The UAE's bond market ended last year in very different and much better shape than 2009.

By the end of the year, 2010 saw a total of US$31 billion (Dh113.86bn) bonds issued from the Mena region - in many respects a complete turnaround.

Turning to this year, there are no signs of this trend abating and, indeed, signs point to total bond issuance in 2011 comfortably beating 2010.

When the markets picked up, what was perhaps most interesting was the variety of entities that came to the market.

Investors were clearly comfortable with sovereigns and sovereign entities: deals such as a heavily oversubscribed 5-year and 10-year American dollar bonds from Qatari Diar (guaranteed by the state of Qatar), Bahrain Mumtalakat and Egypt were all received well, but what was evident was that investors were also keen buyers of corporate bonds such as "Baa2"-rated Kipco and financial issuers such as National Bank of Abu Dhabi (NBAD).

The Government of Dubai returned to the market in September with a successful $1.25bn bond issue.

This significant transaction endorsed Dubai's ability to raise financing from the international markets and as a result changed the perceived risk across the region more broadly.

Other issuers swiftly followed with a wave of new bonds from Mena including International Petroleum Investment Company with their first, and immensely successful, US dollar bond, significant sukuks from Abu Dhabi Islamic Bank, Qatar Islamic Bank, US dollar deals from Saudi British Bank and BBK and a long-term Malaysian ringgit bond from NBAD - not only a variety of issuers, but of currencies and countries.

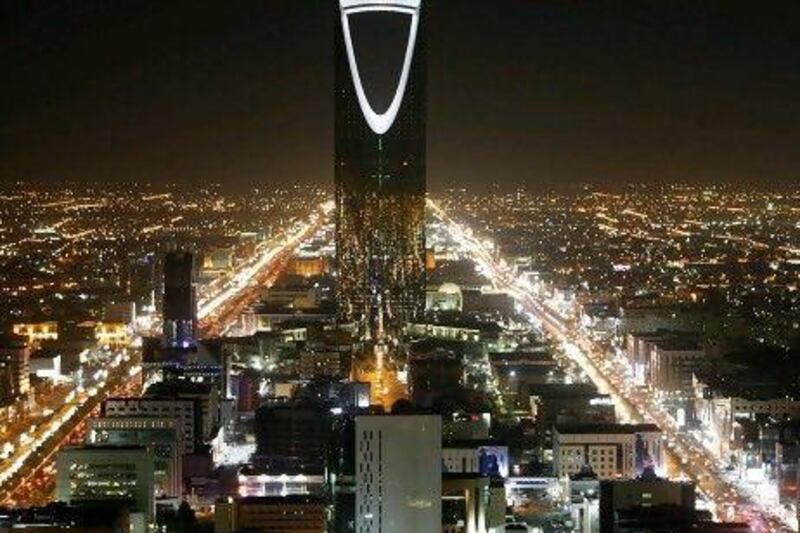

The bulk of international issuance last year came from Qatar ($7bn), Saudi Arabia ($2.68bn) and Dubai ($4.7bn). Jordan tapped the market for the first time with a successful $750 million bond, and in north Africa there were new bonds from Morocco in euros and Egypt.

When these deals came to market there was a noticeable theme: strong names with good track records could raise funds locally and internationally. Renewed confidence in the region this year should allow a wider range of corporations to issue bonds.

In a landmark transaction for the region, last year saw the first high-yield corporate bond from the region. MB Petroleum Services, a "B plus/BB minus"-rated corporation based in Oman, issued a 5-year $320m bond paying an 11.25 per cent coupon.

But why is this significant? A wide range of bonds from sovereigns, banks and less highly rated corporations shows that the market has broadened and matured - demonstrating that investors are not just looking at the so-called AAA entities, but that they are confident enough to invest below this level.

Investors are faced with a choice between low deposit rates at their bank or local equities. Gulf bonds offer a combination of attractive yields and lower volatility that is proving increasingly popular with our clients.

HSBC's recently launched GCC bond platform is a case in point, offering relatively easy access for smaller investors.

Today's business data showcases a sample of the range of bonds available and this will be a regular feature in the business section of The National.

The volume of deals expected this year will be driven firstly by the refinancing of existing debt. Second, infrastructure development will provide another boost.

Abu Dhabi, Saudi Arabia and Qatar in particular have large infrastructure investment plans that will need long-term financing. Third, we are likely to see increasing interest in bonds issued in local currencies.

Saudi Arabia, for example, already has a well developed market and has issued a series of transactions in Saudi riyals for blue-chip issuers such as Saudi Basic Industries Corporation, Saudi Electric Company, Saudi Binladen Group and Apicorp: all of which have been well received by investors.

The surge in Middle Eastern bond issuance has done little to dampen demand from investors. In fact, international money managers are focusing more on the region as liquidity improves and a broader variety of issuers come to market.

This burgeoning appetite for Mena bonds is driven by an attractive yield premium compared with other emerging market bonds.

This is most obvious when looking at sovereign debt.

For example, investors can pick up the Qatar 2020 and Philippines 2020 bonds at a similar yield (about 4.25 per cent), yet Qatar is "AA"-rated and the Philippines is several rating grades lower at "BB".

AJames Milligan is the head of fixed income trading, Mena, and Andrew Dell is the head of global capital financing, Ceemea, at HSBC Bank