Trade and investment relations between China and the six-member GCC economic bloc could soon receive a major boost, especially in the new energy sector, as the two sides edge closer to signing a free trade agreement, according to analysts.

While a Gulf-China FTA has been on the table for nearly two decades, the deal received fresh impetus after China’s new Foreign Minister Qin Gang this week called for it to be finalised “as soon as possible” during a telephone conversation with Saudi Arabia’s Foreign Minister Prince Faisal bin Farhan.

“It is important that the two sides further expand co-operation in such areas as economy and trade, energy, infrastructure, investment, finance and high-tech … strengthen the China-GCC strategic partnership, and build a China-GCC free trade zone as soon as possible,” he said.

Nasser Saidi, president of Nasser Saidi & Associates and former chief economist of the Dubai International Financial Centre, says an FTA could be signed as early as this year.

“The China-GCC FTA negotiations have been ongoing since 2004. While it has taken a long time, agreements have been reached on most trade-related issues,” says Mr Saidi, who also previously served as Lebanon’s minister of economy and industry and deputy governor of the country's central bank.

“This is the last mile for negotiations, and considering [the] GCC’s plans to increase economic diversification, the agreement is likely to focus beyond just oil, [and] into trade [and] services (including digital), tech sectors and both portfolio and direct investments.”

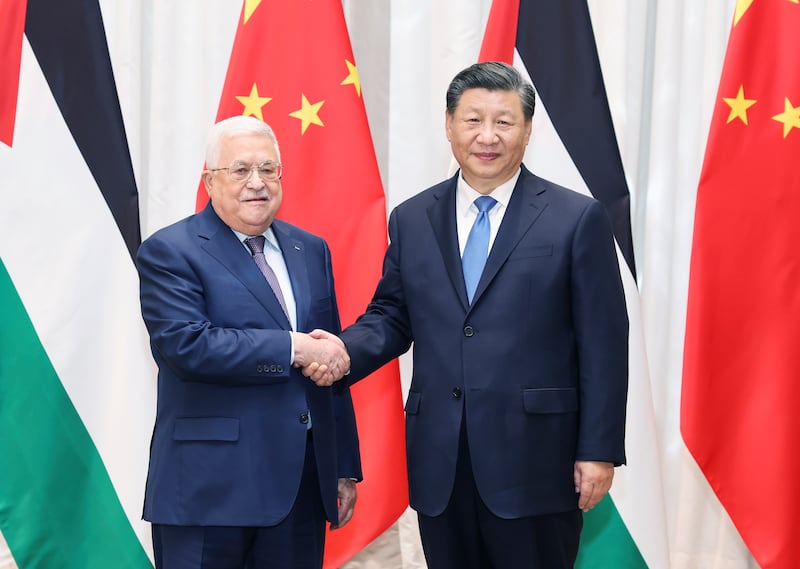

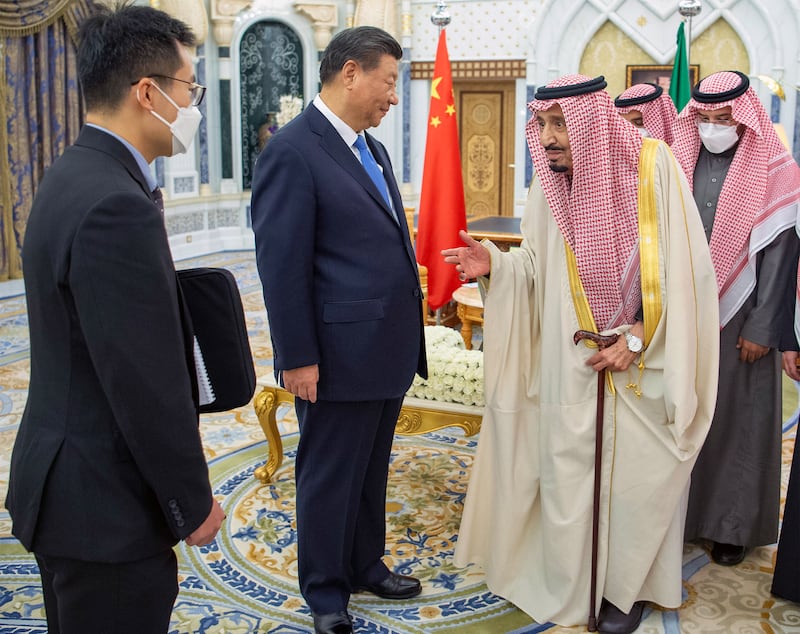

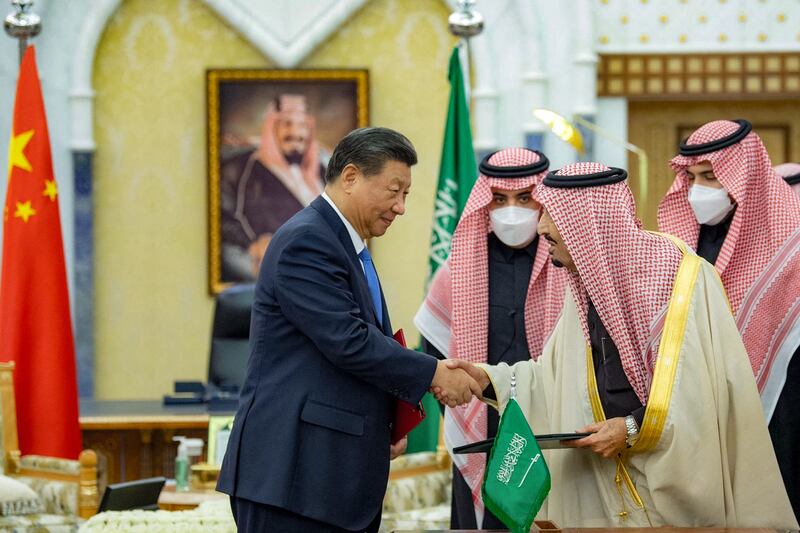

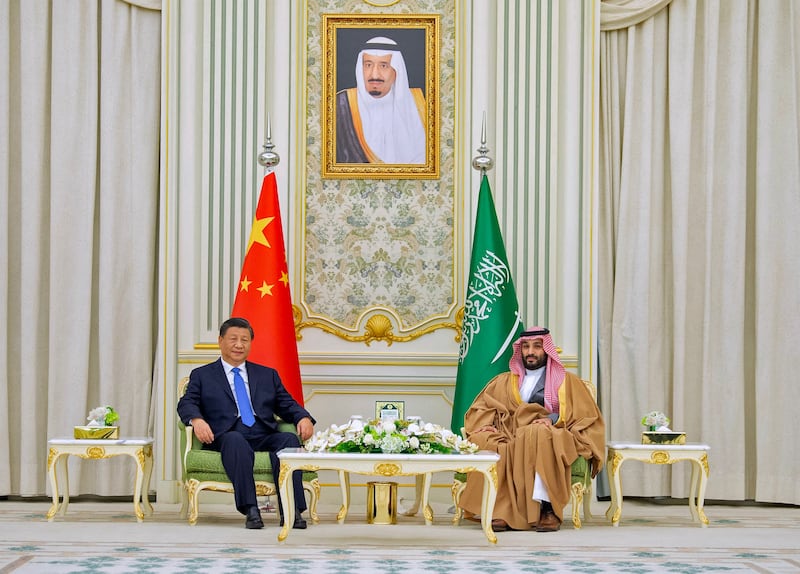

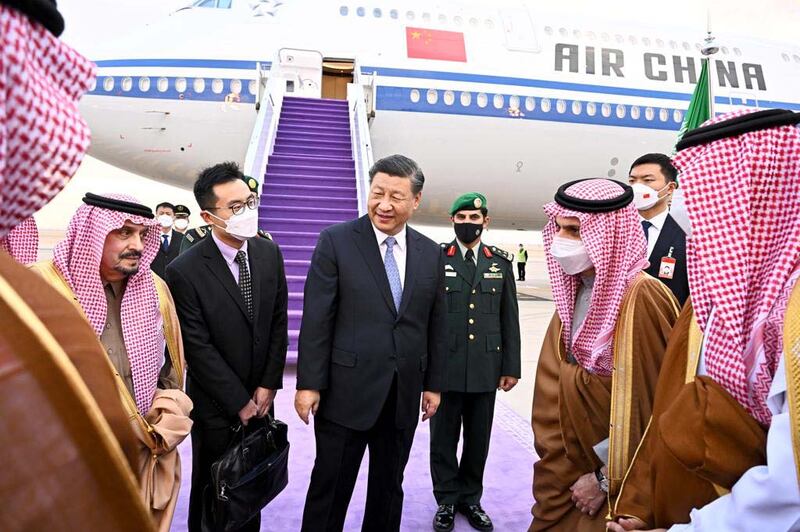

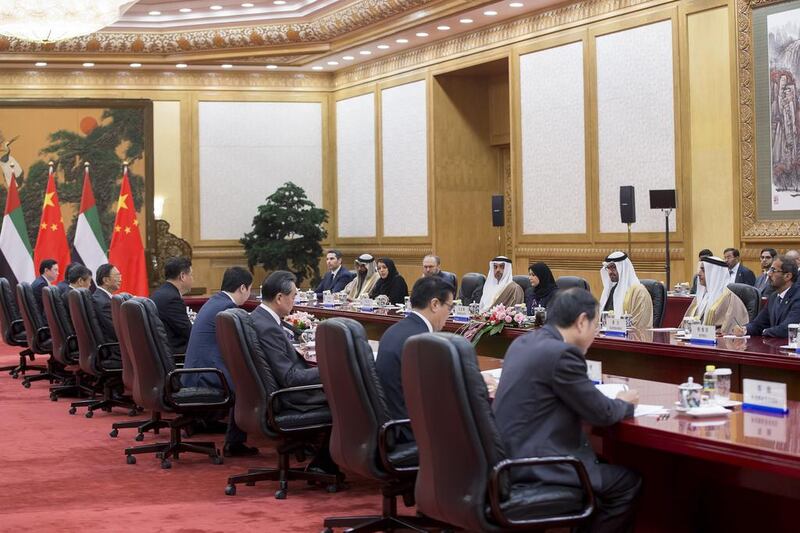

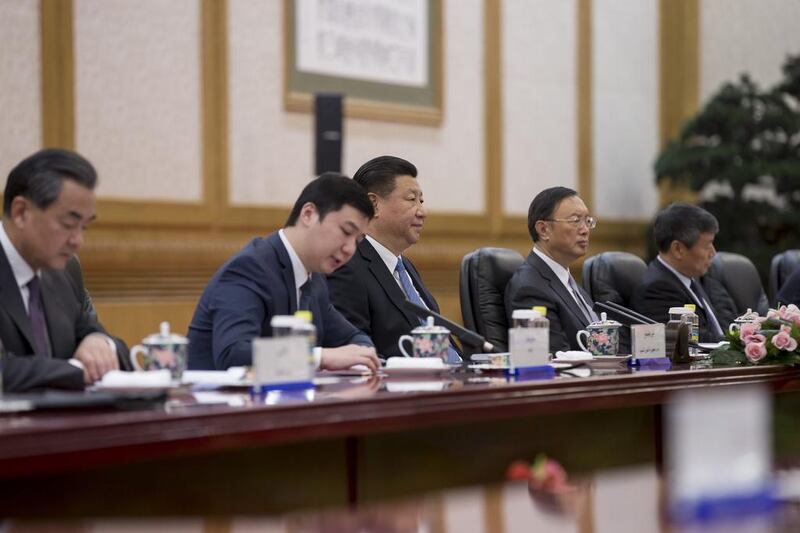

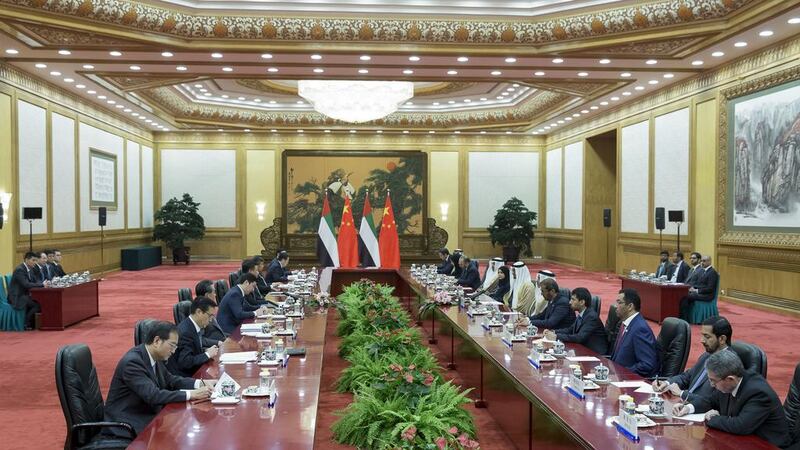

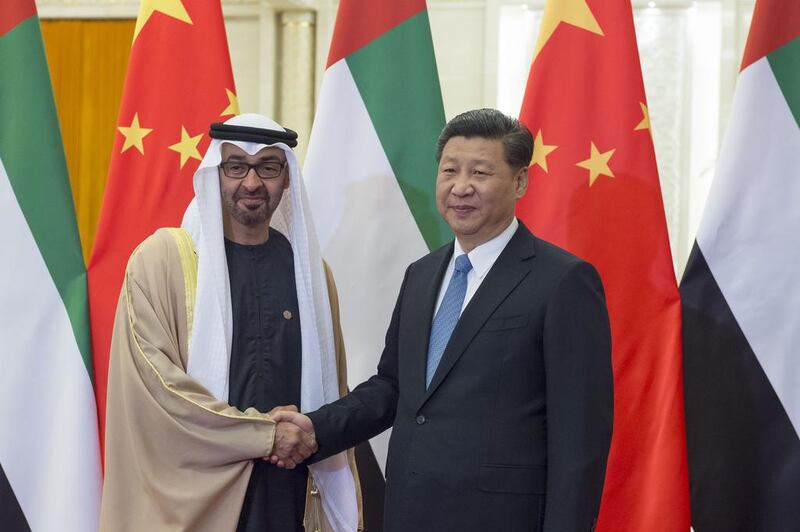

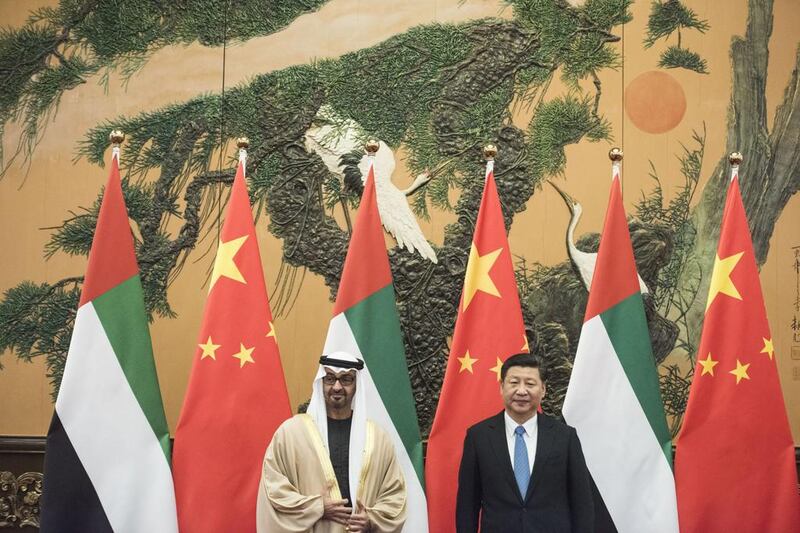

