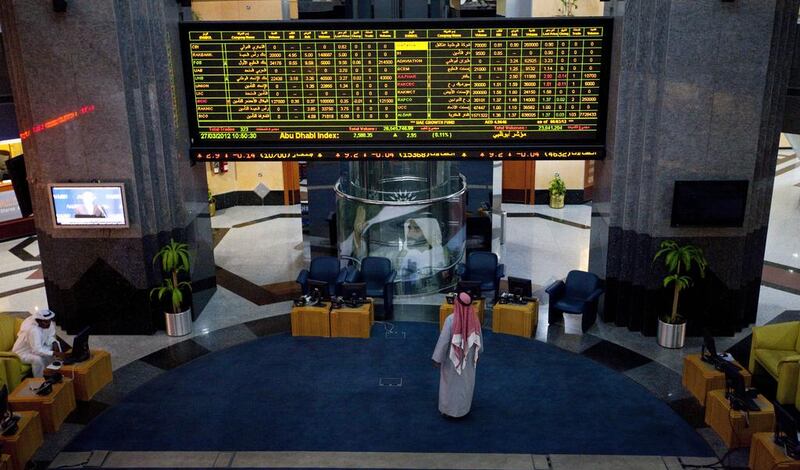

The Abu Dhabi stock exchange is in talks with banks and financial institutions to award a licence for market making.

The move comes amid efforts by financial regulators to make the UAE’s bourses as liquid as the exchanges of New York and London.

Market makers are intermediaries that keep trade flowing by buying and selling stocks when no other buyer or seller is available.

“This is a step in the right direction but it will take time to develop,” said Mohammed Yasin, the managing director of National Bank of Abu Dhabi Securities.

The Abu Dhabi Securities Exchange expects to award the licence in the first quarter of this year, said Rashed Al Baloushi, the bourse’s chief, told Al Ittihad, The National’s Arabic-language sister newspaper. Mr Al Baloushi declined to name the banks and firms that the ADX was in talks with. In 2012, the federal financial regulator, the Emirates Securities and Commodities Authority, approved having market makers.

This push to modernise the exchange comes as the country’s shares are set to join the MSCI Emerging Markets Index in May. Previously the UAE was classified as a “frontier market”, which MSCI uses to designate stocks in countries where there are few listed companies and not many shares circulating.

The current absence of market makers means that buyers and sellers of lightly traded stocks can find themselves without someone to conduct a transaction.

Having market makers, who make a profit on the difference between the price they buy the stock and the markup at which they sell it, is not a condition for the MSCI upgrade, but rather is part of a broader effort by the regulator to make the exchanges more sophisticated.

Still, such a mechanism will have a limited effect until financial instruments, such as options, that market makers use to hedge their trades, are also introduced, Mr Yasin said.

While having market makers may increase trading volume, some observers contend that the main reason many stocks on the Abu Dhabi and Dubai exchanges are not very active is because they are subject to ownership restrictions and are often tightly held by their main owners. Most companies also set limits on the amount that foreigners can buy, and in some cases, such as the telecoms operator Etisalat, international investors are completely barred.

That has made some investors hesitant to buy stocks in the UAE on concerns they will not be able to sell when they want to.

Further, UAE companies that do not wish to relinquish 55 per cent of shares, as listing regulations require, have chosen, such as the property developer Damac, to sell shares in London and elsewhere.

“Market making could add an extra measure of liquidity on the Abu Dhabi market,” said Angus Blair, the founder and president of the Cairo-based Signet Institute, a research house specialising in Middle East financial and economic issues. “But it’s a bit of a red herring because you could add more liquidity on the market by increasing the free float of companies and allowing foreigners to own more shares.”

mkassem@thenational.ae