"It's been one of the best years for our team, by nearly all metrics – total revenue of sales, total new clients, value for most expensive works sold," says Nima Sagharchi, director of Middle Eastern, Islamic and South Asian art at Bonhams. "And overall, Bonhams had the best second half of the year in its history."

Auction houses have seemingly benefitted from the coronavirus pandemic. With traditional competition in the form of art fairs dampened, global auctioneers have been racking up the headlines. Little-known artist Beeple achieved $69 million at Christie's in March, setting a record for his digital artwork Everydays: The First 5000 Days, sold in an equally little-known medium (at the time), non-fungible tokens or NFTs.

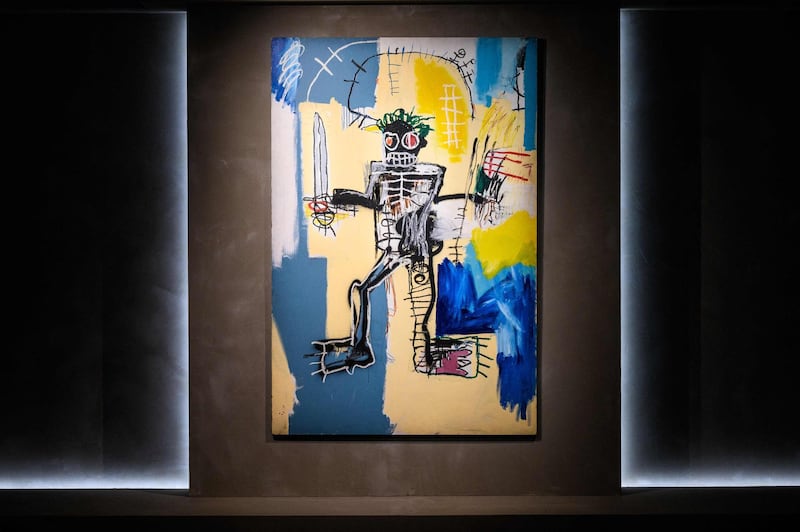

Jean-Michel Basquiat's painting Warrior (1982) sold for $41.7m at Christie's a few weeks later, becoming the most expensive Western work of art to be sold at auction in Asia. And, again at Christie's last month, Banksy sold his Game Changer (2020) for a record £16.7m ($23.1m), the proceeds of which went to the UK's National Health Service charities.

'It has been an incredible year'

Auction houses, it seems, have been killing it, buoyed by a growing stock market and a rise in discretionary income, as the pandemic has limited opportunities for holidays, shopping and entertainment.

Private sales conducted by auction houses have soared, too. Christie's reported that its total revenue last year was up by 84 per cent compared to 2019. Over the past year, it says the house sold more works over $25m via private sales than it had at auction.

"For big fat capitalists, it has been an incredible year," says Belgian art collector and market watcher Alain Servais. "The S&P [stock market index] has grown by 100 per cent since the dip in March last year. Portfolios have been rising by about 10 per cent and 25 per cent. A lot of people have made a lot of money over the past 12 months."

For the art market, the change is not only that there is more money in the system, it's that the money is coming from different places, and going to different artworks.

"It's clear that the wealth is being made quicker now than it ever has been," says Francis Outred, former chairman and head of post-war and contemporary art across Europe, the Middle East, Russia and India at Christie's, and who now runs his own eponymous agency.

Asian markets, younger demographic

“The age of these millionaires and billionaires is getting younger and younger, and they’re looking for places to put their money," Outred adds.

"They’re responding to their instincts, and they’re less obedient to the traditional norms of the art market,” he says.

Many of the new collectors are coming from the tech world or from websites in Asia, such as Hong Kong, Singapore and Shanghai. A whopping 91 per cent of the bidders for the Christie's online-only sale, at which the Beeple work single-handedly helped to propel the acronym NFT into the mainstream, were new to the auction house.

Younger collectors tend to be less afraid of digital work and of buying art online. Their taste is also different, leaning more towards names with social media recognition – and with speculative potential – rather than art-world accreditation. Neither Beeple nor Banksy have had major museum shows, and even Basquiat, though better established, is under-represented in museum collections.

"What is remarkable right now in the auctions is high prices are done by the non-mainstream things," says Servais. "Nobody speaks about anything else than Kaws, Beeple and the new Amoako Boafo. But we could say, tentatively, that none of those artists has any chance to end up in the Venice Biennale.

“It’s a little bit the same in the financial markets. Hardly anyone is speaking about Apple and Microsoft – everybody’s talking about GameStop and Hertz.”

While Banksy soared, some blue-chip artists fell flat at auction in March. At Sotheby's, an Edvard Munch self-portrait went for £4.3m, at the bottom of its estimate. At Christie's, in the same sale as Banksy's Game Changer, an untitled Philip Guston work from 1968 went under estimate for £736,500, and a Francis Bacon sold mid-estimate at a little less than £5m.

How is the Middle Eastern art market doing?

But the past year of auctions have not been an evenly paced success story. After a shutdown in March and April last year, spring sales at Sotheby's and Christie's surprised the world by their jubilant figures, fuelled by pent-up demand. The sales in a suddenly crowded second half of the year, however, slowed to an even respectability, picking up again only this March.

For the Middle Eastern market, the changes have been less pronounced, and the market remains inoculated from the kind of speculation it last experienced before the 2008 financial crash. While some works are in high demand, for example by Iranian artist Bahman Mohasses, most lots at auctions held by Sotheby's and Bonhams in the region last month went for mid-estimate or slightly above.

“Works by established artists with rock-solid provenance will always be attractive,” says Charles Pocock of Meem Gallery in Dubai. “But the middle market is flat.”

Christie's did not hold a Middle East auction last month, having reduced its calendar after a tougher year in the region than elsewhere. In its November Middle East modern sale last year, 45 per cent went unsold by lot; and in the Matters of Material sale, held on the same day, which brought together contemporary artists from the Middle East, Africa and Latin America, 78 per cent went unsold by lot. By comparison, Sotheby's and Bonhams, in their November modern and contemporary Middle East sales, reported that 19 per cent and 28 per cent remained unsold by lot, respectively.

Christie's, an established industry leader, will almost certainly ride out the chaos of the past year. But there will be effects in the short term. "Clients will not want to entrust works or collections to a house that cannot deliver on prices," says Pocock. "It's clear, for example, that Bonhams has already benefited." (Rumours are swirling about two important modern collections that Bonhams has won the right to auction at its next Middle East sale.)

If the regional market is less prone to speculation, it, too, has undergone an expansion of clientele. Sagharchi of Bonhams says the bulk of his bidders from the Gulf were once from the UAE and Qatar, but there's recently been a rise in registrations from Saudi Arabia, Bahrain and Kuwait.

After circumstances return to normal, he’s confident the increased activity will remain. “You can’t put the genie back in the bottle,” he says. “For first-time buyers, just because the world is open you won’t lose interest in art.”

But in the global market, many worry about the long-term effects of speculation around younger artists. There is a frisson of excitement around challenging the status quo – Banksy's donation of the Game Changer hammer price to the NHS is a sore reminder of the shocking amounts of money artworks routinely go for, and the fact that the money might be better used elsewhere.

But will these untested artists hold their prices? And if they don't, will the new buyers come back? More fundamentally, though, what is the effect on the overall art market if the accumulated judgment of curators, critics and experts is ignored? Servais is explicit in his answer. "We're not talking about art anymore, we're not talking about content anymore, we're not talking about art history anymore," he says. "We're talking about speculative luxury goods."