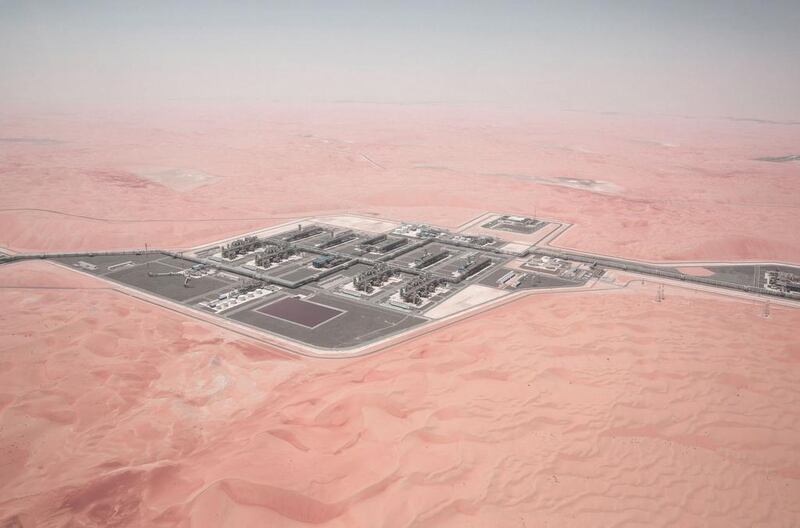

The Abu Dhabi National Oil Company (Adnoc) and Occidental Petroleum of the US plan to increase the capacity of Al Hosn sour gas project by 50 per cent to meet rising local demand.

The US$10 billion Al Hosn facility, which began production from the onshore Shah field last year, produces 1 billion cubic feet (bcf) per day of gas that is processed into 500 million bcf of network gas.

Adnoc did not provide details about when the new capacity will come on stream or the investment needed to ramp up production.

Occidental has a 40 per cent stake in the project, with the remainder held by Adnoc.

“A key element of our 2030 strategy is to ensure we produce sufficient gas to meet our steadily increasing requirement for gas and match rising demand from our international customers,” said Sultan Al Jaber, the Minister of State and chief executive of Adnoc.

“Sour gas will play an important role in ensuring we deliver on those commitments.”

The gasfield also produces 4,400 tonnes per day of natural gas liquids, 33,000 barrels per day of petroleum condensates (high-quality oil produced with gas) and about 9,000 tonnes per day of pure granulated sulphur.

Adnoc plans to use the sulphur to give a boost to the existing ammonia and urea industry.

“Demand for domestic gas is rising and processing additional sour gas from new and existing reservoirs makes sound business sense,” said Vicki Hollub, the chief executive of Occidental.

The UAE’s gas import needs have risen by more than 20 per cent over the past six years, to about 725 bcf annually.

There had been plans in place for further gas development, but earlier this year Royal Dutch Shell pulled out of the $10bn project to develop the Bab ultra-sour gasfield in Abu Dhabi’s western region, citing technical challenges and costs.

Both Shah and Bab contain a high amount of hydrogen sulphide, which is difficult and expensive to process.

Shell was 40 per cent owner and the operator of the Bab, with Adnoc’s Gasco subsidiary owning 60 per cent.

Out of the 1 billion bcf of gas, the Bab project was forecast to produce, by 2020, 520 million bcf of network gas.

Qatar has also agreed to supply more natural gas to the UAE through the Dolphin pipeline system, with the additional amount earmarked for Sharjah Electricity and Water Authority and Ras Al Khaimah.

The long-term sale and purchase agreement is between Qatar Petroleum and Dolphin Energy, a joint venture between Abu Dhabi investment company Mubadala Development, Occidental and France’s Total. Neither has commented about the quantity or other terms of the deal.

Currently, the Dolphin pipeline has the capacity to carry 2 billion bcf of gas, or about 25 per cent of the UAE’s daily consumption.

The UAE has been a net importer of natural gas for the past six years as demand has risen sharply, with most of the imported supply coming from Qatar.

The Dolphin network takes gas from Qatar’s huge North Field through a 364-kilometre pipeline to Abu Dhabi’s Taweelah power station, then runs up to the Northern Emirates, including Fujairah port, and on to Oman.

Energy demand in the UAE is growing by 9 per cent annually because of an expanding population, an expanding industrial base and high electricity consumption.

dalsaadi@thenational.ae

Follow The National's Business section on Twitter

__________________________________

ABU DHABI OIL, Adipec 2016: The National's full coverage

■ Cepsa makes case for part in Borouge petrochemicals expansion

■ Total backs Adnoc on production increases at Bab onshore field

■ Opec's Barkindo says Russia is "on board" for a deal to curb output

■ Dearth of energy investment could trigger soaring oil prices, says UAE Energy Minister

■ Central bank policies may be a roadblock to oil investment, says Yergin

__________________________________