Forget bonds and stocks, the latest investment craze to sweep the UAE's elite could be a Picasso or a Rembrandt.

Emirates NBD's private banking division has launched an art investment fund that will tap into the US$10 billion (Dh36.72bn) Middle East art market.

The bank, which is the biggest by assets in the UAE, has partnered with the Fine Art Fund Group, an art investment company, to attract ultra-rich clients and families with at least $3 million in wealth who wish to invest in art as an alternative asset class.

"We're not doing interior decoration," said Gary Dugan, the chief investment officer of Emirates NBD's private banking division in the Middle East. "It's not an aesthetic investment but a financial investment." He stressed the importance of clients making a profit over buying for enjoyment.

Mr Dugan said the fund was expected to break even this year, without disclosing a target or the bank's targeted assets under management. But he said they would grow by "double digits" every year for the next 10 years.

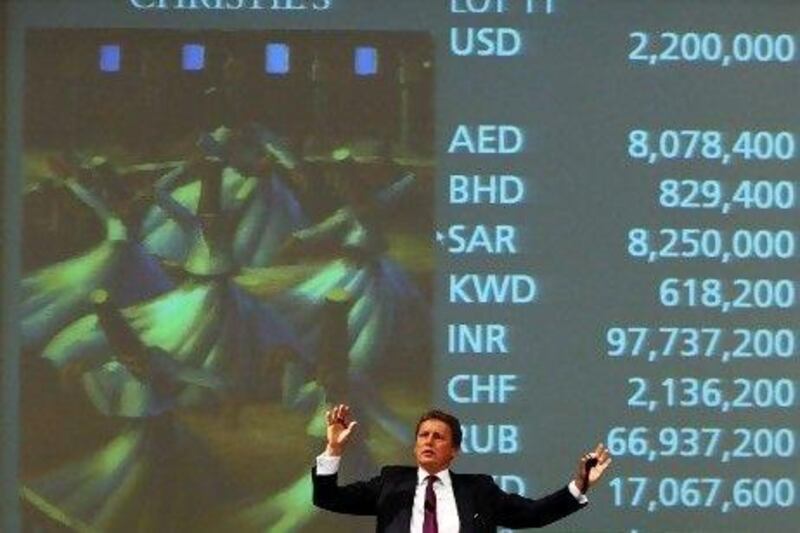

"I believe we'll comfortably take market share in the region," he said. Several museums are planned to open in Abu Dhabi in the next few years, with the Louvre, Guggenheim and the Sheikh Zayed National Museum among those expected to launch. In October, Christie's auction house set a record for Middle East auction sales at $14m, including the sale of Mahmoud Said's 1929 painting TheWhirling Dervishes for $2.5m, the most expensive Middle East painting ever sold.

Art initiatives in Kuwait and Qatar, including the Mathaf: Arab Museum of Modern Art that opened in Doha at the end of last year, and the growing popularity of art from Egypt, Syria, Lebanon and Iraq will lift investment in the Middle East art market, said Philip Hoffman, the chief executive of the Fine Art Fund Group. But he said the Middle East was still at the "rear end" of global art investment, lagging the US and European markets.

International banks have traditionally catered to art lovers in the Middle East, with the international art market worth more than $3 trillion and an annual turnover of $50bn. The Fine Art Fund Group counts 16 Forbes rich list members among its clients and deals in the world's top masterpieces, including Picasso and Raphael.

In its fastest deal, the group bought an Old Master from the 17th century for $4.75m in 2008 and sold it for $6m the next day - at the time Lehman Brothers collapsed."Rare art is being bought by museums and never being sold again," said Mr Hoffman. "Now wealthy individuals are looking to buy a different kind of asset class like art."

One trader at the group has sold more than $5bn of Picasso paintings, he said. "At a time when people are unsure about investing in certain equities and the integrity of certain companies, art investment is about safety that you can physically hold on to and move with you," he said. Mr Hoffman expects the Middle East art market will triple in value over the next five years.

Clients are advised to invest a maximum of 5 per cent of their wealth into art, because the asset class is too illiquid.