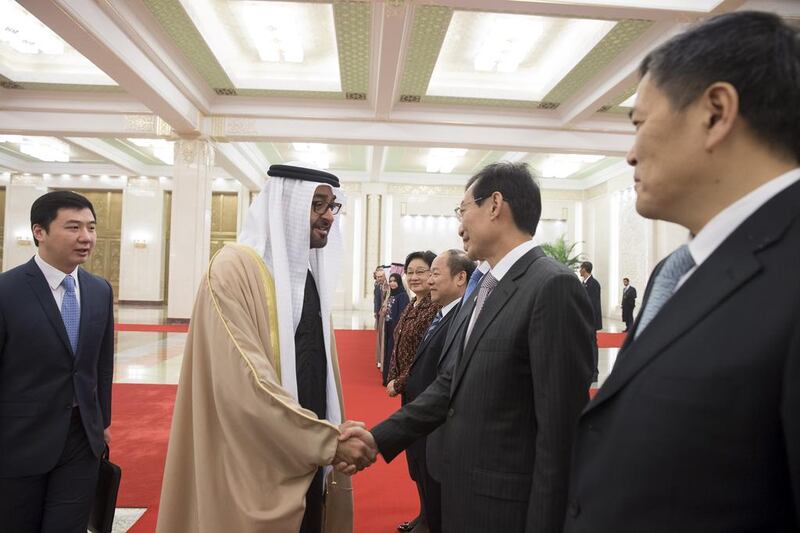

Chinese President Xi Jingping’s historic visit to Saudi Arabia in December heralds a “major shift” in the strategic relationship between China and the GCC.

“President Xi's visit will give a strong impetus and I anticipate an initial FTA could be signed in 2023,” says Mr Saidi.

Lombard Odier macro strategist Homin Lee says the deal could be signed soon.

“We can expect a quick wrap-up of the negotiations as soon as both sides have the resolve to move forward on key issues that have been holding them back,” he says.

Strong ties

Mr Saidi says trade between the GCC and China has been steadily rising and doubled between 2010 and 2021, with China accounting for about 16.7 per cent of the Gulf region’s total trade in 2021.

China, the world’s second-largest economy, is already the top trading partner of Saudi Arabia, with bilateral trade volumes hitting 295.6 billion Saudi riyals ($78.8 billion) in the first nine months of 2022, according to data from the General Authority for Statistics (Gastat).

Exports to China from the kingdom reached 189.5 billion riyals, accounting for 16 per cent of total exports during the period.

Meanwhile, imports from the Asian nation represented about 21 per cent of Saudi Arabia’s total imports at 106.1 billion riyals.

