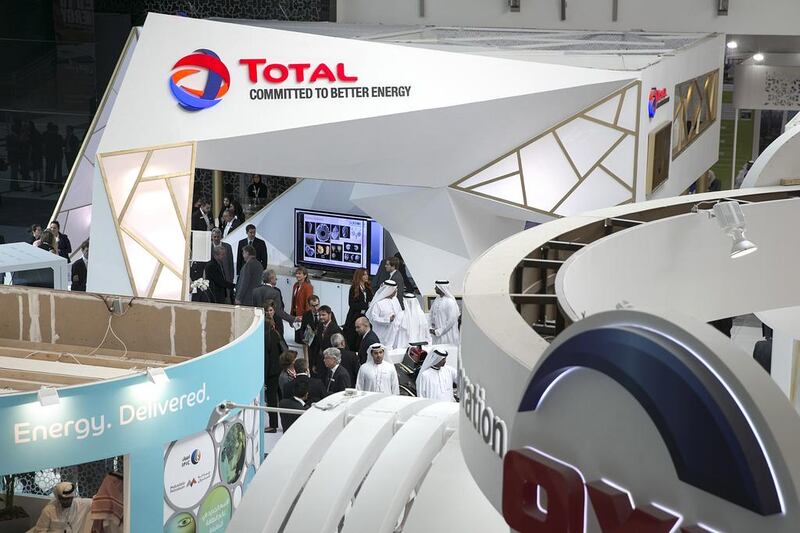

Abu Dhabi’s Supreme Petroleum Council has chosen France’s Total as the first partner in the new oil company formed to steward the emirate’s prime oilfields for the next four decades.

In a major milestone for the country’s oil industry, picking Total as the first stakeholder in the new concession was the culmination of an exhaustive year-long process in which the Council, with the advice of the Abu Dhabi National Oil Company, or Adnoc, evaluated the bids of 11 companies looking for a stake in the new concession to manage and develop the country’s 15 major onshore oilfields, which account for more than half the country’s current production capacity of about 3 million barrels per day.

The oilfields – collectively known as Adco, the name of both the new and old operating company – represent the largest source of Abu Dhabi’s wealth, bringing in between US$50 billion and $60bn in revenue last year when world oil prices averaged nearly $100 a barrel.

In a statement via the UAE’s official news agency, Adnoc said: “By this agreement, Total, which presented the best technical and commercial offers, receives a 10 per cent participating interest in the new concession and is appointed asset leader for the South East and Bu Hasa integrated Asset Groups, with effect from January 1 2015, while additional companies will be added soon.”

The stake is higher than the 9.5 per cent Total held in the old Adco, which had run the concession that oversaw onshore oil production from 1939, soon after oil was first discovered in Abu Dhabi, until it expired at the start of last year.

Adnoc had 60 per cent of the old company, with BP, Royal Dutch Shell and ExxonMobil each also holding 9.5 per cent, and Partex the remaining small stake.

“It is a huge deal, a giant field,” Patrick Pouyanné, the chief executive of Total, said in an interview with The National. “It represents more or less 6 per cent of Total’s production. As we said to Sheikh Mohammed [bin Zayed], it is an historic day for Total. You don’t have many deals in the oil industry that last for 40 years.”

The competition for a stake in the new concession has been fierce, with BP and Shell also bidding to renew their partnerships. However, ExxonMobil dropped out of the bidding, choosing instead to concentrate on development of Upper Zakum, another huge oilfield in Abu Dhabi’s offshore area, where it had negotiated a per-barrel fee rise to $2.85 from $1.

Other bidders included Korea National Oil Company, PetroChina and Inpex of Japan. Adnoc had been seeking to bring in some of its end-customers now that virtually all of its oil production is sold to Asian refiners and future demand growth for oil products is forecast to come mostly from the region.

Although Adnoc and Total declined to discuss the terms of the new deal, ExxonMobil’s Upper Zakum fee is widely expected to have served as a benchmark for the new partnership terms.

“There were many elements involved in awarding the new contract,” Mr Pouyanné said. “We have a very long history in Abu Dhabi, a deep knowledge of the fields of Adco and we had begun our own technical studies of the fields four years ago to prepare our bids.”

For Total, which had equity of 260,000 bpd from Adco in 2013, the last year of its previous concession, the rewards are considerable with its higher stake of increasing field production.

Adnoc has set an ambitious target in terms of recovering oil from its vast reservoirs, where proved reserves are estimated at more than 90 billion barrels by the US energy information agency. Adnoc wants operating companies to achieve a 70 per cent recovery rate, which is a rate that some of the more advanced international oil companies have been able to reach in giant fields elsewhere.

The next phase of development for the Adco fields is to raise production by the end of 2017 to 1.8 million bpd from 1.6 million bpd currently, and Total has one of the biggest tasks as “asset leader” of the Bu Hasa field, one of the biggest. It also is leader for the south-east field (Sahil, Asab, Shah, Qusahwira and Mender), which Mr Pouyanné describes as “techincally challenging”.

While the specific terms of the deal were not discussed, Mr Pouyanné says that Total and Adnoc have agreed a number of targets and the French oil major has incentive to exceed those. “If you are an asset leader you have a dollar fee per barrel and if you meet expectations you are rewarded, so it gives us an additional margin,” he said. This fee is taken in physical barrels which Total can then market.

Adnoc is likely to want to plateau production at 1.8 million bpd for at least 10 years, although the Adco fields have the potential to raise production capacity further to 2 million bpd, Mr Pouyanné said.

amcauley@thenational.ae

Follow The National's Business section on Twitter