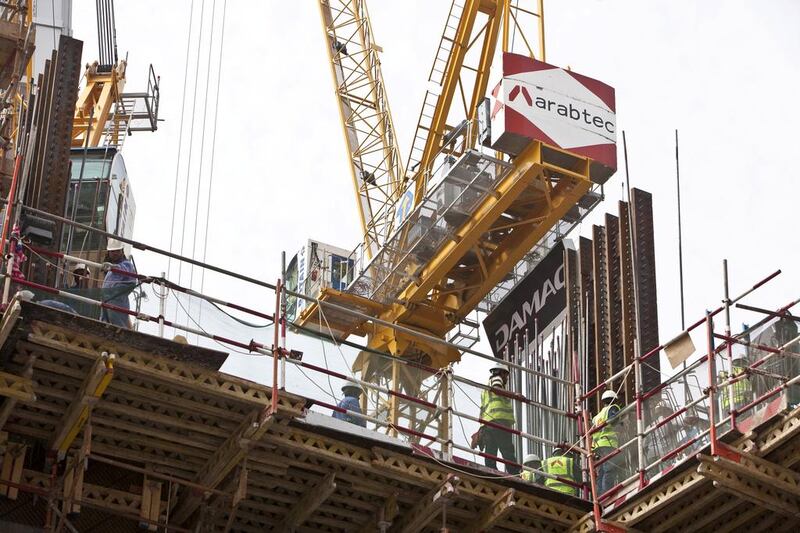

Shares in the UAE's largest construction company, Arabtec, rose today amid reports that it was on the verge of buying a unit of the Kuwaiti construction company Kharafi Group.

Arabtec shares rose 4 fils to close at Dh4.79 on the Dubai bourse today, in line with the market as a whole, amid media reports that the company was in advanced negotiations to buy Kharafi National, the contracting and facilities management arm of the private Kharafi Group, which has operations across the Middle East, Africa and the Balkans.

Sources close to Arabtec confirmed that a deal was brewing between the two companies. A formal agreement is expected over the coming two or three months and could be worth as much as Dh5.5 billion, according to The National's sister paper, Al Ittihad.

Earlier this month Arabtec, which is 21.6 per cent owned by Abu Dhabi Government-owned investment fund Aabar, announced plans to recruit around 10,000 people across the Middle East and North Africa to support its ambitious expansion plan.

Last August, the Arabtec chief executive Hasan Abdulla Ismaik said in a television interview with CNBC Arabia that the company was in talks to merge with big builders in Kuwait and Saudi Arabia. He said it would help the company move “towards bigger profits that will be felt by shareholders and the market as a whole”.

Currently Arabtec runs offices in Abu Dhabi, Dubai, Jordan, Pakistan, Qatar, Saudi Arabia, Egypt, Syria, Russia, Bahrain and Kuwait.

In January Arabtec also announced plans to open a new regional headquarters in Belgrade, Serbia to drive expansion into the Balkan region. The move would be in line with Arabtec’s ambitious growth strategy to expand beyond its traditional activities of construction in Dubai and the UAE which was hit hard by the property crash.

In June, Arabtec raised Dh2.4 billion in the first phase of its rights issue, which it said would be mostly used for its expansion and diversification into affordable housing and oil and gas operations.

Since then the company has announced a string of new initiatives aimed at diversifying the company's business even further including a joint venture with Korean giant Samsung and a new business aimed at developing its own real estate schemes as well as building them. In recent weeks, Arabtec has won a Dh22 billion contract to build 37 new towers across Abu Dhabi and Dubai as well as a Dh2.59bn contract to build the final phase of Gate Towers on Reem Island in Abu Dhabi and a Dh5.7bn contract for a theme park in Jordan.

An Arabtec spokeswoman told The National that the company did not comment on market rumours. "If we have anything to announce, we will announce it on the Dubai Financial Market," she said.

lbarnard@thenational.ae

Follow us on Twitter @Ind_Insights