Global hotel chains are focusing on aggressive expansion plans for India despite the challenges.

With a population of more than 1.2 billion, a growing economy, and a relatively low number of quality hotels in the market, hoteliers are keen to be involved.

"India's probably the most important market in the world for us in terms of growth, and I say that because the opportunities are so immense and ultimately the fundamentals over the next five,10, 15, 20 years, in my mind are probably better than anywhere in the world," said Christopher Nassetta, the president and chief executive of Hilton Worldwide.

"That has to do with the fact of the underlying growth in population, middle class, infrastructure spend, and ultimately the growth in demand for travel and tourism, against an existing room base that is so low," he said, speaking at the Hotel Investment Conference South Asia last week. Indeed, online research shows Orlando has more than 140,000 hotel rooms, more than in the whole of India.

Hilton operates 12 hotels in India, but hopes to have 50 by 2016.

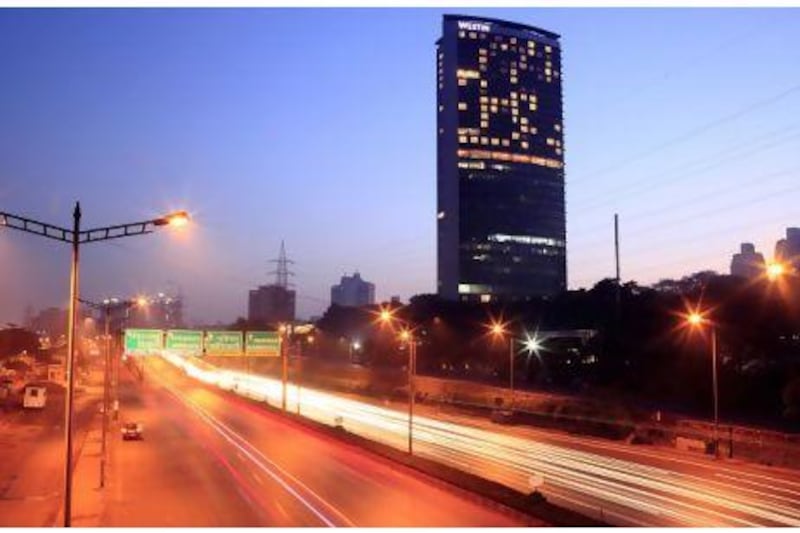

Starwood Hotels and Resorts, whose brands include Le Méridien, Sheraton, and Westin in its portfolio, has even bigger ambitions.

"We see India today as our fourth- largest country, soon to be our third-largest, but most importantly a market like no other in terms of growth potential," said Frits van Paasschen, Starwood's president and chief executive. "We have 36 hotels open today. We have another 25 definitively under construction. But there's no reason we won't have at least a hundred hotels either open or under construction in the next couple of years."

Marriott International, meanwhile, with 18 hotels operating in the country as of the end of last year, is opening a JW Marriott, a Marriott, Ritz-Carlton and a Fairfield property in Bangalore this year - and plans a total of 51 hotels in India.

Hotel operators generally look for a partner to invest in and own the property, leaving them to focus on the management. They say India is a tough market, with expensive land, construction and financing costs. On top of this, with more hotels opening and slowing economic growth, revenues have come under pressure. Occupancy levels fell to 58 per cent last year from 68 per cent in 2006, data shows. Average daily rates dropped to 6,200 rupees (Dh415) from 7,100 rupees over the same period.

"I think the opportunities far outweigh the challenges," said Mr Nassetta. "The cost of land is a challenge. The cost of financing makes it difficult for owners. The process is lengthy - I would say 50 to 100 per cent longer than in other parts of the world from the starting point of a discussion to the completion and opening of properties.

"Acquisition of talent - while there are many, many people here and a number that are trained in hospitality, there really aren't enough to keep up with the demand growth and supply that's following."

Hotel chains stress they are looking for returns in the long term.

"I think the perspective you have to have in a market like this has to extend beyond the coming several quarters or few years," said Mark Hoplamazian, the president and chief executive of Hyatt Hotels, who added that a quarter of Hyatt's future hotels planned globally were in India. Mr van Paaschen also said India was a challenging market, but added that it was the place to be for future growth.

"India's a tough place to do business. We're going to be patient because this a business that we see as being an extraordinary growth market in the next 20 to 30 years, and I think, unlike a market like China, which in the next 15 years will be largely built out, India will still be on the steep part of its growth curve and we want to be ready for that."

But while travel within India is growing rapidly and hotels have a rapidly growing customer base on their doorstep, international tourist arrivals are still low considering India's size. Only 6.6 million tourists were registered last year.

"If you look at the statistics over the last year in India and inbound travel from the rest of the world, [tourism] has grown much more slowly than local travel," said Arne Sorenson, the president and chief executive of Marriott.

"India should focus on inbound travel because it is a compelling destination," said Mr Sorenson.

Because Indians are increasingly travelling abroad, opening more hotels in the country allows companies to promote their brands to a market that is potentially very lucrative for their properties across the world.

"You have an ageing population in the western part of the world and a very young population in India," said Amitabh Kant, the former joint tourism secretary behind the Incredible India campaign. "India becomes a very best case of a population which is going to go in for drive, for dynamism, for growth, for progress, and it's going to travel. It's going to travel in a big way. It's very important to understand the demographics will play a very critical role."

All the hotel openings will create many job opportunities.

"Another important source of both talent and capital for the Indian market is the Indian diaspora," Mr van Paaschen said.

"As we look at our hotels for example in the Middle East, many of those hotels are predominantly staffed by people from southern Asia, and so bringing some of those associates back here with the international experience they've already had has been a big opportunity for us."