At nearly 100 years old South African Airways (SAA) should be enjoying a golden age as one of the world’s venerable carriers.

Instead, it is on its deathbed, slowly succumbing to debt and poor management decisions.

The colourful livery of its aircraft has been a familiar sight in airports around the world but, up close, the company is far less pretty. SAA is more than 9 billion rand (Dh2.389bn) in debt, and will need at least 13bn rand more over the next two years to survive. As a state-owned entity, this means the government will have to tap its own resources to fund the bailout.

Until now, the ruling African National Congress has been united in backing the airline’s continued existence. However, incoming Minister of Finance Tito Mboweni broke ranks at an investment conference in late October, saying it was “unlikely” SAA’s troubles could be fixed.

“My view is, close it down,” Mr Mboweni said. He pointed to precedents such as the national carrier of Switzerland, Swissair, which went bust in 2001. It was shut down with 8bn Swiss francs (Dh29.47bn at today's rate) in debt. Later, however, the Swiss government sold the brand off and Swissair reemerged as a private company, controlled by German firm Lufthansa.

“We have the case study of Swissair,” Mr Mboweni said. “Shut it down, bring others in and form a new airline.” He suggested the state retain ownership of SAA’s colours, much as privatised British Airways still flies UK colours, which he said remained under the ownership of the UK government.

In essence, SAA as a brand could be transferred to a private company but the airline itself would cease to exist.

As it is, the carrier is battling to keep its aircraft flying. It operates a fleet of around 64 mixed types from its headquarters in Johannesburg.

“Why would anyone be interested in buying a stake in a company that is billions of rand in debt?” says Dawie Roodt, director and chief economist of Pretoria-based Efficient Group. Turnaround plans had come and gone over the years with little result; there was no reason to think this time would be any different, Mr Roodt said.

He notes that state backed airlines such as Emirates, Etihad and Ethiopian Airlines have "cracked the nut" of being commercially successful. However, these also had geography in their favour, allowing them to become hubs for passengers travelling between the West and East.

In contrast, South Africa is far from the busy air routes, whereas the UAE and even Ethiopia lay on major transport corridors. This makes SAA a costly airline to operate and expensive for consumers to use.

“The best solution is to simply close it down. I simply cannot understand why we the taxpayer must subsidise something that is used primarily by the rich," Mr Roodt said.

SAA’s feeble position is not helped by the fact that the country itself is in a weak economic state. South Africa's debt to gross domestic product ratio is now close to 60 per cent, far exceeding international guidelines of 40 per cent.

_______________

Read more:

Kenya Airways may have to look abroad for pilots amid expansion

Emirates says no plans for South African Airways stake purchase

_______________

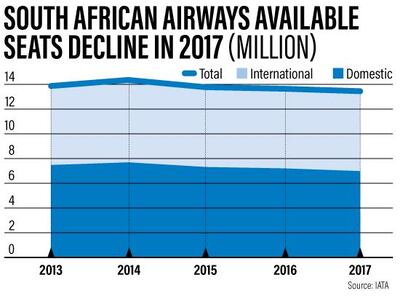

Consequently, Mr Mboweni’s sentiments have been backed by the treasury, which has warned repeatedly over the past year that SAA is a threat to the country’s national budget. In the meantime, the airline has dumped many international routes.

More recently it has cut domestic flights on local routes and to major international destinations such as London. SAA has also negotiated landing slots with international airports that have yet to be taken up, including countries in the Middle East and North Africa region such as Morocco and Algeria.

“Negotiating these landing rights would have cost millions,” says Leon Louw, director of the Free Market Foundation in Johannesburg. “There’s up to 30 countries that have signed agreements, and they aren’t being used because SAA doesn’t have the money.”

In addition, suppliers are slashing payment periods to reduce the risk of losing out from a collapse of the troubled state carrier, which is struggling to pay lenders 5bn rand due by the end of this month.

Companies with contracts with SAA are cutting settlement terms to seven days from 21 days as the creditor deadline looms, interim chief fnancial officer Deon Fredericks told Bloomberg in Cape Town. The National Treasury is working to facilitate the payment, with the process “well under way,” he said.

“The problem with turning SAA around is that the board has to continuously focus on the funding issues rather than getting on with the operational plan,” said Mr Fredericks, who started a 12-month secondment from landline company Telkom last month.

Still, backers of the airline say it fulfils an important role beyond simply carrying passengers. SAA, along with other state entities has created jobs and skills, especially for black South Africans.

Lumkile Mondi, senior economic lecturer at the University of the Witwatersrand, says SAA may not be profitable but it has helped black economic advancement.

“In South Africa, most of the economy is still in white hands,” Mr Mondi said. “Most of the capability creation for black skills, and black entrepreneurship can only be amassed through state owned entities such as SAA.”

Meanwhile, the emergence of new airlines, as well as a diversifying of intra-African routes, is beginning to make itself felt across the wider continent. Uganda Airways in August agreed to acquire four Canadian Bombardier CRJ900 aircraft and two Airbus A330-800neo a month earlier, which will form the basis of its fleet. Uganda is also the first African customer to acquire the Airbus Neo.

The Democratic Republic of Congo began flights in June. Its Congo Air has two A320 aircraft it uses to service internal destinations. Its only international stop as yet is a regular flight between the capital Kinshasa and Johannesburg, South Africa.

"The quality of African airlines has improved considerably in recent years and the use of new aircraft is just a part of that; remember Ethiopian Airlines was the launch customer of the Boeing 787 some years back, and they have done a tremendous job in building on that reputation," Mory Camara, international account manager- Europe-Middle East & Africa at OAG, a digital flight data platform that assists airlines in scheduling, told The National recently.

Already more than 100 airlines operate across Africa, with more on the way. “The International Air Transport Association [Iata] has identified that the top 10 fastest growing aviation economies over the next 20 years will all be in Africa," says Tim Harris, chief executive of Wesgro, the development agency of the Western Cape Province in South Africa. "Better air connectivity has boosted trade in goods and services as well as tourism."

Iata forecasts that passenger numbers in Africa will grow by 5.9 per cent per year. By 2036 it will see an extra 274 million passengers a year for a total market of 400 million passengers.

It seems unlikely SAA as it is now will be in any position to take advantage of that.