Less than a week after sounding a bullish tone, Deutsche Bank is pouring cold water on investors again.

Europe’s biggest investment bank said on Wednesday that the euro’s gain against the dollar and higher funding costs will reduce revenue in the securities unit by about 450 million euros ($553m) this quarter. The comments sent the bank’s shares down to the lowest level since November 2016, leading losses among European lenders.

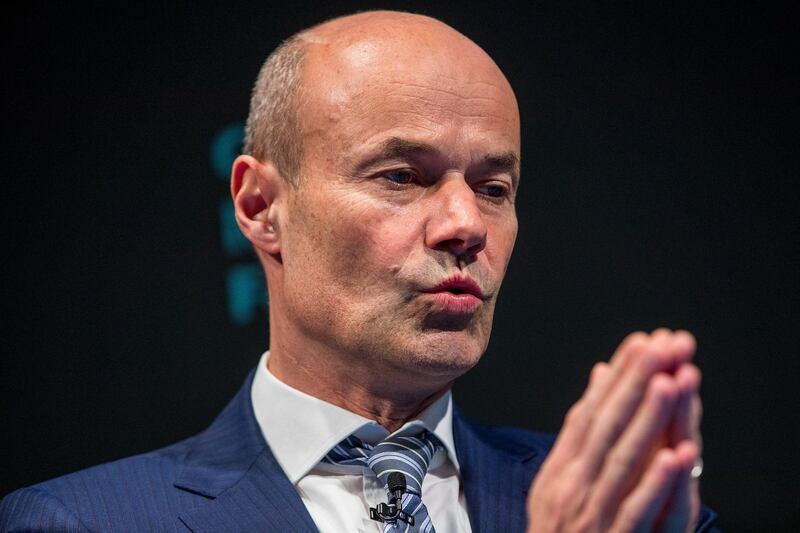

An otherwise constructive environment “means that we’re sort of, depending on the business, flat to slightly down from last year,” chief financial officer James von Moltke said at an investor conference in London. The first quarter of 2017 was “relatively strong,” making for “a more difficult comparison.”

“For years, Deutsche Bank has been trying to gloss over the glum present by giving an upbeat outlook on the future,” said Dieter Hein, an analyst with Fairesearch who has a sell recommendation on the stock. “Today’s announcement is yet another case in point.”

_______________

Read more:

Deutsche Bank chiefs bow to pressure and waive bonuses

Is it time to stop paying bank workers bonuses?

Deutsche Bank starts cutting global workforce

_______________

Mr Von Moltke’s comments come after the lender, in its annual report last week, predicted that volatile markets are here to stay and will help it arrest two years of declines at its debt-trading business. The bank’s executives have been pleading with investors for patience, with chief executive officer John Cryan saying in January that his work had entered a “third phase” in which revenue should start to grow again.

Deutsche Bank fell as much as 7 per cent in Frankfurt trading.

Marcus Schenck, co-head of the corporate and investment bank, said at a separate event in London on Wednesday that the lender still has some work to do to convince its shareholders that the turnaround is on track.

“[Mr] John has always made it very clear. Look, this is not a one-quarter journey. This is a several-year journey,” Mr Schenck said. “We think we’re on the right path with that journey. But we definitely are a show-me case.”

Trading revenue, the biggest source of income at the investment bank, rose 6.8 per cent to 2.4bn euros in the first quarter of 2017 from a year earlier. Underwriting and advisory revenue surged 29 per cent to 657 million euros over the same period, while global transaction banking saw a 5.4 percent decline, company filings show.

Deutsche Bank will continue to “prune” its business this year to better align costs with actual and anticipated revenue, Mr von Moltke said. Still, taking more “radical” action would be challenging and might not be in the best interest of the company’s business and its shareholders, he said.