Mubadala will launch a joint fund worth US$10 billion with two Chinese state institutions, it was announced on Monday.

Mubadala, Abu Dhabi’s strategic investment company, will manage the UAE-China Joint Investment Cooperation Fund with China Development Bank Capital and China’s State Administration of Foreign Exchange.

The UAE and Chinese governments will each contribute $5bn, or Dh18.3bn, to the fund, which will invest in “sectors of strategic importance for the UAE and China”, the Government said.

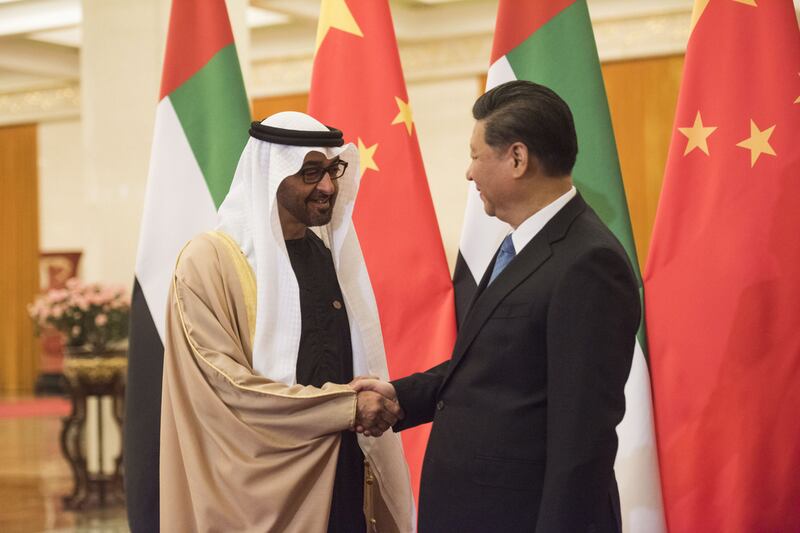

Sheikh Mohammed bin Zayed, Crown Prince of Abu Dhabi, is in China on a three-day state visit.

“This investment fund is a reflection of the growing partnership between the UAE and the People’s Republic of China,” said Sheikh Mohammed, also Deputy Supreme Commander of the Armed Forces.

“The launch of this strategic, commercially driven fund represents the next stage of our partnership as we seek to work more closely in developing our economies and contributing to global growth.”

Xi Jinping, president of China, said: “This dynamic investment fund will serve to further strengthen and deepen the strategic and economic relationship between China and the UAE.

“This fund will also play a critical role in supporting the One Belt, One Road initiative, as we work towards improving connectivity and cooperation with our regional partners across Eurasia.”

Mubadala, which aims to invest in assets that promote Abu Dhabi’s development, has already launched similar joint investment ventures.

In 2013, it launched a $2bn fund with the Russian Direct Investment Fund, a state-backed asset manager. It also has joint investment vehicles with GE Capital and Trafigura.

The fund has prominent political backing.

China’s One Belt, One Road strategy aims to encourage investments in infrastructure projects along the medieval Silk Road trade route.

Attracting foreign investors to develop projects along this route is important to China’s leadership, said Chang Liu, of Capital Economics.

“It’s symbolically important for China to have foreign investment partners in South-East Asia and the Middle East,” Mr Chang said. “Part of the purpose of One Belt, One Road is symbolically to connect these countries. It’s politically important.”

The UAE is one of the founder members of the Asian Infrastructure Investment Bank, a $100bn fund regarded as a rival to the International Monetary Fund for stewardship of the world’s economy.

For more on the UAE and China’s agreements:

› UAE renews renminbi swap deal with China

› Sheikh Mohammed bin Zayed begins China visit at Great Wall

› Sheikh Mohammed bin Zayed and UAE dignitaries on China state visit - in pictures

› A breakdown of dealings between UAE and China - graphic

› Visit marks the beginning of a 'new era of UAE China relations'

business@thenational.ae

Follow The National's Business section on Twitter