Chinese state companies will be big bidders in BP's fire sale of US$10 billion (Dh36.72bn) of assets to cover its oil spill liabilities. No doubt this will trigger a fresh bout of agonised hand-wringing from politicians and alarmist media reports that China is cornering the oil market. China undoubtedly has huge weight in energy markets and its national oil companies (NOCs) are keen to expand. Roscoe Bartlett, a member of the US House of Representatives, worried in January that the Chinese were "aggressively buying up oil all over the world" and might not share it with others.

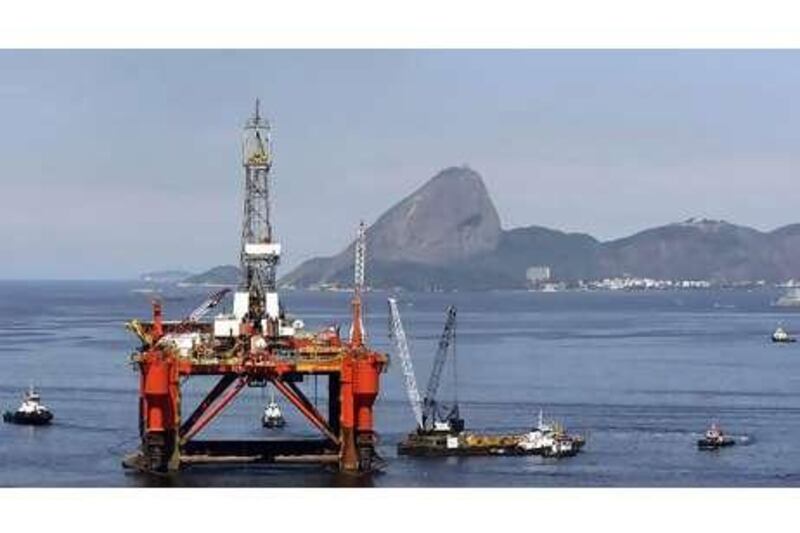

In the past 12 months, Chinese companies have spent $25bn on acquiring "equity oil" in the Gulf of Mexico, Canada, Argentina, Nigeria, Syria and Iraq's Kurdistan region. China National Petroleum Corporation (CNPC) and China National Offshore Oil Corporation were prominent winners in the Iraqi oil auction. And the Chinese government made $50bn of oil-linked loans to Brazil, Kazakhstan, Venezuela and Russia.

But fears about China's "locking up" global oil supplies betray a simplistic view of energy markets and of Chinese motives. Oil is traded globally. If China needs oil it has simply to offer market prices to Saudi Aramco, ExxonMobil or any other supplier. And if Canadian oil is shipped to Beijing, the US can buy from Nigeria or Mexico. On the contrary, Chinese investment increases global oil supplies. Chinese service companies offering low-cost drilling and construction help to keep down development expenditure. China's NOCs have invested in places that were off-limits to most western corporations, such as in Sudan and Burma.

Commercial interests in an oilfield are not the same as owning reserves, which are usually the property of the state. Laws prevent the Chinese or anybody else from selling oil to their home country at below-market prices. A previous loan was renegotiated when Russian oil producers complained China was getting a discount. During the Arab oil embargo of 1973-1974, then British prime minister Edward Heath demanded Shell and BP guarantee UK oil supplies. The companies explained they could not; if they tried, their Middle East operations would simply be nationalised. Heath backed down.

In the unlikely event of military conflict, the presence of Chinese geologists in Calgary or Buenos Aires would not secure oil supplies, just as the Dutch ownership of Indonesian fields did not save them from Japanese soldiers in the Second World War. China needs export markets to sustain its economy. If China did somehow deny world oil supplies to others, it would quickly find US and European consumers were unable to buy its products.

The scale of China's oil acquisitions is also often overplayed. The $69bn spent since 2007 by Chinese companies acquiring oil, gas, metals and mining assets is not much more than the $58bn paid by US corporations. And the Chinese NOCs remain very domestically concentrated. BP's 18 billion barrels of oil equivalent reserves are spread all over the world, from the US to the North Sea to Russia, Abu Dhabi and Australia. Ninety-seven per cent of PetroChina's somewhat larger 21 billion barrels of oil equivalent is in China.

In fact, China is discovering that overseas oil acquisitions can be costly and problematic, one of the reasons behind the switch to the loans-for-oil strategy. Relative newcomers to the international scene and lacking deepwater technology, Chinese corporations have been forced into "pariah" states such as Iran and Sudan, and remote frontiers including Niger and Mali. Much-touted "infrastructure for oil" deals worked in Angola but flopped in Nigeria, a victim of local politics. Equity oil represents only 3 per cent of China's imports.

The idea of a monolithic "China Inc" executing a long-term master plan is also exaggerated. Chinese state-owned enterprises have their own agendas, respond to changing circumstances and jockey for power and influence in Beijing. China's spending reflects a desire to diversify its foreign exchange holdings away from US Treasuries. And the country's main focus is still at home: total outward foreign direct investment in 2008 was less than that of Belgium or the Netherlands.

This is not to deny that Chinese natural resources acquisitions represent a challenge to others. They certainly make it tough for international oil companies to grow. Shell, ExxonMobil and the others are constrained by shareholder expectations and unable to muster similar coalitions of oil service providers, banks and infrastructure developers. From a western point of view, Chinese largesse shields regimes such as those in Iran, Zimbabwe, Burma and Sudan from international pressure. It complicates efforts to encourage higher standards of transparency, and environmental and human rights safeguards.

Energy is just one facet of peacefully accommodating the emergence of a new superpower. Much more constructive than chequebook competition are joint ventures such as that between BP and CNPC for Iraq's Rumaila field, which combines the strengths of both. Increasing investment into the listed Chinese NOCs by western shareholders and by China into areas such as Canada fosters shared understanding of each other's business cultures.

International oil companies are now keenly aware that supporting rogue regimes is a dangerous long-term policy and that ethical business eventually pays dividends. Inviting China into the International Energy Agency would invigorate joint initiatives on holding strategic stocks, eliminating oil subsidies and increasing efficiency. The western countries ultimately overcame the 1970s energy crises by co-operating with each other. The same can happen with the rise of China, if we can escape the idea that this is a zero-sum struggle over a shrinking pool of oil.

Robin M Mills is a Dubai-based energy economist and the author of The Myth of the Oil Crisis business@thenational.ae