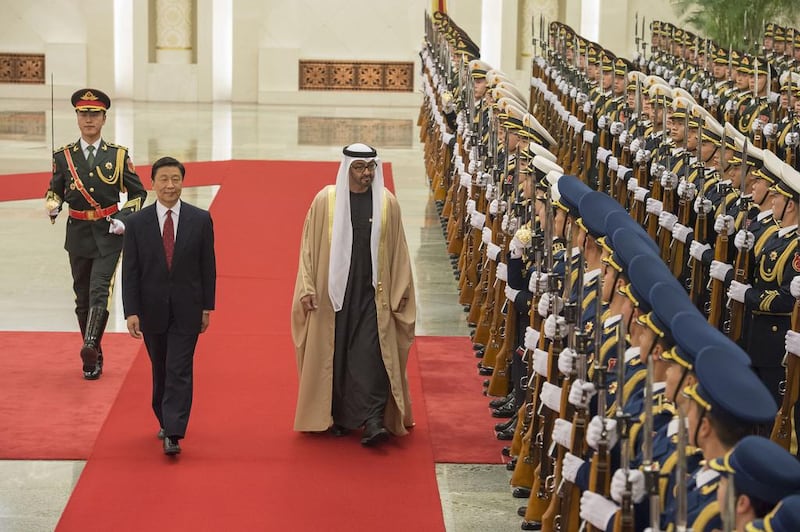

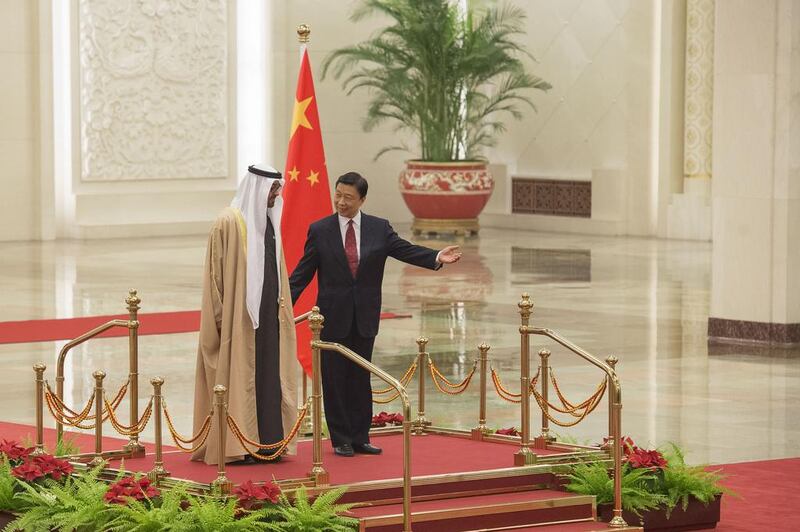

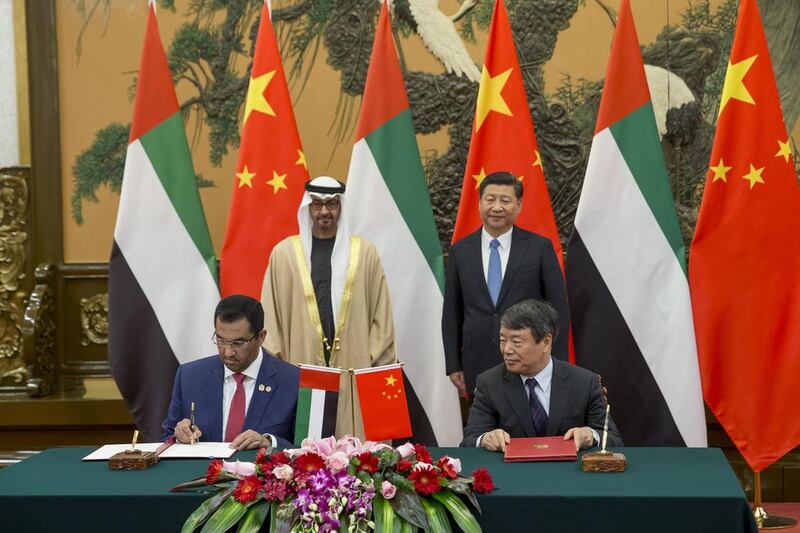

Trade between China and the Emirates is also growing rapidly.

Volumes reached a record high of $99.27 billion last year, marking an annual increase of 37.4 per cent, Zhang Yiming, China's Ambassador to the UAE, tweeted on Friday.

China's imports from the UAE stood at $45.41 billion, up about 59 per cent, while its exports to the Emirates also grew more than 23 per cent to $53.86 billion, he said.

The Asian nation has become the UAE’s largest non-oil trading partner, while the Emirates is China’s second-largest trading partner and the largest export market in the Arab region, Mr Yiming told state news agency Wam in November.

“An FTA will definitely boost trade connections. This was very much visible with the comprehensive economic agreement signed with India [by the UAE] and it should help in deepening trade ties further between the GCC and China,” says Abu Dhabi Commercial Bank's chief economist Monica Malik.

Mr Lee from Lombard Odier says China would have a chance to compete better on the supply of intermediate goods to the GCC if the FTA comes into effect.

“The region is ramping up its infrastructure investments amid a boom in energy markets, and China is in a good position to help with such efforts with its large industries capable of supplying capital goods and related commercial services for projects abroad.”

But the FTA will have a major impact on more than just trade.

“Generally, tariffs on good are fairly low, so while a FTA will benefit trade, it is probably investment linkages that will generate the greater returns,” says Scott Livermore, chief economist at Oxford Economics Middle East.

