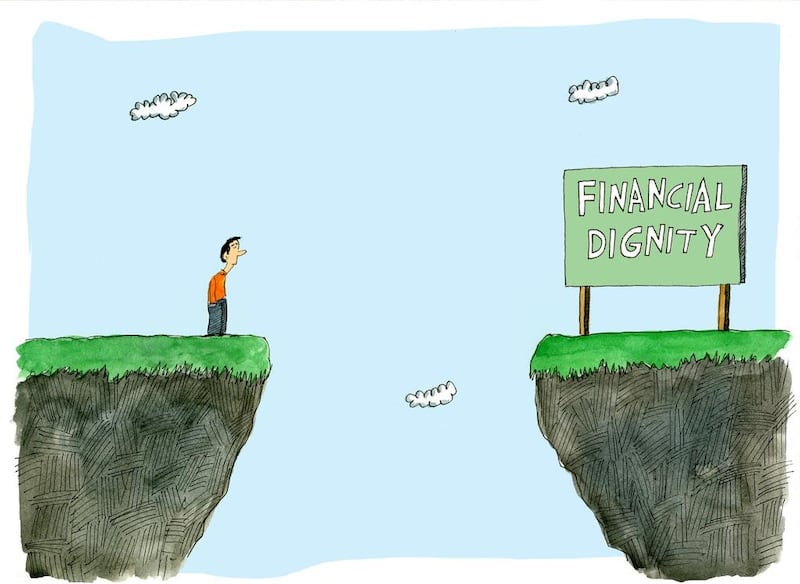

Today's word is: dignity. To live with dignity is to live with self-respect.

Who doesn't want that? Well, if you want it, you need financial dignity too.

Financial dignity means different things to different people, and I believe that Benjamin Franklin, one of the founding fathers of the United States, summed it up quite nicely in these words: "Let honesty and industry be thy constant companions, and spend one penny less than thy clear gains; then shall thy pocket begin to thrive; creditors will not insult, nor want oppress, nor hungerness bite, nor nakedness freeze thee."

For me, financial dignity means having enough money to get by for a few months if I am not able to earn for whatever reason.

It also means living debt-free, and being able to both earn money and spend key time with my son during the working week. To be able to take holidays when I want (still working on the "where I want"), and to live comfortably - each of us having our own definition of what that is - for the rest of my life.

What does financial dignity mean to you? Before reading on, why don't you write down your thoughts - how you envisage your future, and how you want to live.

Think of what you've written as your goal. But a goal without a plan of action is worthless, and this is where many people, I believe, lose the plot: they dream, but don't break it down into manageable, measurable chunks.

It's overwhelming to think big, but have no road map of how to get to where you want to be. Imagine setting out to drive somewhere without knowing where you're headed, or how best to get there - no road map means wasting time, burning up resources, and losing money.

Financial dignity boils down to the controlled use of all the money that you have in your life with the aim of achieving the life and lifestyle that you want for yourself.

And so, to make your goals a reality, you must control what you do with the money in your life.

Let's create some simple steps to make this happen:

First: set out clear and measurable targets that break down your goal into achievable mini-goals.

Second: Like it or not, whatever your goal is, making it happen depends on access to cash. This is money you need to save. No more loans or debt from today, OK?

Third: it's all about controlling what you spend. Let's look at an example - imagine that you want to save a chunk of cash as a downpayment for a property investment.

Step one: I will have saved Dh150,000 five years from today. I will use this as a downpayment to buy a flat to rent out.

It's essential to set out a clear, concise target, and a time-frame for it to happen.

Saying "I want to be rich" or "I want to buy a property to rent out" are not smart objectives.

Once you have your measurable, clear statement, it's no good saying you want to save Dh150,000 in five years without coming up with a plan to make it happen.

Step two, working out the money you need to save: this target translates into Dh30,000 a year, which means putting aside Dh2,500 per month. Is that reasonable for you? In terms of what you earn, not what you spend. If it is, then this is where your financial road map needs to kick in:

Step three: keeping track of what you're doing with your money every day for a few months, with the aim of cutting out unnecessary outgoings, and controlling what you spend.

You have money in your life, and what you do with it every day will either help you to achieve your goal, or not. Again it boils down to controlling what you spend, and to what's more important to you: the meal in a fancy restaurant a couple of times a month, or saving the Dh150,000 and what that gives you - a step closer to your bigger picture dream.

So, let's make this the year that we work on creating a plan to have financial dignity, be proud people, and resolve never to be in need.

If only we listened to Benajamin Franklin's words ... and then lived by those simple rules.

So, what will it be? Living with financial dignity or financial stress?

Great! Dignity it is.

Nima Abu Wardeh is the founder of the personal finance website www.cashy.me. You can contact her at nima@cashy.me

On the money: make this the year you find financial dignity

To me, financial dignity means many things, such as living debt free and having enough money if I am not able to earn.

Editor's picks

More from the national