The Middle East is poised to become a "swing" producer for refined oil products as the sector's importance in world trade grows, according to Standard & Poor's Platts commodities pricing unit.

Platts, which is one of the most important of the world crude oil and products price-setters, said on Tuesday it would add four new benchmark prices for trading out of the port of Fujairah, in recognition of its growing role in regional trade in petrol, gas oil and other refined product trading. The benchmark prices include assessments for petrol, diesel/gas oil, jet fuel and fuel oil.

Although refining capacity has been growing rapidly in the Middle East, the pricing of refined products is still dominated by those set in Singapore, and most market participants expect that it will take many years for regional pricing to challenge the status quo.

Indeed, a poll of about 130 traders and other market professionals at Platts’ annual Dubai Oil Forum held on Tuesday found that only 13 per cent expected any impact before 2020, and even then about half expect that Singapore will continue to dominate into the foreseeable future.

“This is a marker for the future and about the way we see broader market trends developing … Over the next few years, we hope to see more diversity in those trading, and not just in Fujairah but in other regional markets which currently are dominated by the national oil companies,” said Gurdeep Singh, a Platts executive.

Among the trading trends expected to influence the Middle East market is the fact that after a period of resilience, European refining capacity is predicted to stall as its reliance on imported oil products grows.

Similarly, India’s refining capacity had been among the world’s fastest growing, but it now has no new capacity due to be built, even though its demand for petrol and products such as liquefied petroleum gas continues to soar.

The International Energy Agency says that on current trends the Arabian Gulf refiners will be India’s biggest supplier of imported refined products by 2035-40, taking over from Singapore and other Asian refiners. Growing refining and product-trading ability is a key strategic objective for the region’s major oil exporters, in part to meet growing domestic demand but also with the broader aim of diversification to make them less exposed to crude oil prices.

In the past couple of years Saudi Arabia added 800,000 barrels per day of capacity to bring its domestic total to 3 million bpd, and under its 2020 Transformation Plan the goal is to balance its worldwide refining capacity with its crude oil output, which recently hit a record 10.67 million bpd.

In the UAE, capacity at the largest refinery in Ruwais, in the Western Region, doubled last year to 900,000 bpd and there are plans to add further capacity to handle a growing stream of crude oil from offshore, as well as to feed the much-expanded Borouge petrochemicals plant next door.

Emirates National Oil Company has also awarded the main contract on a US$1 billion plan to raise capacity at its Jebel Ali refinery in Dubai by 50 per cent, to 210,000 bpd.

Kuwait’s $4bn Al Zour refining project, which was contracted at the end of last year, is expected to nearly double the country’s refining capacity to 1.4 million bpd by 2019.

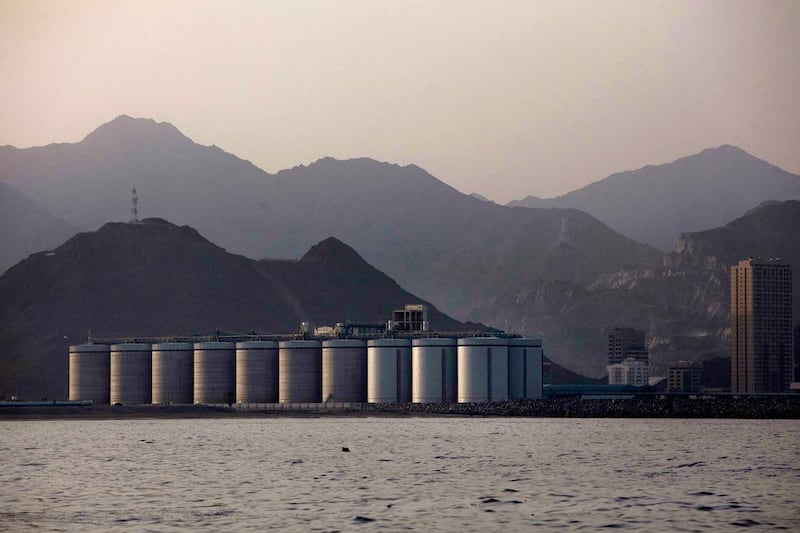

The next phase of expansion in the UAE, however, is stalled awaiting a decision by Abu Dhabi's International Petroleum Investment Company (Ipic) about the main contracts for its $3.5bn refinery project in Fujairah, where the winner from an all-South Korean shortlist was expected to be announced in June last year.

The delay is partly because Ipic is in the midst of a merger with Mubadala Development Company as Abu Dhabi Inc rationalises its strategic investment companies. But the opportunity is there for Gulf refiners, especially in India.

“With a population of 1.3 billion and around 250 million households, India is developing at such a rate that, as one Indian refining executive told me recently, demand for some refined products, especially LPG [liquefied petroleum gas], is basically whatever you can supply,” said Mr Singh.

amcauley@thenational.ae

Follow The National's Business section on Twitter