Global property has been one of the finest investments of the last decade, with the major global “superstar cities" spearheading the charge.

New York, London, Toronto, Singapore, Hong Kong, Shanghai, Mumbai and of course Dubai are just some of the cities that have posted double-digit price rises, year after year.

Internationally mobile expats are particularly keen on global property and many have been handsomely rewarded as a result, but now they need to tread carefully.

While the breakneck growth continues in many global favourites, fears are growing that it all could end in a housing crash.

UBS Wealth Management is the latest to warn of a global city housing bubble as monetary stimulus is reversed and interest rates finally start rising. Could the city superstars come crashing back to earth, and how much exposure do you have?

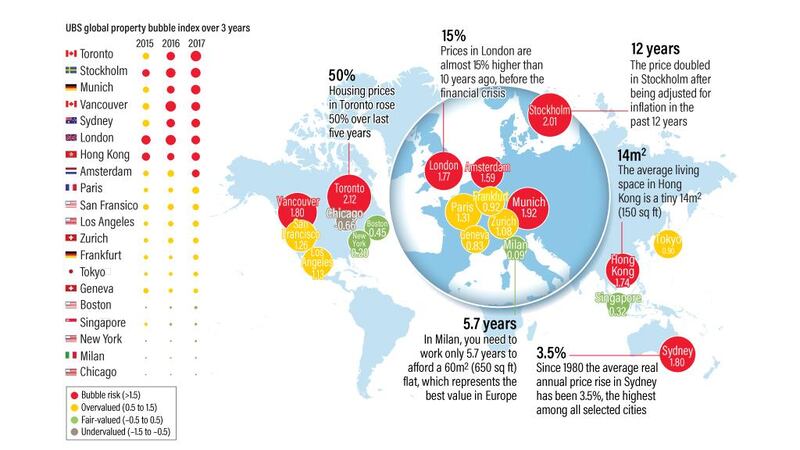

Housing bubble risks are growing with the annual UBS Global Real Estate Bubble Index 2017 showing three quarters of the 20 global cities it covers are at risk of a bubble or overvalued.

The danger is greatest in Toronto, up significantly in the last year, while Stockholm, Munich, Vancouver, Sydney, London and Hong Kong remain risky, and Amsterdam has now joined this group.

Valuations are also stretched in Paris, San Francisco, Los Angeles, Zurich, Frankfurt, Munich, Tokyo and Geneva.

There are still affordable cities, with Boston, Singapore, New York and Milan looking fairly valued. However, Chicago is the only city in the study considered undervalued.

Claudio Saputelli, head of global real estate at UBS Wealth Management, says improving economic sentiment, growing incomes and cheap borrowing have driven demand for urban housing.

"As supply is always a constraint in the most appealing cities, soaring prices are the consequence. Inexpensive financing and bullish expectations have caused valuations to skyrocket and encouraged bubble risks to grow,” he says.

The bubble has also been driven by the "superstar city" narrative, he says, as global money pours in and local prices decouple from rents, incomes and national price levels.

Mr Saputelli says the surge in international demand, especially from China, has crowded out local buyers. “Average price growth of almost 20 per cent in the last three years has confirmed the expectations of even the most optimistic investors. This thesis has helped fuel overvaluation and even bubble risks.”

Bubble or no bubble?

So are we facing the long-feared bursting of the property bubble? Paul Tostevin, associate director at property specialists Savills World Research, is sceptical.

He says local incomes are no guide to affordability in major world cities that suck in cash-rich international investors. “There is no direct relationship between local incomes, borrowing, interest rates and values.”

Analysis from Savills suggests that most prime housing values remain justified when compared to the price of alternative assets, in historic terms. “Taking gold as a benchmark, major world centres including London, New York and even Hong Kong are still well below their former peak-equivalent pricing in gold,” Mr Tostevin says.

Buyers continue to drive global house prices to fresh highs. The latest Global Residential Cities Index from Knight Frank, published in October, shows prices up 6.1 per cent in the year to June 2017, although down slightly from 6.9 per cent in the previous quarter.

Toronto remains the fastest-growing city with prices up an incredible 29.3 per cent in the year, although a new foreign buyer tax may curb future growth.

_______

Read more:

Hong Kong property market too risky, says Savills

Toronto's property buyers and sellers fall out over price

Is the global property bubble ready to burst?

Is now the time for Gulf investors to buy London property?

_______

Emerging markets

Emerging markets are leading the charge with prices in Kochi in India up 27.3 per cent, and three Chinese cities in the top 10, with Wuxi, Zhengzhou and Changsha all up around 20 per cent, along with Hong Kong.

Hamilton in Canada and Reykjavik in Iceland both grew around 25 per cent, while Izmir in Turkey and Wellington in New Zealand were up around 20 per cent.

Emerging market cities are now outperforming developed countries, although Russia, Latin America and Africa are all struggling.

