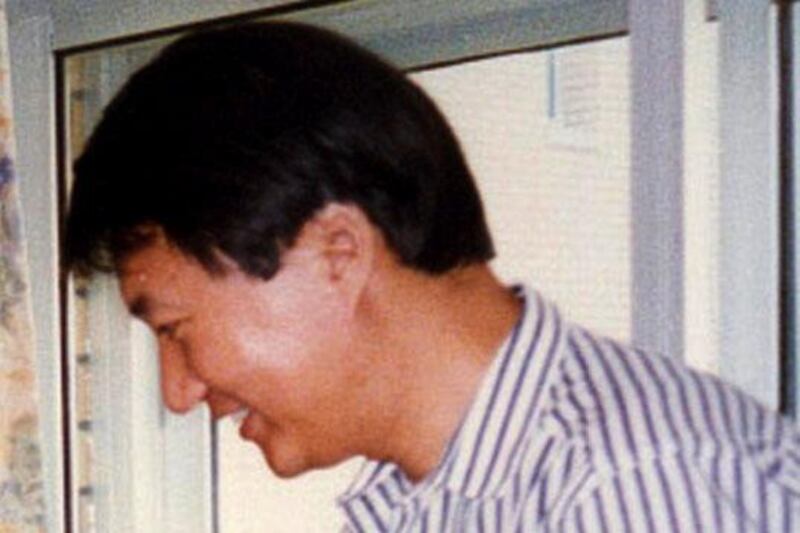

HONG KONG // The row between Australia and China over the detention of four Rio Tinto employees on suspicion of bribery and espionage is threatening to damage China's image as a place to do business. Tensions began to rise on July 5, when Shanghai police detained Stern Hu - born in Tianjin, China but an Australian citizen - and three local Chinese employees of Rio Tinto.

The Chinese have alleged they used bribes to get access to insider information, classified as state secrets, and the four are accused of damaging China's economic security. No formal charges have been filed against them. The background to these accusations is a nationwide clampdown on graft in China. Corruption, especially by Communist Party cadres, is regularly cited as the chief source of unrest, and the Chinese president Hu Jintao has led a campaign to punish officials on the take.

By showing that foreign companies are also liable to prosecution on corruption charges, the Beijing government is making a political point for domestic consumption that no one is above the law. However, the lack of transparency in the Rio Tinto case has clearly irked many in the international community, and has not helped China's image as a place to do business. "A range of foreign governments and corporations will be watching this case with interest and be watching it very closely, and will be drawing their own conclusions as to how it is conducted," was the stern reading of the case from the Australian prime minister, Kevin Rudd, a noted Sinophile who worked at the Australian embassy in Beijing and speaks Mandarin, and who is keen to keep the Sino-Australian relationship sweet.

The Australian financial services minister, Chris Bowen, highlighted another adverse effect of the arrests. "The Chinese government would be very aware it is not good for business certainty. It is a concern for Australian and other foreign business people working in China that this could happen," he told Australian TV. The style of arrest and follow-up accusation bear all the hallmarks of similar detentions of political dissidents. The similarity between the treatment of political dissidents and economic transgressors has reawakened nagging doubts that some in the foreign business community have about doing business in China.

The country has done much to introduce the rule of law in recent years, especially in the introduction of legislation to make investment easier, to help firms, domestic and foreign, set up factories and produce goods. However, there is a suspicion that the Rio case was an attempt by the state to intervene against a foreign company to gain advantage for local companies. Some analysts say China is taking its revenge for the collapse last month of a bid by the Chinese state company Chinalco to buy a US$19.5 billion (Dh71.52bn) stake in Rio Tinto, which was subsequently abandoned by the Australian company in favour of a link-up with its fellow Anglo-Australian miner, BHP Billiton.

China's image as a place to do business has suffered numerous setbacks in recent months. In March, China rejected Coca-Cola's $2.3bn bid to buy China Huiyuan Juice Group under an antimonopoly law that has been criticised for a lack of openness. The blocking of the bid was seen as a blow to foreign businesses hoping to make big acquisitions in China, and it was felt it would have a longer-term impact on foreign investment in China.

Simon Crean, the Australian trade minister, has warned that if the Rio case is not handled properly, it could damage the country's trade relations with China, saying the Chinese government needs "to be clearer in terms of what the allegations are". "If those allegations warrant charges being laid through their system, then lay them. But this uncertainty and having to respond to speculation is not helpful," he said.

China remains the world's most attractive large market and its fastest growing major economy, and this economic muscle puts it in a strong position at a time when the rest of the world is hurting. The country's economy is managing to keep growing strongly through domestic stimulus, despite the collapse of export markets. Australia needs China, the world's biggest consumer of iron ore and its biggest trading partner. But China also needs Australia, and ultimately it needs foreign markets to start growing again and buying Chinese goods.

The leadership in Beijing will not be happy about the possible global damage to its reputation, and it now looks like the government is trying to save face in the affair. The change in emphasis in utterances from senior Chinese officials, moving away from more serious charges of espionage to less serious charges of bribery, is significant. The most likely scenario, the private sector intelligence group Stratfor wrote in a China security memo, is that Mr Hu "will be given persona non grata status and shipped back to Australia, unable to return to China."

business@thenational.ae