The spring art auctions in New York set a new record for the art market's biggest name, Pablo Picasso, and settled into sustained buying that proved the market had recovered, with aggressive spending on works by artists with the strongest reputations. Prices confirmed that the market was inching upwards from the dark days of 2008. For the most desirable works, the market lept upwards. Two weeks of auctions kicked off on May 4 with an auspicious sale. Picasso's colourful Nude, Green Leaves and Bust from 1932 sold to an unknown buyer for $106,482,500 (Dh391m), the highest price ever for a work of art at auction. In second place that night was Grande Tete Mince, a bust by Alberto Giacometti, which brought in $53 million.

The sale, which totalled $335.5 million, was a warm-up. A week later, in the same room at Christie's, the iconic Flag (1960-66) by Jasper Johns sold for more than $28 million as part of the sale of the author Michael Crichton's collection, which realised close to $100 million. The following day, Sotheby's achieved the two highest prices of the week at auction with Andy Warhol's colossal late Self Portrait, which sold for $32 million, and, Mark Rothko's red abstract Untitled from 1961, which brought $31 million.

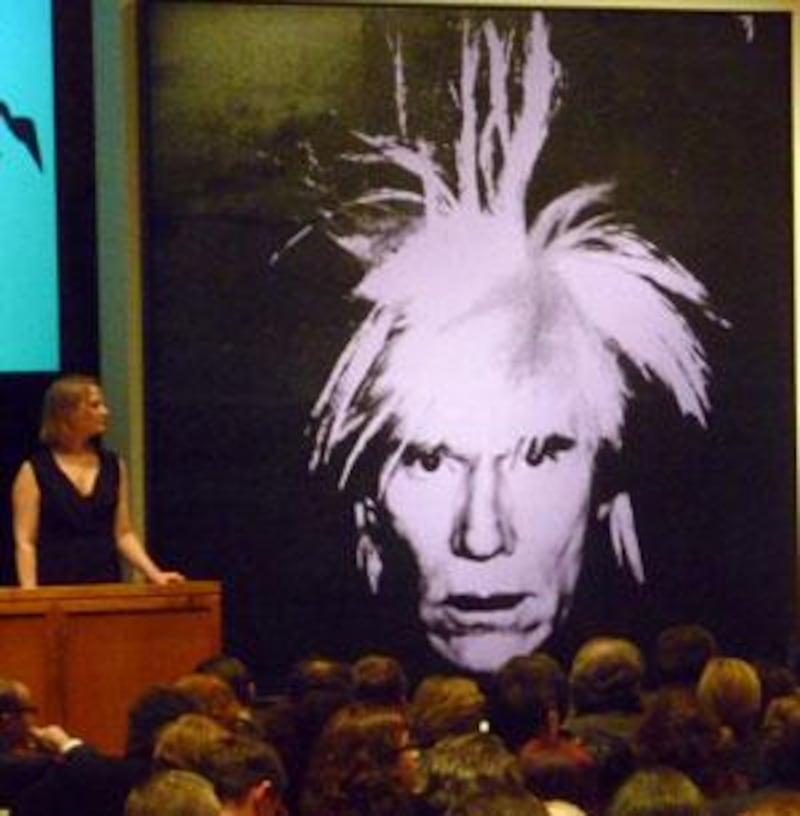

Warhol's nine-foot-by-nine-foot purple-on-black portrait was on display during the entire sale like the image of the defiant leader of a movement that was no longer in retreat. Intended or not, it seemed motivational. Sotheby's $190 million total for its May 12 contemporary evening sale far exceeded the $47 million total of the same sale last year. Standing in front of the Warhol, which was consigned by the designer and film director Tom Ford, the Sotheby's auctioneer Tobias Mayer said the evening's results indicated "a global hunger for great icons ? from a global community that will seek out trophies - and once they find the trophies, they go for them full-throttle".

On that point, the rival auctioneers agreed. The two weeks of sales were evidence that "the people at the highest levels of the market had become comfortable spending money again," said Mark Porter, Christie's president in America, who noted that "all of 2008 was a real crisis". The market is "sober now - strong but selective", said Amy Cappellazzo, the co-head of Christie's contemporary department in New York.

Sceptics doubt that sobriety is the right term. "There is a tremendous amount of liquidity in certain areas and people are afraid of currency-dominated investments," said the New York dealer Richard Feigen. "They don't wish to be in dollars. They don't want to be in euros. They don't want to be in sterling. They've been told that this is the place, and it's being treated like gold. So they're going into art.

"There's no explanation why a head [Giacometti's Grande Tete Mince] brings $50 million. It's inexplicable, but that's where the money's being dumped right now." During the same two weeks, Greece's economy pulled the European Union into crisis and the euro lost value. "It's had no impact," said Brett Gorvy, the co-head of Christie's contemporary department. "If anything, stock market variance brings more collectors to the art." Yet Christie's announced that only 21 per cent of buyers at its contemporary sale were European, while 72 per cent were American.

"They're paying with money, and they're either paying with euros or they're paying with dollars," said Jan Kallir, the co-owner of the Galerie St Etienne in New York, who added that, despite the upswing, prices of some artists are still at 50 per cent of 2007 levels. If buyers in New York were emerging from a cautious phase, the composition of the sales in both weeks remained cautious, with estimates far below the market's high in 2007, and mostly proven artists included. (The strategy seemed to work at Christie's on May 11, when the first 56 lots sold without a buy-in.)

The record-setting Picasso at Christie's on May 4 was nothing if not commercial, from a period and in a style that was expected to bring the broadest possible interest. Johns, now 80, the highlight of the Crichton collection, is the most prominent living artist in the United States, and his Flag rallied American buyers. Among the few younger artists sold at Sotheby's on May 12 was the Italian satirist Mauricio Cattelan, whose whimsical sculpture of himself emerging from a hole in the floor brought $7.9 million, doubling its high estimate and setting an auction record for the artist. It was sold by the New York dealer William Acquavella, an indication that the art trade was unloading work held from sale during harder times.

Warhol remained the market's workhorse. "He's the real volume trade in our market, the artist who sells the most by volume," said Cappellazzo of Christie's. That market could be deepening, as the high price for Self Portrait, from 1986, the year before Warhol died, reflected new interest in the artist's later work. In case its price didn't make the point, Mayer predicted that the haunting picture would have the same importance in art history as Claude Monet's Water Lilies.

Still, uncertainties remain. Specialists at Christie's noted that there was no Asian buying at its May 11 contemporary sale. (Neither house offered specifics about Middle Eastern buying, citing only "global interest".) Larry Warsh, a collector of contemporary art, including Chinese art, said that Chinese buyers were not at the New York spring sales in significant numbers, and he didn't believe they were bidding. "The Chinese tend to be nationalistic collectors," he said, adding that hopes that they will fuel the rebuilding of the western art market are exaggerated. "The auction houses need to attract Chinese buyers to bolster up the market with fresh dollars, but those buyers don't care about Warhol. They don't care about Basquiat. They don't care about Keith Haring. If they are buying contemporary art, the art is from China" he said.

With or without the world's largest population, the buoyant mood conveyed optimism. So did buying below the top levels. At the end of the Sotheby's May 12 sale, a bidding match between the dealer Larry Gagosian and an unidentified woman drove the price of Untitled (Stardust) by Jean Michel Basquiat above $7 million. The final price for the 1983 work seemed high, but not as high as the price the buyer might get for it in a stronger economy.