Focus areas

While oil is a major focus for trade between China and the GCC, the FTA will open up several opportunities outside that sector.

“The broader energy sector beyond crude oil is likely to be an important focus, especially natural gas and renewables,” says Robert Mogielnicki, senior resident scholar at the Arab Gulf States Institute in Washington.

The non-oil goods and services trade is also an important component of any FTA negotiations, he says.

Mr Saidi says an FTA would open new sectors such as services, technology, artificial intelligence and robotics, and strengthen linkages in infrastructure, transport and logistics, leading to a “potential doubling of non-oil trade in three years”.

Opportunities also exist in construction, manufacturing, tourism and space exploration, as well as the linking of financial markets, he says.

ADCB's Ms Malik says GCC sectors linked to petrochemicals will also be key areas since China is expected to be a main driver for petrochemicals demand globally going forward.

“In the longer term, as diversification programmes in the region deepen, we will see a broader range of exports going to China. In the near term, we expect much of the benefit of the non-oil trade will be cheaper imports from China,” she says.

Mr Lee says the Gulf region could look at adding “competitively priced” imports of machinery, transport equipment and manufacture products from China.

“China’s green sectors might also get a boost from the deal since the GCC region is trying to diversify its energy infrastructure and China has leading positions in many sub-sectors that are key to electrification and electric vehicles.”

Changing flows

Globally, geopolitical factors have shifted the nature of trade significantly. Last year's overall trade growth is projected at 3.5 per cent owing to a deceleration in the world economy, according to World Trade Organisation estimates.

The WTO has trimmed its forecast for trade growth to 1 per cent in 2023, citing increasing downside risks from high inflation, declining consumer spending and the continuing energy crisis.

Arab leaders attend GCC summit in Saudi Arabia

However, countries such as the UAE significantly outpaced the global trade growth last year — at an estimated 15 per cent — and continue to seek new opportunities across continents.

“We expect the GCC countries to maintain a degree of strategic flexibility for the foreseeable future when it comes to trade, as they are fundamentally incentivised to get the best value for the commodities they export to other countries,” Mr Lee says.

According to Mr Livermore, while the Gulf states are looking to the East for growth opportunities, the bloc is seeking to broaden its economic sphere and the “West will remain important economically, as well as politically”.

Mr Mogielnicki from the Arab Gulf States Institute believes Asian economies clearly present a longer-term priority for GCC countries’ global economic engagement.

“Growth across the strongest Asian countries is likely to outplace global averages over the short and medium terms,” he says.

Combining strengths

Looking ahead, China-GCC relations are set to grow significantly in the longer term.

“China will remain one of the GCC’s main energy importers and the GCC will have the option to use China’s competitive cyclical industries for its efforts to expand and diversify domestic capacity, and prepare for the global climate transition,” says Mr Lee.

Ms Malik says China and GCC trade relations are already on a strong footing, but going forward, “broadening and strengthening trade will be key, it will be prioritised and it will be an area of mutual growth”.

While China is a big export market, Mr Saidi sees many opportunities beyond trade and investment.

“First and foremost, there could be significant benefits from the adoption of the PetroYuan,” he says.

“Oil could continue to be priced in USD, but payment and settlement would be in Yuan. The Yuan could be used for all bilateral trade with only the net balance settled in euro or USD.”

At the moment, the greenback still accounts for 60 per cent of the global reserve currency and the pricing and selling of crude is in US dollars.

Deeper economic ties mean that China and the Gulf region can benefit from increased co-operation on numerous fronts such as the integration of banking and payment systems, the expansion of central bank swap agreements, collaboration between special economic zones and state-owned enterprises becoming an instrument of economic and industrial policy.

“Sovereign wealth funds can also be used as an instrument for co-operation — for example GCC SWFs can focus more of their portfolios on Asian economies, especially China, and vice versa,” says Mr Saidi.

“In parallel, China will emerge as a geostrategic partner of the GCC in defence and security, given alignment on most political issues.”