Kate Everett-Allen, partner for international residential research at Knight Frank, says: “Long-term frontrunners such as Hong Kong, Reykjavik, Wellington and Budapest are holding firm but we have seen some new contenders rise up the rankings, most notably key Indian cities.”

Prices are not rising everywhere though; Taipei City, Athens, Milan, Singapore, Cape Town, Rio de Janeiro, Perth, Rome, Darwin and Johannesburg all fell, with oil town Aberdeen in Scotland the worst performer on the index, down -9.5 per cent.

European outlook

Ms Everett-Allen says European cities predominate at the bottom of the table, particularly in the southern European economies such as Greece, Cyprus and Italy.

Daniel Howarth, co-head of international at Ennes, a mortgage brokerage that recently opened an office in Dubai, says prime foreign investors living in the Middle East are right to be concerned about the slowdown in developed markets, amid political uncertainty in Europe. “They should keep a close eye on bellwethers like interest rates, tax changes and governmental upheaval and be prepared to move quickly if the property market moves against them,” he says.

Mr Howarth says banks are reacting faster than clients to mitigate the risk of property inflation. “Many international European banks fear over-exposure in key areas such as London, Paris and Zurich. Banks are discontinuing interest-only finance in these areas and demanding larger deposits to protect against forced sales during a price crash,” he says.

Europe is a particular concern as low interest rates and local wealth taxes encourage people to take on debt. “This accentuates the risk that many will fall into negative equity should the market move downwards," says Mr Howarth, who suggests investors seek a fresh valuation for any investment property they own, especially if they bought a long time ago or have a high loan-to-value mortgage.

If it has fallen in value, he suggests paying down some of the debt, refinancing to a cheaper mortgage, or increasing your monthly repayments. “This should reduce the shortfall and give you more flexibility if you need to refinance in the future, when markets could be more unstable and banks less flexible.”

Mr Howarth says Europe still has plenty of opportunities, with little evidence of a bubble in the south of France, Monaco and northern regions of the UK. “These look solid compared to the artificial property inflation in many European capitals.”

He does not expect a financial meltdown along the lines of 2007 but says a market correction is likely at some point. “If clients cling to the frothy growth behind the capitals, they can expect to get their fingers burnt.”

The city leaders

Faisal Durrani, partner and head of research at property specialists Cluttons in Dubai, says Beijing has been tightening the screws by restricting the export of capital overseas, cooling the Chinese global buying spree.

Investors should understand both the global and local factors affecting specific markets. "Toronto, for example, has emerged as a clear preference for migrants and students, particularly from the Middle East, following Donald Trump’s election last year. This has underpinned the spike in values we are recording today. However, foreigners now face 15 per cent tax on foreign home buyers," says Mr Durrani.

In prime central London, values have been correcting for two years, down 4 per cent in that time, with Brexit and new residential taxes partly to blame. However, weaker sterling has also made property cheaper for overseas buyers. “The London population is growing rapidly, property supply is tight and domestic purchasers are hungry for "period" homes, which will forever remain in finite supply, so the market has a bright future.”

With parts of London delivering 300 per cent growth over the last 20 years it remains a draw for international property investors and some will even see recent weakness as a buying opportunity, Mr Durrani adds.

The Middle East markets

Figures from Cluttons show the local Dubai property market continues to stabilise, with residential values holding steady in 25 of the 32 locations it monitors.

Mr Durrani says the top of the market is under most pressure as investors and buyers are cautious of committing to luxury home purchases. “We are wary of the expected mismatch between planned supply and demand with an estimated 90,000 units due for completion before 2020, although experience suggests nearly a third will not be delivered in that timeline," he says.

He notes that although US$33 billion infrastructure and construction projects for Expo 2020 will generate jobs, these will mostly be middle to lower income households, while the planned stock appears aimed at the middle to top end of the market.

Dubai property looks set to end 2017 around 5 per cent lower, with similar slippage likely next year. “However, it may flatten out as the Expo 2020 effect filters through and lifts job creation rates,” Mr Durrani adds.

Residential values in Abu Dhabi are also under pressure as the government looks to rebalance the economy away from oil. “Households in Oman and Bahrain are focusing on affordable rental locations, driving down rents at the top of the market.”

The residential villa market remains buoyant in Sharjah. “It is now one of the best performing property asset classes in the region, underpinned by its relative affordability and high demand due to supply of this stock,” Mr Durrani adds.

Craig Plumb, head of research at JLL MENA, says after two years of falling prices there is no sign of a bubble in Dubai. "Prices could fall further due to oversupply but we do not expect all the planned projects to materialise, so any decline is likely to be minimal. We expect some price increases in Dubai by the end of 2018 but only 5 per cent at most,” he says.

The global property market may be showing bubble-esque signs, but the gentle deflation in Dubai suggests that locals have less to worry about. It may be a good thing that Dubai has lost its superstar reputation for now.