Boursa Kuwait postponed the listing of its shares as government operations came to a halt amid the coronavirus outbreak.

The stock exchange, whose listing was initially set for April 19, did not announce a new date for the listing but said it will be “in due time based on the date identified by the Capital Markets Authority (CMA)”.

“Boursa Kuwait will continue to share regular updates, in line with its transparent approach to ensure stakeholders are kept up to date with the latest developments,” it said in a statement.

If the listing had gone ahead, Boursa Kuwait would have been the second stock exchange in the Gulf to list its shares after the Dubai Financial Market.

The coronavirus outbreak has disrupted trade and supply chains, triggering a global recession as economic growth has come under pressure.

Boursa Kuwait’s shares were offered to Kuwaiti nationals at the end of last year. It marked the second and final phase of the privatisation process of the oldest stock exchange in the region.

The first phase took place in February 2019, when a strategic consortium consisting of local investors and an international Securities Exchange operator acquired a 44 per cent stake in the company.

The consortium comprised of Hellenic Exchanges-Athens Stock Exchange, National Investments Company, First Investment Company and Arzan Financial Group.

The second phase, the nationwide IPO, was implemented in the last quarter of 2019 with the distribution of the CMA’s 50 per cent stake to Kuwaiti citizens. Boursa Kuwait raised $33 million (Dh121m) through the IPO.

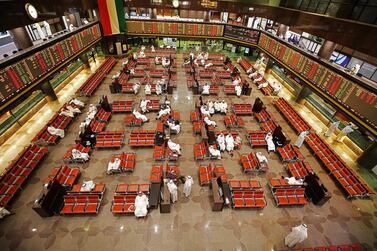

Boursa Kuwait replaced the Kuwait Stock Exchange in 2014. A market development programme led by the CMA in collaboration with Boursa Kuwait and the Kuwait Clearing Company introduced reforms to increase competitiveness and liquidity, reinforce transparency and management, elevate investor confidence and attract international, regional, and domestic investments.

FTSE Russell granted Kuwait emerging market status in September 2017, S&P Dow Jones Global Benchmark Indices upgraded it in December 2018. MSCI, the index compiler was set to to upgrade Kuwait to emerging market status in May, but this has been postponed until November, state-run Kuwait News Agency said last week.

The inclusion of Kuwait into MSCI's emerging markets index is likely to lead to as much as $3 billion in passive inflows, Boursa Kuwait said at the time of the announcement.

In March, Boursa Kuwait was one of the first in the region to reduce the loss limit for trading to 5 per cent after the Kuwait Premier Market hit a 10 per cent down-limit three times within two weeks due to the coronavirus outbreak.