The UAE Government has drawn up plans to introduce both a federal sales tax – or value-added tax (VAT) – and a corporation tax, according to Al Ittihad, the Arabic-language sister paper of The National.

This would make the UAE the first country in the Arabian Gulf to introduce an economy-wide indirect tax on consumption.

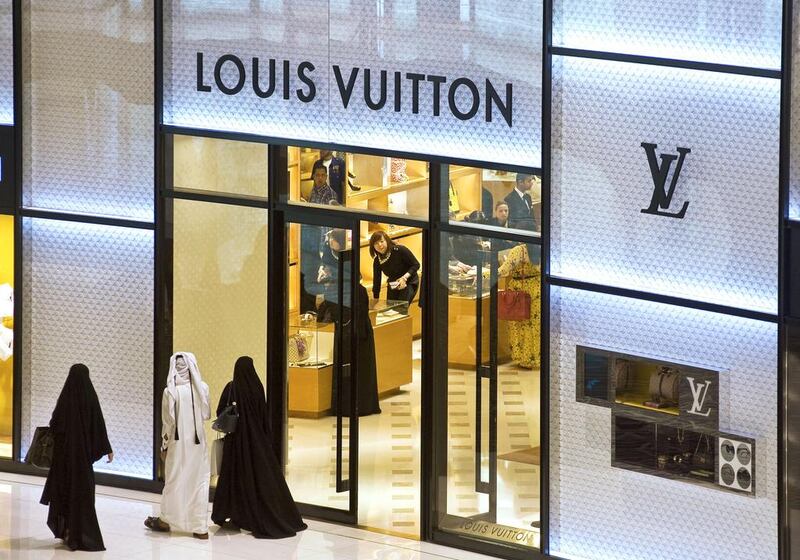

VAT would be levied at a higher rate on luxury goods, alcohol, and tobacco. Basic goods and essentials would be exempt from VAT.

“VAT is likely to have an effect on consumer spending because it will immediately push up consumer prices,” said William Jackson, a senior emerging markets economist at Capital Economics. “In the near term, it will act as a drag on growth.”

The government did not specify what the tax rate would be, but the IMF has previously recommended that the UAE set VAT at, or about, 5 per cent.

It is not known when or how the government would introduce VAT. Companies and consumers would be given up to two years to adjust to the new tax rules.

The government also plans to introduce a corporation tax, Al Ittihad reported, but did not provide details. The UAE currently levies corporation tax on foreign banks’ operations in the country.

The Ministry of Finance, which is responsible for federal tax collection and government accounts, said that it had finished drafting laws providing for a federal tax system, in addition to legislation to introduce VAT and corporation tax.

It is likely to be some time before the proposals become law. High-profile legislation must be shuttled between all interested government departments, before it is scrutinised by the Federal National Council, approved by the Federal Supreme Council, and signed by Sheikh Khalifa, the President.

“The draft of the corporate tax law and the value-added tax law has been discussed with the local and federal governments,” Younis Haji Al Khouri, an undersecretary at the Ministry of Finance, said last month.

The move comes as Gulf states address a new era of low oil prices. Oil has fallen from about $115 per barrel in June last year to approximately $50 per barrel now, cutting government revenues by about 20 per cent against 2013 levels.

That has opened up a hole in the UAE’s budget. The country will run a fiscal deficit of 2.3 per cent of spending this year, the IMF estimates.

The IMF has long suggested that the UAE introduce a VAT. In its annual economic study of the country, the fund said that the UAE “should consider raising non-hydrocarbon revenues by introducing a VAT, in coordination with the GCC countries, and broadening corporate income and excise taxes”.

Mr Jackson said the move towards a VAT “reinforces the impression that the UAE is the one Gulf state that is taking fiscal consolidation seriously”.

He added: “It seems that the UAE is taking the most serious steps to increase non-oil sector government revenues of all the Gulf countries.

“The UAE is in a stronger position than other Gulf nations because policymakers have more confidence that country’s private sector is fully functioning and well developed, and because its economy is more diversified away from dependence on oil.”

abouyamourn@thenational.ae