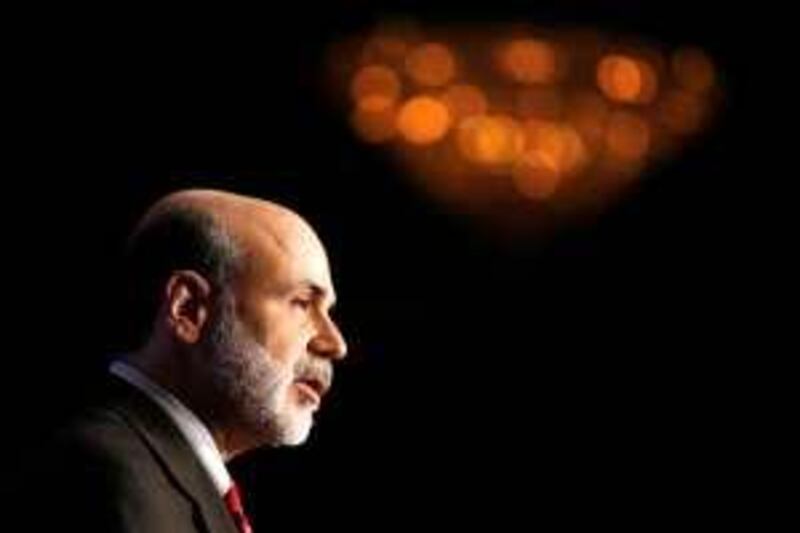

Eager to placate critics who say he is soft on inflation, Ben Bernanke, the chairman of the US Federal Reserve, on Wednesday gave a sneak preview into how he plans to tame a recovering US economy. But with that recovery still seemingly over the horizon and Europe on the brink of a new crisis, he may as well have yelled "Fire!" in a crowded theatre.

Even as Mr Bernanke was outlining his strategy for weaning the US economy from unprecedented levels of monetary medication, leaders in France and Germany were scrambling to put together a plan to keep the Greek government solvent and avert a crisis of confidence in the euro. The two events may seem as different as chalk and cheese: Mr Bernanke was presenting an eventual shift in monetary policy; the EU's troubles revolve around the immediate shortcomings in the fiscal policies of some of its members.

Yet they stem from the same chronic imbalances in the global economy that helped ignite the financial crisis. And they are now accelerating a sharp reversal in the year-long rally in global financial markets that was touched off in Dubai. "All of this is being undertaken at a time when the stresses in the system have hardly been repaired," says Sean Darby, a strategist at Nomura in Hong Kong. "We had a Dubai shock last year which sort of came and went, and of course we've now just had the problems in the PIIGS."

By PIIGS, Mr Darby is referring to the acronym traders have given to Europe's most fiscally troubled members: Portugal, Italy, Ireland, Greece and Spain. But it was Dubai's announcement on November 25, after all, that touched off the anxiety over high levels of government debt. When Dubai announced that the government-owned conglomerate Dubai World would be asking creditors for a standstill on payments, it prompted investors to begin looking at what other governments might be sitting on potential debt time bombs.

Some began comparing Dubai with Argentina a decade ago and Russia in the late 1990s - big debt defaults that sent shockwaves through global markets. In the immediate term, the Greek drama has thrown into reverse an engine of banker bonuses that traders know as the carry trade, in which investors borrow cheaply in one country's currency and invest in higher-yielding returns elsewhere. Record-low US interest rates unleashed a tsunami of investments into riskier emerging markets in the past year. Now those developing-economy assets are falling and the once-beleaguered dollar is staging an unlikely recovery.

"There's a little bit of a pullback in risk appetite around the world," says Giyas Gokkent, the chief economist at National Bank of Abu Dhabi. While low US interest rates were designed to make it cheaper for American companies to obtain credit, credit is still shrinking in the US as banks repair their balance sheets. But low US rates have succeeded in making it cheaper for companies and governments abroad to borrow.

Gulf governments took advantage of this to launch a series of bond issues, with even Dubai managing to sell US$1.93 billion (Dh7.09bn) in Islamic bonds last October amid swelling investor demand for emerging-market credit. But by the time it did, the writing was on the wall for what economists warned was an unsustainable rally - a bubble even - in emerging-market assets. Spending and borrowing are classic means of reviving growth in a downturn. But the theory behind them - known as Keynesian economics after the late economist John Maynard Keynes - also requires that governments use good times to balance the budget and accrue surpluses.

Most western governments have fallen short on this end, instead maintaining unsustainable public spending programmes for armaments and social welfare. The result, economists warn, are dangerous levels of government indebtedness. To battle the crisis, governments around the world not only lowered interest rates, they further opened their treasuries, borrowing heavily to inject funds into battered banks, buy up toxic securities, bail out companies and make big capital expenditures while businesses went into hibernation. The IMF projects that government debts among the Group of 20 leading and emerging economies will rise to 118 per cent of their aggregate GDP by 2014. Combined with low interest rates, concerns about US indebtedness had been pushing down the dollar, sparking complaints from Asia and Europe that the US was trying to inflate its way out of the recession. Since Asian and Gulf exporters manage the value of their currencies against the US dollar, the brunt of the dollar's decline was borne by Europe, where the euro's sharp rise meant much of Asia's export surpluses were going to the euro zone. As a result, some economists and analysts say the latest turmoil in markets is merely a pull-back in the euro's excessive increase. But analysts have been warning that US rates would have to start heading upwards at some point. In addition to setting rates at record lows, the Fed set about buying up troubled mortgage-backed securities and US government bonds from financial institutions, creating money in the process and doubling its collection of assets to $2.2 trillion. Mr Bernanke's remarks on Wednesday, therefore, were a widely expected effort to silence sceptics who worried that he may have no stomach for the fight against inflation. Glimmers of recovery in the US have been encouraging speculation that the Fed would need to move. Recent figures show US GDP surged by 5.7 per cent in the fourth quarter, with unemployment falling slightly in December to 9.7 per cent from 10 per cent. But economists say the US economy is not really recovering yet. Much of the lift in GDP growth, they say, can be explained by a restocking of inventories by companies that cut back during the credit crunch. And the slight improvement in employment data may be no more than a seasonal improvement that could easily fade with spring. "That's not a reason to think that the underlying economy has improved or the labour market is getting better," says Donald Hanna, the chief economist at Fortress Investment Group in New York. As a result, economists say, Mr Bernanke unveiled little new in his remarks on Wednesday. When the US economy begins to recover, he said, the Fed plans to soak up credit by raising the rate it will pay banks to deposit cash at the Fed to discourage them from lending it out. But Mr Bernanke reiterated his oft-stated promise to keep the Fed's key lending rates at record lows for an "extended period". So with the US economy still so weak, are markets right in trying to anticipate a US interest-rate increase? "Only if you think the Fed is stupid," says Mr Hanna. warnold@thenational.ae