apple started there were only two employees: Steve Jobs and Steve Wozniak. Neither had any experience in running companies. Neither had any experience in building personal computers. Now Apple is the largest company in the world. Who’s to say that Trump’s approach is wrong? The most one can say is that it is different from the presidents who came before him. They were politicians, he is a businessman.

As to the turnover issue, this is used to point out that Trump is inconsistent. In business there is a constant argument between persistence, and staying the course against all odds, versus flexibility, and flowing like water around obstacles. A balanced approach is persistence in the vision and flexibility in the execution. Regardless of whether you agree with Trump’s policies or his effectiveness of enacting them, one thing is clear: Trump has been consistent on his policies whereas he has been flexible on how to execute those policies. A politician is the opposite, flexible on his policies, changing to suit his needs, but consistent on the execution: horse trading.

This all points to three more years of business friendly policies, at least for America. Market bubbles might pop but the underlying business fundamentals remain strong. In the UAE this means we need to watch out for contractionary monetary policy, in the form of interest rate increases, but a strong American economic engine will power the world. And let’s not forget, a stronger US dollar means higher purchasing power for the same oil price.

Sabah al-Binali is an active investor and entrepreneurial leader with a track record of growing companies in the Mena region You can read more of his thoughts at https://al-binali.com/