Gulf International Bank, the lender backed by Saudi Arabia’s Public Investment Fund, swung to a net profit in the fourth quarter of 2022 on the back of strong revenue growth across all categories last year.

In the quarter ended December, the bank reported net income attributable to shareholders of $28 million, compared with a loss of $1 million in the same period last year, it said on Tuesday.

All revenue categories “exceeded planned growth”, with net interest income of $110.1 million in the fourth quarter up 67 per cent annually due to “effective balance sheet management, increased spreads and the benefit of rising interest rates”, the lender said.

Fee and commission income grew 6 per cent annually and trading income rebounded after a volatile year in 2021.

Total income during the quarter stood at $12.9 million, up more than four times from $3.1 million in the same period last year.

“After the disruptions of the recent past, including the Covid pandemic, 2022 saw the bank deliver its best financial results for more than a decade,” said GIB’s group chief executive Abdulaziz AlHelaissi.

“Assets are increasing in scale and quality, the balance sheet is prudent, diversified and solid, risk is well managed, and the culture of the bank is established, strong and empowering.”

GIB, a pan-GCC bank established in 1975, is regulated by the Central Bank of Bahrain. It is owned by all the GCC governments, with the PIF, Saudi Arabia's sovereign wealth fund, the main shareholder with a stake of more than 97 per cent.

The bank has branches in London, New York and Abu Dhabi, in addition to a representative office in Dubai.

GIB has been diversifying its revenue by investing in and building on capital-lite business lines, it said.

For the full year ended December, GIB reported a net profit of $78.7 million, up 108 per cent annually.

Growth across all business lines contributed to a 32 per cent increase in revenue with net income for the year up more than 82 per cent to $96.1 million.

Fee and commission income of $101.4 million rose 40 per cent annually on the “realisation of investments in financial markets activities, risk distribution, retail and global transaction banking”, the bank said.

Foreign exchange income increased by 84 per cent on successful diversification initiatives.

The bank also recorded a 71 per cent increase in recoveries on written-off loans following the establishment of a special assets unit, it said.

Provision charges for the year fell nearly 57 per cent to $71.6 million, while loans and advances were at $11.5 billion, “in line” with the previous year.

The bank's total assets at the end of the year rose 3 per cent to $32.6 billion.

GIB maintained a more diverse funding profile in 2022, with customer deposits of $21.9 billion comprising the majority of total deposits and an increase in non-interest-bearing deposits, it said.

To further diversify funding sources and carry out its sustainability strategy, the bank secured a $200 million sustainability-linked repo facility, one of the first in the GCC, it said.

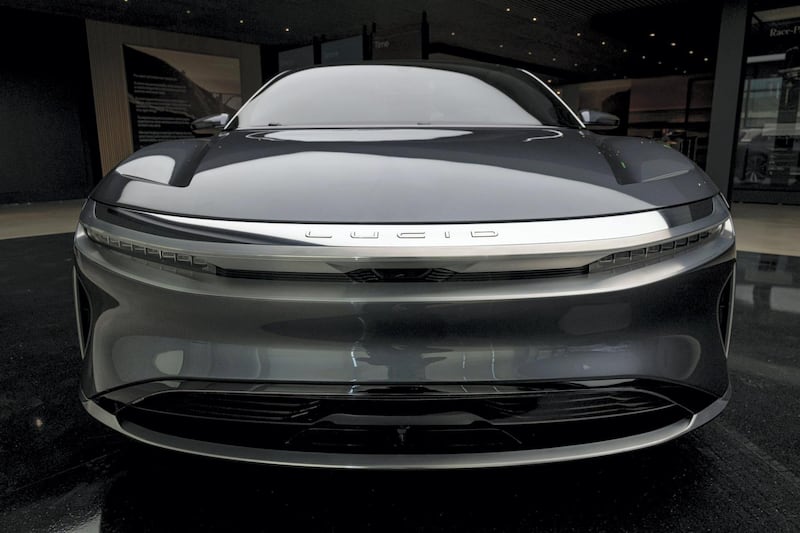

As part of its sustainability efforts, GIB's Saudi subsidiary is supporting Lucid Motors' first international manufacturing plant at King Abdullah Economic City.

The PIF owns 65 per cent of luxury electric vehicle manufacturer Lucid, which plans to build a factory in the kingdom within the next two to three years.