Global regulators have turned their attention to minerals obtained in conflict zones eight years after the Kimberley Process curbed the trade in blood diamonds.

Gold standards Bodies involved with global movement of precious commodities.

Organisation for Economic Cooperation and Development An international organisation representing 28 industrialised nations that has produced a draft of the OECD due diligence guidance for responsible supply chains of minerals from conflict-affected and high-risk areas that will encompass best practices for the industry as a whole.

World Gold Council The largest industry group representing global gold miners, which proposed standards allowing miners to certify their gold production as conflict-free. The draft-standards are currently being stress-tested by gold mining companies.

Responsible Jewellery Council A lobby group that has launched a certification system requiring members to be audited by accredited third parties to ensure responsible ethical human rights practices from the mines to the retail sector.

London Bullion Market Association A market group that has produced a draft responsible gold guidance to refiners who must comply from January 1. Ruth Crowell, LBMA's commercial director, is the co-facilitator of the OECD guidance drafting committee.

Securities and Exchange Commission A US regulator that has proposed rules mandated by the Dodd-Frank financial oversight law that would require disclosures by US-listed companies concerning conflict minerals that originated in the Democratic Republic of the Congo and other conflict areas. Final rules are yet to be adopted.

[ More from Industry Insights ]

The Organisation for Economic Co-operation and Development (OECD) published new guidelines for companies that deal in minerals in May and is drafting a supplement on gold.

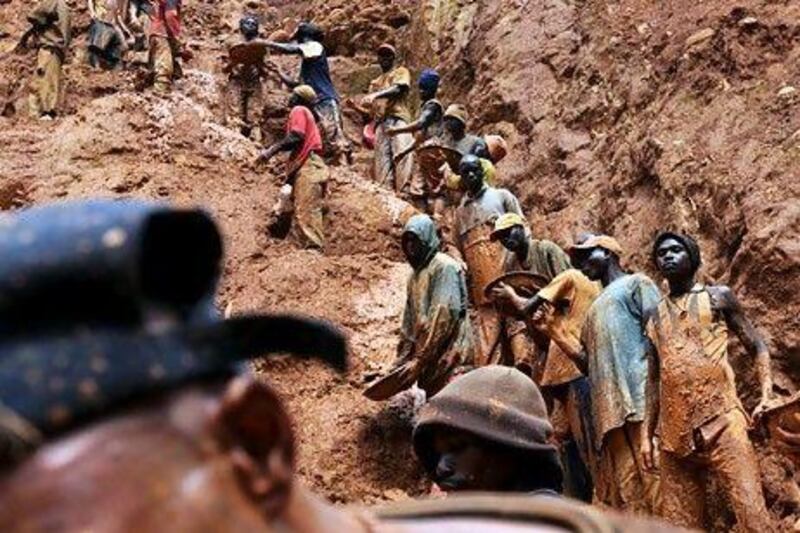

The new rules have been prompted by opponents of the lucrative trade in minerals from the Democratic Republic of the Congo (DRC), where cash earned from the trade has been cited as fuelling the civil war.

But the rules also apply to several other countries deemed to be at high risk of conflict or human rights abuses.

The task of policing the minerals trade, which is worth hundreds of billions of dollars annually, is much more complicated than monitoring the diamond trade.

Not only are minerals much more abundant than the precious stones, but they are also much easier to disguise through processing and refining.

The OECD, which represents 28 industrialised countries, has sought input from several other nations involved in the minerals trade and has approached Dubai and India in particular to help draft a supplement on gold.

The Dubai Multi Commodities Centre (DMCC), based at Jumeirah Lakes Towers, is in talks with the OECD, along with several Dubai traders and refiners. Also involved are the US Securities and Exchange Commission (SEC) and the London Bullion Market Association (LBMA), whose Good Delivery List of refiners is the gold industry's chief source of high-quality bullion.

"Companies want one set of expectations, not a set of expectations from the DRC, the LBMA, the DMCC, the SEC and the OECD," said Tyler Gillard, a legal expert at the investment division of the OECD. "Companies have had an opportunity to participate and shape the due diligence recommendations, and the guidance should reflect that."

The guidance clarifies how companies can identify and better manage risks throughout the supply chain to ensure respect for human rights, avoid contributing to conflicts and cultivate transparent mineral supply chains. They are a voluntary set of principles, without sanctions.

But some jurisdictions, such as the US and Europe, might use these as a benchmark for public listing. The OECD has made "huge amounts of progress" in the drafting process for the gold supplement over the past six months, Mr Gillard said. It is expected to be finished by the end of this year or early next year.

Companies buying minerals from Central Africa have come under scrutiny in recent years as armed groups in the eastern DRC derive funding from the mineral trade, fuelling a conflict that has persisted for more than 15 years, with more than 5 million people killed. The DRC has a third of the world's known cobalt reserves, 4 per cent of its copper, and deposits of gold, tin ore and diamonds.

While data is scarce, it is estimated that up to 80 per cent of minerals in some of the worst-affected areas may be smuggled out for use by jewellers, the car and aerospace industries, producers of medical devices and other manufacturers around the world, according to the OECD report.

Last year, the US Congress passed legislation - part of the Dodd-Frank Wall Street Reform and Consumer Protection Act - requires US companies involved in the minerals trade in the eastern DRC to declare publicly the steps they are taking to ensure their business does not support the armed groups that profit from Congo's insecurity.

On the basis of this public reporting, consumers and investors are able to choose to give their business to companies that are conscientious about working with conflict-free mines.

SEC regulations that go into effect next year have spurred major corporations including Apple, Intel and Hewlett-Packard to implement tracing programmes and adopt technology to monitor the supplies of minerals they use in their production.

twitter: Follow and share our breaking business news. Follow us