Emirates NBD, Dubai's biggest lender by assets, raised the foreign ownership limit of its stocks to 20 per cent and plans to double the ratio in the future, pushing its shares to a 12-year high on Monday.

The bank seeks to increase the ownership limit to boost the level of foreign direct investment and become part of major equities indexes such as the FTSE Russell and MSCI emerging market benchmarks.

Emirates NBD will seek shareholder and regulatory approvals for the planned changes “in due course” it said in a statement on Monday, without specifying a date.

The board and stakeholders of Emirates NBD, whose shares trade on the Dubai Financial Market, have already approved a raise in its foreign ownership limit to 20 per cent, from 5 per cent previously. This will go into effect on Monday, the lender said.

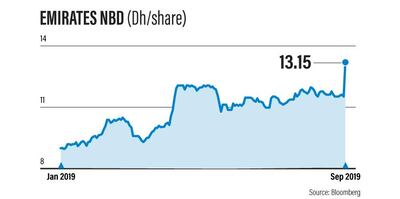

The bank's shares, which have gained more than 46 per cent since the beginning of the year, climbed 14.85 per cent by 1.10pm UAE time on Monday, reaching a 12-year high of Dh13.15.

“The decision to increase the FOL is “in line with our position as a strategic partner to the UAE government, [and] we are confident that today’s announcement will contribute ….. [to] developing the UAE as a pivotal hub in the global economy”, Emirates NBD chairman, Sheikh Ahmed Bin Saeed Al Maktoum, said.

“The announcement will strengthen the UAE’s proposition as one of the most attractive economies for foreign direct investment and contribute to increased liquidity and depth in the UAE’s capital markets,” he added.

Emirates NBD’s plan to lift its foreign ownership limit (FOL) is aimed at diversifying its investor base and follows First Abu Dhabi Bank’s (FAB) proposal in July to remove the cap on its FOL to support the UAE in "attracting capital, foreign investments and promoting economic growth", it said in a statement at the time.

FAB currently caps FOL at 40 per cent. The proposed changes would be subject to the supervision of regulatory authorities and would require amendments to the current laws and policies, it noted.

With the implementation of 20 per cent of FOL, Emirates NBD can become part of the FTSE Russell emerging market gauge in March next year and could be a constituent of MSCI's Emerging Market Index in May 2020, Cairo-based investment bank EFG Hermes said in a note on Monday.

Inclusion into the FTSE index could see an inflow of $123 million (Dh451.4m) into Emirates NBD shares from passive funds tracking the benchmark. However, inclusion in MSCI’s emerging markets gauge would more than double this amount to $294m, according EFG Hermes estimates.

Emirates NBD’s move to eventually raise its FOL to 40 per cent is an indication that companies in Dubai are echoing FAB’s recommendation to boost their foreign ownership levels. This could double the UAE’s weight in emerging market indexes and bring in an estimated $5 billion in passive inflows to its equities markets, Mohamad Al Hajj and Shabbir Malik, analysts at EFG Hermes, wrote in the report.

“This step is very encouraging as once implemented it would double our inflows estimates, as the free float of Emirates NBD is 40 per cent and as such will get the full benefit of a 40 per cent FOL,” EFG analysts said.

The move is a "positive surprise" and a "key catalyst" that should help re-rate the stock, they added.

Moving forward, Emirates NBD is expected launch the rights issue later this year. In March 2018 the bank received shareholders' approval to issue new shares worth Dh7.3 to raise the lender's capital. The bank is expected to use the issue to fund the acquisition of Denizbank in Turkey.

In April Emirates NBD agreed to pay 15.48 billion Turkish lira ($2.8bn) to Russia's Sberbank to buy its stake in the Turkish lender under a revised agreement which helped Emirates NBD save $400 million on the transaction.

"Emirates NBD’s capital position is robust, and it should comfortably absorb the impact of the Denizbank acquisition," EFG Hermes said in the note to investors. "While it is well positioned in terms of capital, given its relatively large exposure to Turkey (20 per cent of assets) post-acquisition, and risks to capital from further devaluation of TRY (Turkish Lira), we believe Emirates NBD will act conservatively to preserve its credit rating and go for a rights issue," EFG Hermes said, adding that the option of rights issue will also help Emirates NBD de-lever its balance sheet.