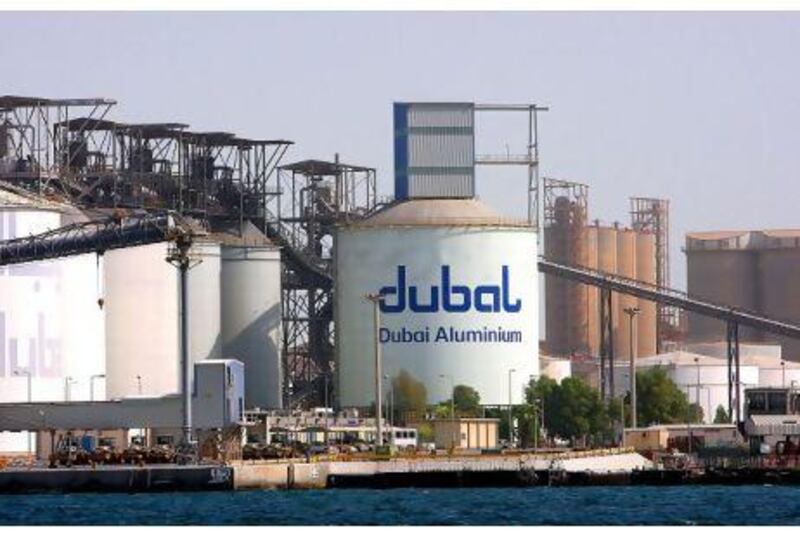

Dubai Aluminum (Dubal), one of the world's largest producers of the industrial metal, has announced a boardroom reshuffle.

Sheikh Mohammed bin Rashid, Vice President of the UAE and Ruler of Dubai, yesterday decreed that Ahmed Humaid Al Tayer will be replaced as deputy chairman by Saeed Mohammed Ahmed Al Tayer, according to the state news agency Wam.

Mr Saeed Al Tayer already acts as chief executive of the Dubai Electricity and Water Authority (Dewa), the emirates utility. Sheikh Hamdan bin Rashid, Deputy Ruler of Dubai, remains Dubal's chairman, and the rest of the board is unchanged.

Profits at the Dubai-owned smelter dropped 55 per cent to US$430 million (Dh1.57 billion) last year, as the industry suffered from a supply overhang and weak demand. The company also faces a challenge to secure increasingly scarce raw materials, experts say.

Dubal's competitors were also hit by declining earnings. Russia's Rusal, the world's largest producer of aluminium, recorded a 92 per cent drop in profits last year, while Aluminium Bahrain, Dubal's closest regional competitor, reported a decline of more than 50 per cent.

"Aluminium has suffered alongside the other industrial metals. Aluminium has performed the least well," said Fawaz Halazon, the managing director at Equity-i, a private equity firm active in the commodity sector.

The twin pressures of low revenues and high energy costs have led to consolidation in the industry, and allowed Middle Eastern players to expand their market share. Smelters in the region typically have access to cheap energy, giving them a competitive advantage.

Aluminium prices are expected to stabilise and creep up again this year. In the longer term, a scarcity of bauxite, the core commodity used in the production of aluminium, is predicted to drive prices up further.

This will benefit producers that have secured their supply of bauxite. Late last year, the UAE signed a long-term supply agreement with Guinea, one of the four countries with large reserves of bauxite. Producers can also offset a bauxite crunch by owning their aluminium refinery, a facility that refines bauxite into the feedstock for smelters.

So far, only Emirates Aluminium, or Emal, a joint venture between Dubal and Abu Dhabi's Mubadala, and the Saudi Arabian miner Maa'den have committed to such a model.

"In time, all the smelters will have to vertically integrate," said Mr Halazon.

The GCC produces about 3.6 million tonnes of aluminium a year, or about 10 per cent of the world's total aluminium output, according to Aluminium Middle East 2013.

This is expected to rise to 9 million tonnes per year to account for between 15 and 17 per cent of global output as regional investments into the aluminium sector steadily climb to a projected Dh55bn in 2022.